|

Getting your Trinity Audio player ready...

|

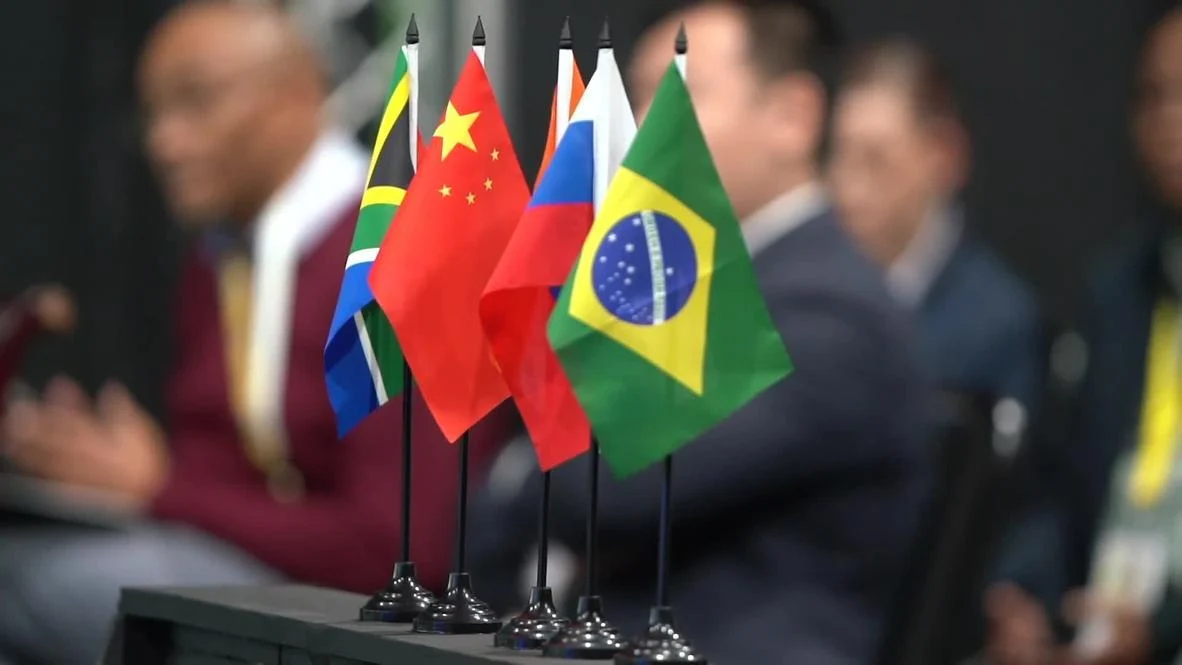

While the recent shift in US leadership may influence global dynamics, the BRICS nations, comprising Brazil, Russia, India, China, and South Africa, are poised to continue their efforts towards de-dollarization. Despite potential policy changes under the incoming US administration, the BRICS bloc’s strategic focus on reducing reliance on the US dollar appears resolute.

Economic and Political Imperatives

The BRICS nations have been actively exploring alternatives to the US dollar, driven by both economic and political considerations. The imposition of Western sanctions on Russia has accelerated this trend, forcing the bloc to seek new avenues for economic cooperation. By increasing the use of local currencies in bilateral trade, BRICS members aim to reduce transaction costs and minimize exposure to exchange rate fluctuations.

Expert Insights on De-Dollarization

Renowned economist Lauren Johnson has highlighted the compelling reasons behind the BRICS nations’ push for de-dollarization. “There are economic and political motivations for using local currencies,” Johnson stated in a recent interview. “By trading in their own currencies, these nations can lower transaction costs and diminish their dependence on foreign currencies.”

The Road Ahead for BRICS De-Dollarization

While the full realization of a shared payment system among BRICS nations remains a work in progress, the bloc’s commitment to reducing dollar dominance is evident. As the global economic landscape continues to evolve, the BRICS nations’ efforts to diversify their currency reserves and explore alternative payment mechanisms could have significant implications for the international monetary system.

In conclusion, the BRICS nations’ de-dollarization agenda is driven by a combination of pragmatic economic considerations and geopolitical factors. Despite potential shifts in US foreign policy, the bloc’s determination to strengthen its economic and political independence is likely to persist, shaping the future of global finance and trade.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m a crypto enthusiast with a background in finance. I’m fascinated by the potential of crypto to disrupt traditional financial systems. I’m always on the lookout for new and innovative projects in the space. I believe that crypto has the potential to create a more equitable and inclusive financial system.