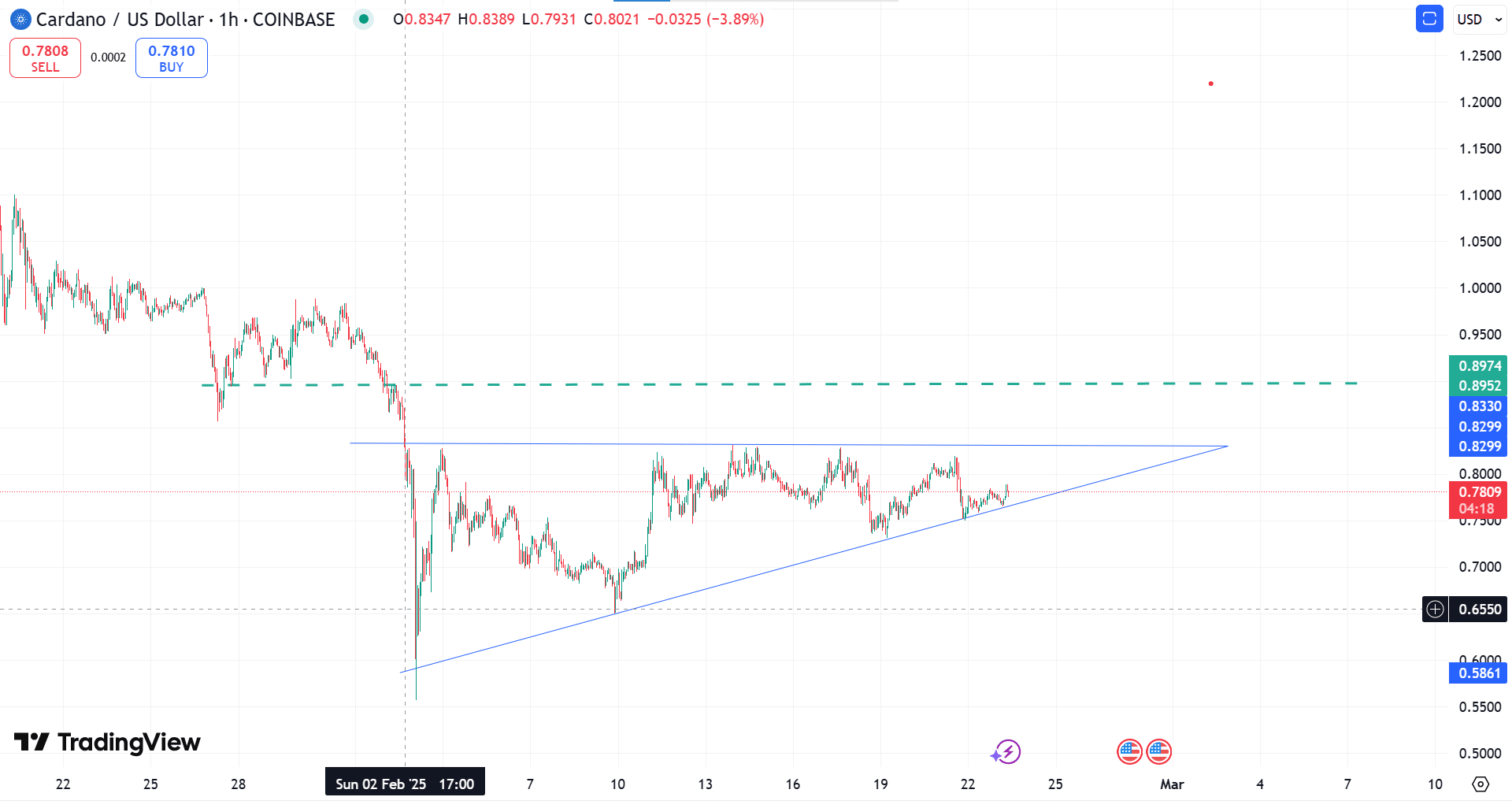

Cardano (ADA) is showing signs of a strong price recovery after a short-heavy market phase. Following a period of selling pressure, ADA’s latest uptrend inside an ascending triangle pattern suggests growing investor confidence as buyers step in.

Market Sentiment & On-Chain Signals

At the time of writing, ADA is trading at $0.7809, reflecting a 1.08% increase despite a decline in 24-hour trading volume, per CoinMarketCap data. Market indicators point toward increasing trader participation, with Open Interest rising by 2.09% and the long-short ratio stabilizing at 0.92, signaling a neutral stance among traders, according to Coinglass.

