|

Getting your Trinity Audio player ready...

|

BlackRock’s Bitcoin ETF (IBIT) has solidified its position as a leading force in the cryptocurrency investment landscape, recently attracting an impressive $970.93 million in inflows within a single day. This substantial figure, reported by ETP tracker Sosovalue on April 29th, underscores the growing appetite from traditional markets for Bitcoin as the broader crypto market exhibits strong bullish momentum.

IBIT Leads While Other Spot ETFs See Mixed Performance

While BlackRock’s IBIT enjoyed a significant influx of capital, the overall picture for U.S.-based spot Bitcoin ETFs was more varied. On April 28th, these ETFs collectively recorded inflows of $591.29 million, indicating that IBIT’s performance significantly outpaced its competitors. Notably, Fidelity’s FBTC experienced outflows of $86.87 million, and Grayscale’s GBTC saw $42.66 million in outflows. Meanwhile, Valkyrie’s BRRR, Invesco’s BTCO, and Franklin Templeton’s EZBC reported net flows of $0, highlighting BlackRock’s current dominance in attracting institutional investment in Bitcoin ETFs.

Also Read: Bitcoin ETFs Lead Massive $3.4B Crypto ETP Inflow Surge: CoinShares (April 2025)

Bitcoin Price Nears $95K on Strong Institutional Interest

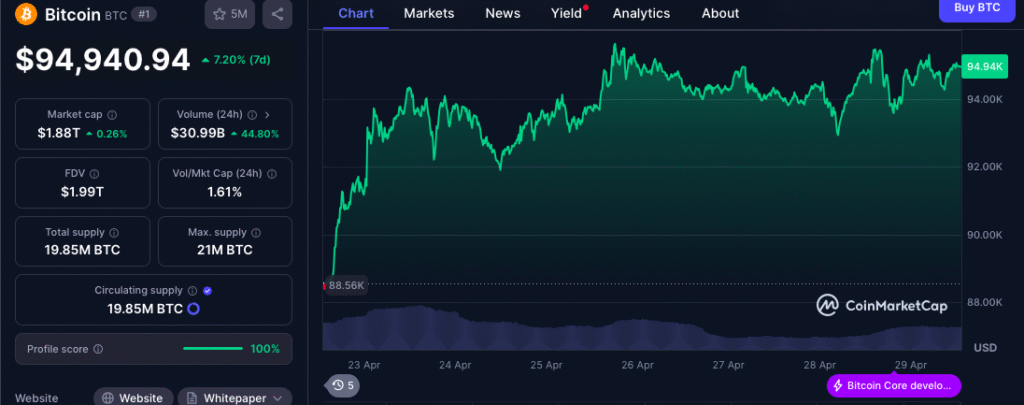

The robust inflows into Bitcoin ETFs, particularly BlackRock’s IBIT, coincide with a notable surge in Bitcoin’s price. The flagship cryptocurrency has climbed over 7.5% in the past week, nearing the $95,000 mark. This upward trajectory reflects the increasing institutional interest fueled by the accessibility offered through ETF products.

CoinGlass data further supports this bullish outlook, revealing that Bitcoin’s futures open interest remains above $60 billion, and derivatives volume has surged by 50% to $96.56 billion. The market sentiment remains optimistic as crypto-backed financial products gain traction among traders and investors amidst growing speculation of a sustained bull market.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m a crypto enthusiast with a background in finance. I’m fascinated by the potential of crypto to disrupt traditional financial systems. I’m always on the lookout for new and innovative projects in the space. I believe that crypto has the potential to create a more equitable and inclusive financial system.