|

Getting your Trinity Audio player ready...

|

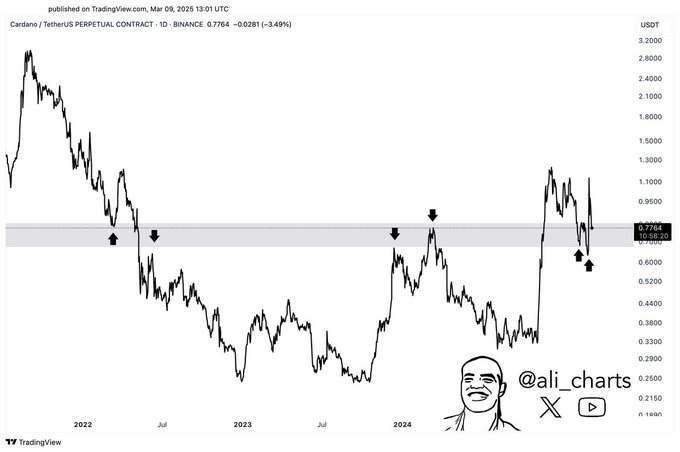

Cardano (ADA) is currently trading within a crucial support zone between $0.80 and $0.66, a historically significant range that has influenced price movements in previous market cycles. With the broader crypto market facing continued volatility, ADA has recorded a 2.65% decline over the past 24 hours and a sharp 20.20% drop over the past week.

Key Support and Resistance Levels

The $0.80–$0.66 range has played a dual role as both resistance and support in the past. Crypto analyst Ali Martinez highlights that maintaining this level is critical for ADA’s next move. Historical trends suggest that failing to hold this support zone could lead to further declines. In 2022, ADA lost this range, resulting in a significant drop, while in 2023, it initially faced rejection before breaking above the level in early 2024.

Currently, ADA is once again testing this critical support. If the price holds, a recovery could be on the horizon. However, a drop below $0.66 may open the door to lower price levels and extended bearish pressure.

Mixed Technical Indicators

Technical analysis presents an uncertain outlook for ADA. The Bollinger Bands show that ADA is near its lower band at $0.5386, suggesting possible oversold conditions. Meanwhile, the middle band at $0.7871 is acting as immediate resistance, with the upper band at $1.0356 serving as a key breakout level.

The Relative Strength Index (RSI) stands at 47.04, indicating neutral market conditions. A move above 50 could signal growing buying pressure, while a drop below 40 may confirm a continuation of the downtrend. Additionally, the MACD indicator recently showed a bearish crossover, reinforcing the risk of further declines unless bullish momentum emerges.

Market Activity and Investor Sentiment

ADA’s trading volume has surged by 66.40% to $3.53 billion, highlighting increased market participation. However, Open Interest has dropped by 9.49% to $831.18 million, indicating traders closing positions amid uncertainty. Options volume has also declined significantly by 92.94% to $6.59K, suggesting reduced speculative activity.

On-chain data from IntoTheBlock shows an uptick in network activity, with active addresses rising by 11.99%, new addresses increasing by 4.79%, and zero-balance addresses growing by 12.26%. Despite this, whale activity has declined, with large transactions falling from 12K on December 10 to just 4.73K in the last 24 hours. This reduction in large transactions suggests diminishing interest from big investors, potentially limiting ADA’s upward momentum.

At the time of writing, ADA is fluctuating between $0.80 and $0.90. A rebound above $0.80 could pave the way for a move toward $1.00, but if ADA fails to hold above $0.66, further downside pressure could emerge. As volatility remains high, traders will closely monitor whether ADA stabilizes or continues its decline.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

Also Read: Cardano (ADA) Price Rebounds: Is a 10% Surge to $0.81 Next?

I’m a crypto enthusiast with a background in finance. I’m fascinated by the potential of crypto to disrupt traditional financial systems. I’m always on the lookout for new and innovative projects in the space. I believe that crypto has the potential to create a more equitable and inclusive financial system.