|

Getting your Trinity Audio player ready...

|

BONK, the Solana-based meme coin, has been making waves in the cryptocurrency market as it attempts to break out of a recent rising wedge pattern. The digital asset is currently trading at $0.00002906, having surged by 8% after retesting the wedge’s support level just 48 hours ago.

Technical analysts are closely monitoring BONK’s price movements as it approaches a crucial resistance level. The cryptocurrency has successfully bounced back from a 23% dip, finding support at $0.00002823. The next significant hurdle is the $0.00003592 resistance level.

A key level to watch is $0.00002940, which recently acted as a strong resistance zone before being breached on July 19th. A sustained break above this level could potentially ignite a bullish rally towards the aforementioned resistance.

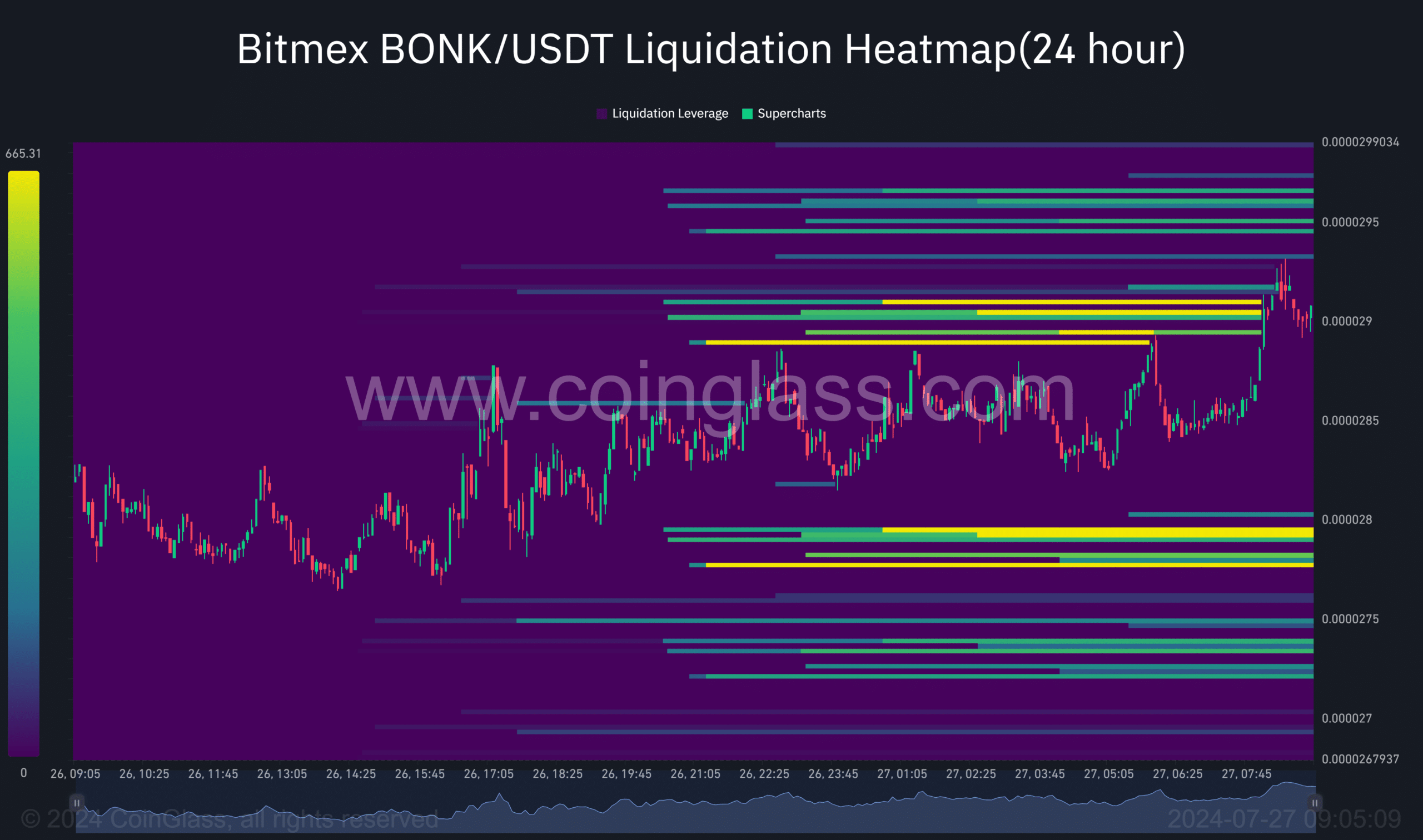

However, the situation is not without its complexities. Bitmex liquidation data reveals a concentration of stop-loss orders around specific price levels, suggesting increased market volatility. The spike in BONK liquidations, particularly short positions, has likely contributed to the recent price surge.

The open interest-weighted funding rate, a measure of market sentiment, has been highly volatile over the past two months. Currently, it stands at zero, indicating a neutral market sentiment.

While the recent price action and technical indicators suggest a potential bullish breakout, it’s essential to remain cautious. The rising wedge pattern is typically associated with bearish outcomes, and a failure to break above the resistance could lead to a downward correction.

Investors and traders should closely monitor BONK’s price movements and volume in the coming days. A decisive break above the $0.00002940 level would strengthen the bullish case, while a failure to do so could signal a potential reversal.

Ultimately, the cryptocurrency market remains highly volatile, and investors should exercise caution and conduct thorough research before 1 making any investment decisions

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m the cryptocurrency guy who loves breaking down blockchain complexity into bite-sized nuggets anyone can digest. After spending 5+ years analyzing this space, I’ve got a knack for disentangling crypto conundrums and financial markets.