|

Getting your Trinity Audio player ready...

|

The global financial landscape is experiencing a significant shift as the trend of de-dollarization gains momentum. While the US dollar (USD) continues to dominate international trade, many countries are increasingly looking to alternative currencies for cross-border transactions. Among the nations at the forefront of this movement are Iran and Russia, both of which have formally decided to abandon the greenback in favor of their respective national currencies for trade.

As part of the BRICS bloc, Iran and Russia are now making strides to reduce their reliance on the US dollar due to the heavy sanctions imposed by Western countries. In a statement by Mohammad Reza Farzin, an Iranian central bank official, he confirmed that Iran and Russia had entered into a currency agreement, effectively eliminating the use of the dollar in trade between the two nations. “Now we only trade in rubles and rials,” Farzin stated. This move is part of a broader push within BRICS nations to promote the use of national currencies, especially among countries facing economic sanctions.

In July 2024, Iran and Russia further cemented their commitment to de-dollarization with a currency swap agreement, allowing both nations to bypass the US dollar entirely. They have also turned to alternative financial systems, such as Russia’s Mir payment system, as a substitute for SWIFT, the global network traditionally used for international transactions.

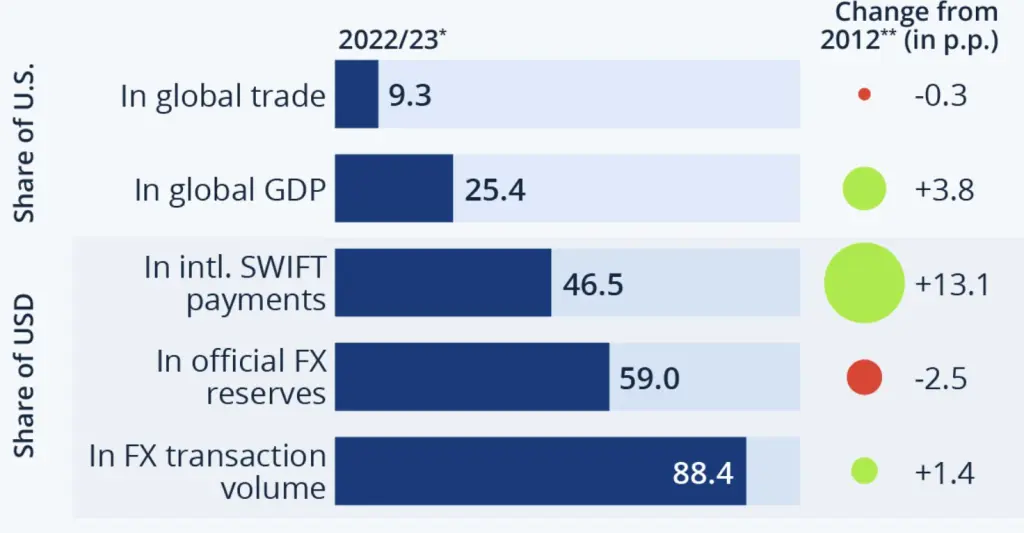

Despite these efforts, the US dollar remains the dominant global currency. According to a report by Statista, the dollar still accounts for a staggering 88.4% of foreign exchange transactions and 59% of official foreign exchange reserves. While the de-dollarization trend is gaining traction, experts believe the US dollar is unlikely to be dethroned in the near future. However, geopolitical shifts and economic policies, such as those under President-elect Donald Trump’s pro-business stance, could alter the dollar’s position over time.

In conclusion, while the de-dollarization trend is growing, it’s clear that the US dollar’s global dominance remains secure for the time being. However, the efforts by countries like Iran and Russia highlight the changing dynamics of global trade and finance.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

Also Read: BRICS Push for Yuan: Can China’s Currency Overtake the US Dollar in Global Trade?

I’m your translator between the financial Old World and the new frontier of crypto. After a career demystifying economics and markets, I enjoy elucidating crypto – from investment risks to earth-shaking potential. Let’s explore!