|

Getting your Trinity Audio player ready...

|

- BNB broke $1,200, triggering $5M in liquidations.

- Positive funding rates indicate strong bullish sentiment.

- Analysts warn a potential correction could target $700.

Stay ahead with real-time updates and insights—Join our Telegram channel!

BNB made headlines this week, climbing above $1,200 to set a fresh all-time high. The rally caught many traders off guard, triggering significant liquidations across the crypto market. Despite BNB’s impressive performance, the overall crypto market slipped slightly, highlighting a mixed sentiment among investors.

Record Highs and Liquidations Shake the Market

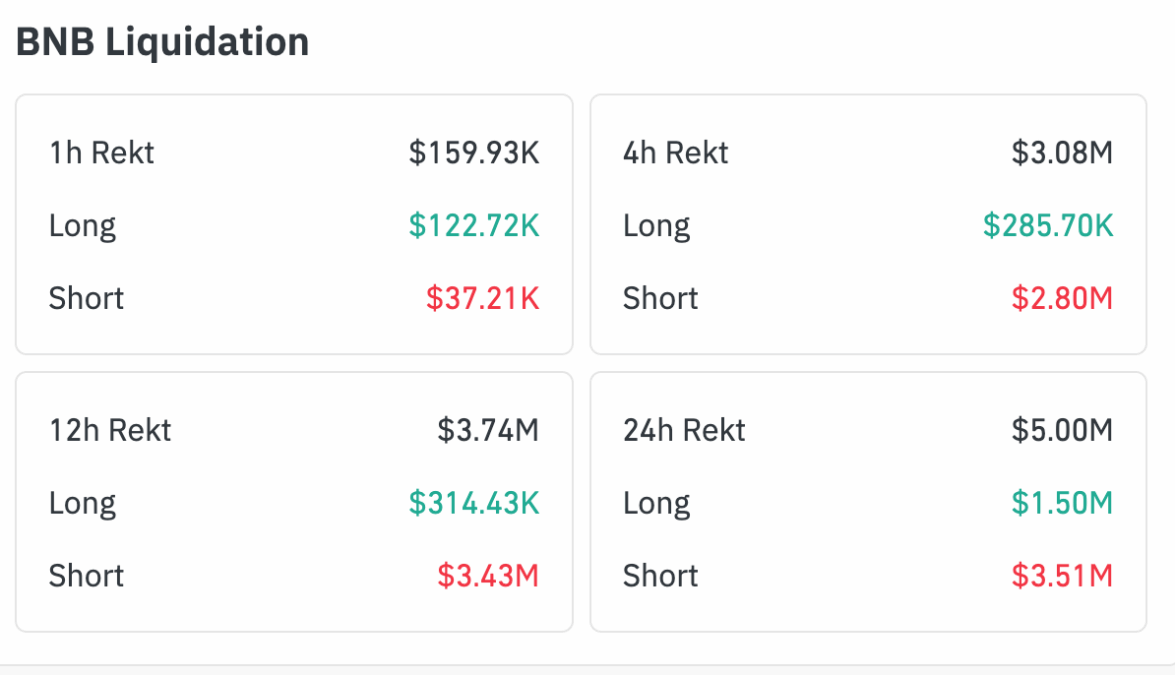

According to CoinMarketCap, BNB traded at $1,202.01 with a 24-hour trading volume of $4.21 billion, rising nearly 2% in the past day. Coinglass reports that roughly $5 million in BNB positions were liquidated in the last 24 hours. Short traders were hit hardest, losing $3.51 million, while long positions accounted for $1.50 million in losses.

The most active liquidation periods occurred within 12 hours, totaling $3.74 million, dominated by short positions at $3.43 million. Another $3.08 million was wiped out during the last four hours, again mostly affecting shorts. These trends underline the unexpected strength of BNB’s upward movement.

Positive Funding Rates Signal Bullish Bias

BNB’s funding rate has remained mostly positive since mid-July, suggesting that traders betting on rising prices are paying small fees to those betting against it—a pattern common in strong uptrends. Significant spikes in funding rates during late July, mid-August, and late September coincided with notable price rallies.

Although funding rates briefly dipped below zero in early August and mid-September, selling pressure was short-lived. Buyers quickly regained control, reinforcing optimism in BNB’s growth trajectory.

Market Sentiment and Technical Outlook

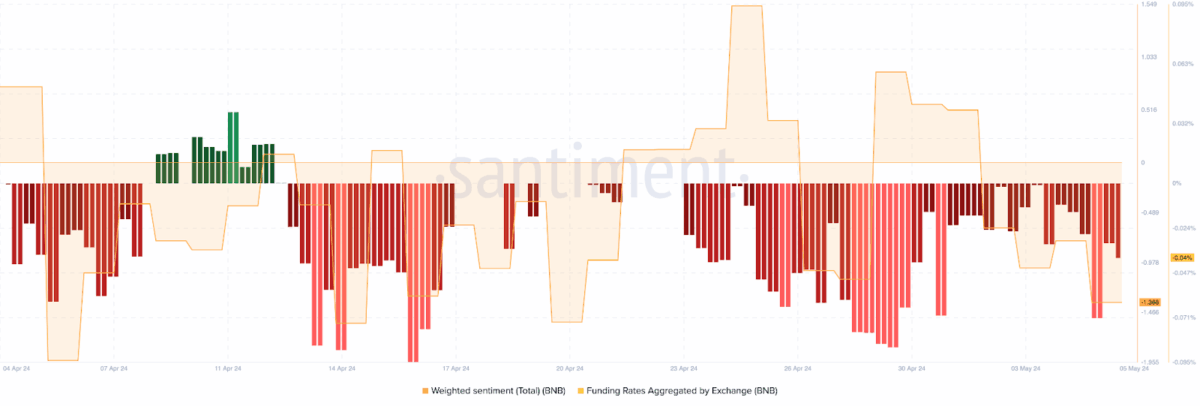

Santiment data indicates that investor sentiment around BNB was cautious from late March to early May 2024, with funding rates in the red. However, the recent surge above $1,200 reflects renewed confidence and strong buying power.

Analysts at Crypto Claws suggest that while BNB’s rally is impressive, it could signal a temporary peak. Profit-taking by institutional investors might trigger a correction toward $700 by December.

BNB’s breakout past $1,200 highlights strong market demand and bullish sentiment. Yet, the wave of liquidations and persistent high funding rates indicate that volatility remains high, and traders should prepare for potential pullbacks in the coming months.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

Also Read: ASTER Phase 2 Airdrop Kicks Off Amid $5B Market Surge and Binance Listing Buzz

I’m a crypto enthusiast with a background in finance. I’m fascinated by the potential of crypto to disrupt traditional financial systems. I’m always on the lookout for new and innovative projects in the space. I believe that crypto has the potential to create a more equitable and inclusive financial system.