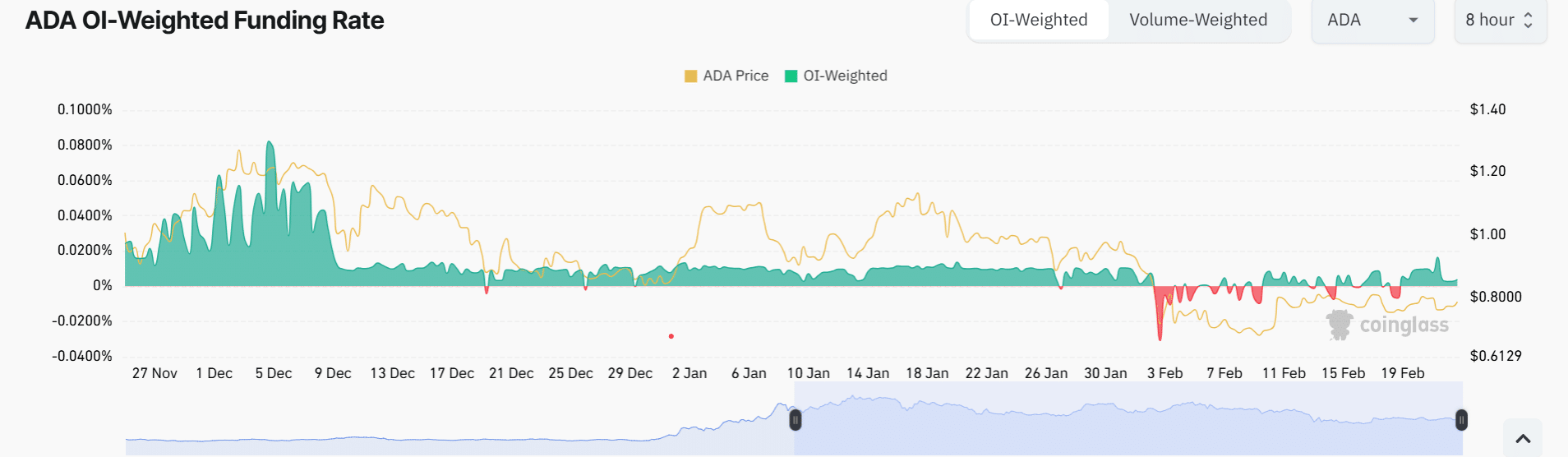

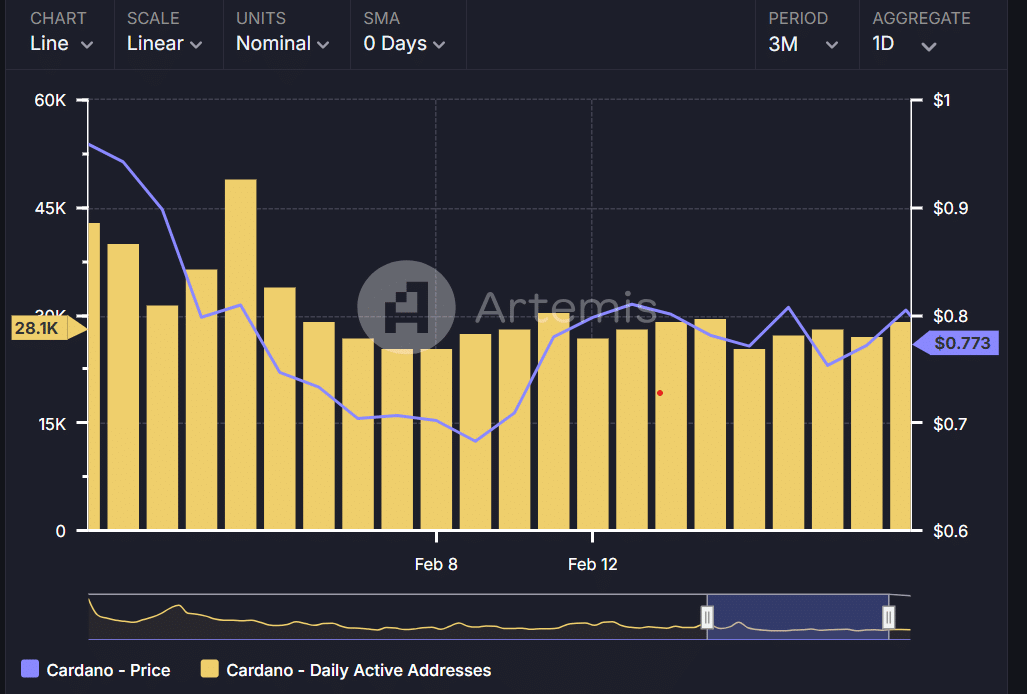

Additionally, ADA’s Weighted Funding Rate has turned positive, indicating increased demand for long positions. Data from IntoTheBlock shows a bid-ask volume of 68.09%, with exchange signals leaning bullish. This trend aligns with rising active addresses on the Cardano network over the past 72 hours, further supporting a growing market presence.

Cardano’s Recovery and Potential Breakout

ADA’s price movement within an ascending triangle pattern suggests strong accumulation. A breakout above the key $0.83 resistance level could pave the way for further gains. If bullish momentum persists, ADA may test the $0.90 resistance zone before targeting the critical $1.00 psychological level.

Cardano’s technical indicators reinforce this outlook. Its 200-day Exponential Moving Average (EMA) at $0.7301 and 200-day Simple Moving Average (SMA) at $0.6547 remain below the current price, confirming long-term bullish momentum, per TradingView data. Meanwhile, the Relative Strength Index (RSI) at 44 suggests ADA is slightly oversold and recovering from a bearish phase.

Also Read: Cardano (ADA) Price Holds Strong: Key Support Levels Signal Potential Breakout to $1

What’s Next for Cardano?

With increasing buying pressure and improving market sentiment, ADA’s bullish trend could strengthen in the coming days. If trading volume aligns with price action, a breakout above $0.83 may push Cardano toward a new uptrend, solidifying its position in the ongoing crypto market rally.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.