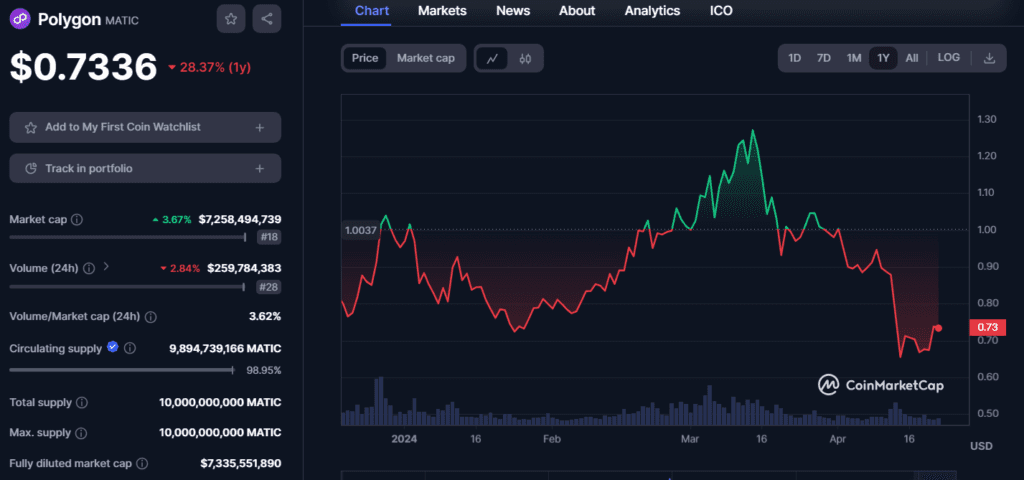

The Polygon network is presenting a curious case of resilience in the face of a bearish cryptocurrency market. While the native token MATIC’s price has dipped 28% year-to-date, the network itself has seen a surge in daily active addresses, reaching a milestone of 1 million for 30 consecutive days. Analysts attribute this primarily to the booming NFT sector on Polygon.

NFTs Fueling Growth

Data from Artemis reveals a significant spike in NFT trading volume on Polygon, with projects like CyberKongz and Cryptokhat leading the charge. This isn’t a recent phenomenon either. Polygon consistently boasted higher NFT trading volumes than Solana in early 2024, reaching $10.5 million compared to Solana’s $4.1 million. This growth was directly linked to a surge in NFT inscriptions on the network.

At the time of writing, Polygon sits comfortably in third place for top NFT collectible sales, trailing only giants like Ethereum and Bitcoin. However, the story isn’t all sunshine and rainbows.

DeFi Downturn: Polygon’s Decentralized Finance (DeFi) sector paints a contrasting picture. The Total Value Locked (TVL) on the network has dropped from $1.1 billion to a concerning $890 million. Decentralized Exchange (DEX) volumes have also declined significantly, pushing users towards alternative platforms for their DeFi needs. This, as expected, has dampened the price action of MATIC, preventing it from capitalizing on recent market rallies.

Leadership Exodus and Whale Interest

Market analysts like Katie Talati, director of research at Arca, point to the departure of Polygon’s former president, Ryan Wyatt, as a contributing factor to MATIC‘s underperformance. Wyatt, credited with securing major partnerships for Polygon, left last year to head business development for Optimism, a rival network. This move is seen by many as a blow to Polygon’s growth trajectory.

Despite these setbacks, there are positive signs. The total number of MATIC addresses continues to rise, with addresses holding between $1,000 and $100,000 worth of the token accounting for a significant 7.7%. Additionally, a recent transfer of 1.9 million MATIC tokens from Binance to a decentralized wallet hints at continued whale interest. Crypto analyst Ali Martinez interprets this as a bullish signal, even predicting a price surge to $1, as long as MATIC can maintain support above $0.87.

A Network Divided?

Polygon’s current state presents a fascinating dichotomy. While the NFT sector thrives, the DeFi landscape struggles. The million-dollar question remains: can Polygon capitalize on its NFT boom to reignite DeFi and propel MATIC’s price forward, or will the network become known solely for its thriving NFT marketplace? Only time will tell.