|

Getting your Trinity Audio player ready...

|

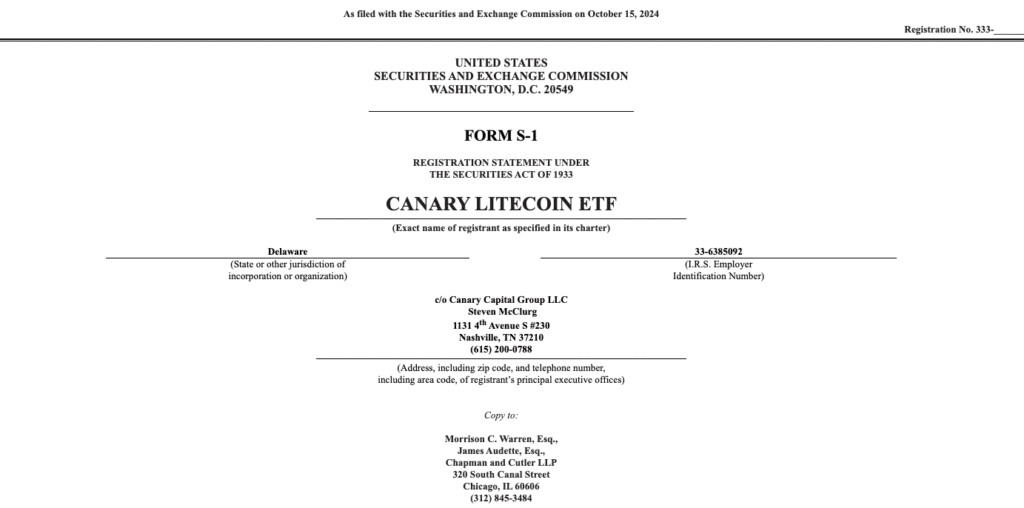

Canary Capital, a prominent asset manager, has submitted registration documents to the US Securities and Exchange Commission (SEC) for a spot Litecoin exchange-traded fund (ETF). This move comes hot on the heels of their previous filing for an XRP ETF, sparking speculation about the potential impact of the upcoming US presidential election on cryptocurrency-related products.

The proposed Litecoin ETF aims to closely track the performance of the CoinDesk Litecoin Price Index (LTX), providing investors with exposure to the cryptocurrency without directly owning it. Litecoin, often referred to as a “digital silver” to Bitcoin’s “digital gold,” is known for its faster transaction times and lower fees.

Political Factors and Regulatory Landscape

Analysts have suggested that the timing of Canary’s filings may be influenced by the upcoming presidential election. With Kamala Harris, a known cryptocurrency supporter, potentially succeeding Joe Biden, there’s a growing optimism among industry players. Harris’s public statements and behind-the-scenes discussions indicate a more constructive approach towards crypto regulation compared to her predecessor.

However, the regulatory landscape remains complex. Under Biden’s administration, the SEC has adopted a more aggressive stance, launching numerous enforcement actions against cryptocurrency-related entities. This has created uncertainty for investors and hindered the development of crypto-based financial products.

Also Read: Litecoin Surges Past 77 Million Transactions in 2024: A Decade of Growth and Innovation

The Path to Approval

Obtaining SEC approval for a crypto ETF is a challenging process. Canary Capital must now wait for the SEC to review their registration documents and authorize a rule change allowing a national securities exchange to list the proposed ETF. If approved, this would be a significant step forward for the cryptocurrency industry, providing investors with a more accessible and regulated way to invest in Litecoin.

The Future of Crypto ETFs

The growing interest in crypto ETFs reflects the increasing institutional adoption of cryptocurrencies. As regulatory clarity improves and investor confidence grows, we can expect to see more such filings and potentially the launch of additional crypto-based ETFs. These products offer a potential avenue for mainstream investors to participate in the cryptocurrency market without the complexities associated with directly owning cryptocurrencies.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m your translator between the financial Old World and the new frontier of crypto. After a career demystifying economics and markets, I enjoy elucidating crypto – from investment risks to earth-shaking potential. Let’s explore!