|

Getting your Trinity Audio player ready...

|

The cryptocurrency market has faced a dramatic decline since Donald Trump’s inauguration on January 20, shedding nearly $1 trillion in value. While Bitcoin has historically been seen as a hedge against economic uncertainty, its recent performance suggests a shift in market dynamics.

Bitcoin’s Changing Role in Financial Markets

Traditionally, Bitcoin has mirrored gold’s movements, acting as a store of value during financial instability. However, this pattern has reversed under the Trump administration. While gold prices have continued to rise, Bitcoin has suffered a severe correction. Crypto analyst Symbiote pointed out, “Since Trump became president on January 20, the market has dropped from $3.7 trillion to $2.5 trillion. This is strange because Trump is the most pro-crypto president ever.”

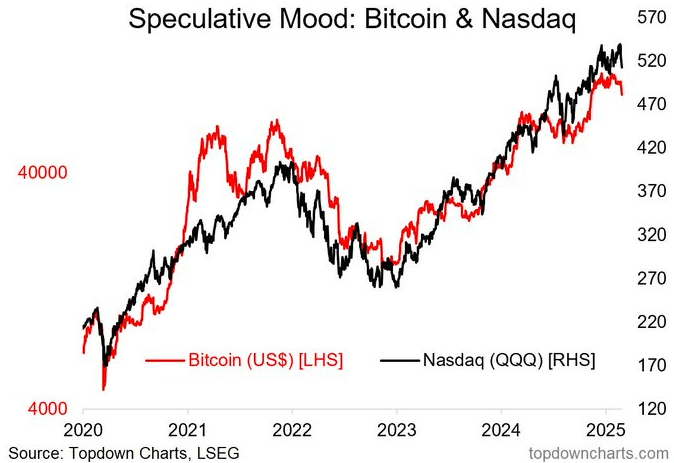

One major factor behind this shift is Bitcoin’s increasing correlation with traditional financial assets. In 2024, BTC moved in tandem with the Nasdaq 100 and S&P 500 about 88% of the time, a sharp contrast to its previous role as an independent asset. Now, this correlation has dropped to 40%, signaling that Bitcoin is behaving more like a high-risk tech stock than a hedge against inflation.

Liquidity Crisis and Market Volatility

Another concern is liquidity. Since 2020, financial markets have been adjusting to reduced liquidity, which has significantly impacted crypto. Investors are shifting funds back into the US dollar, traditionally the most stable asset in times of economic uncertainty. This has led to repeated flash crashes in crypto markets, increasing volatility and investor anxiety.

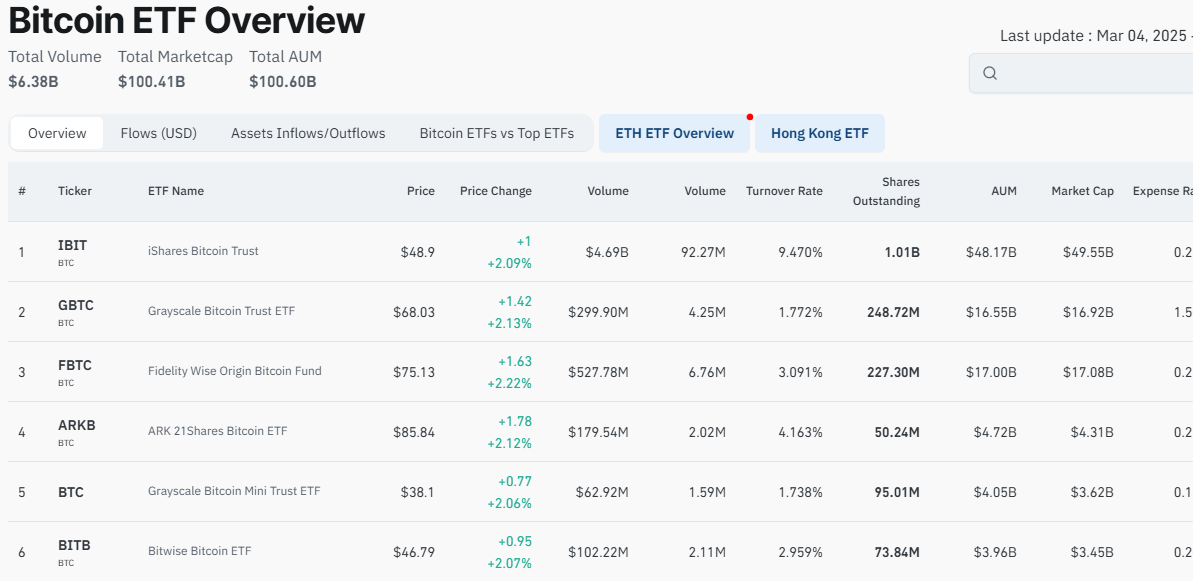

Coinglass data confirms this trend, showing Bitcoin ETF assets under management (AUM) declining from $120 billion to $100 billion in just a few weeks. Meanwhile, decentralized finance (DeFi) has taken a hit, with total value locked (TVL) dropping from a 2025 peak of $128.7 billion to $93.2 billion, according to DefiLlama.

Trade War Fears Impact Crypto Sentiment

Concerns over potential global trade wars under Trump’s leadership are also weighing on crypto sentiment. A Bank of America survey found that 42% of respondents consider trade wars the most bearish factor for risk assets in 2025, up from 30% in January. Only 3% of those surveyed believe Bitcoin would perform well in such a scenario, highlighting a shift in market perception.

Adding to this uncertainty, Goldman Sachs’ volatility panic index has surged from 1.4 in December to over 9.1, with expectations of more market swings ahead. The Kobeissi Letter warns that Bitcoin’s price action will likely remain turbulent as trade war concerns escalate.

Despite the current bearish trend, some experts believe Bitcoin still holds long-term value. BeInCrypto recently suggested that Bitcoin could serve as a financial lifeline for the U.S. amid its soaring national debt. Coinbase CEO Brian Armstrong argued, “You can buy Bitcoin as a way to vote with your dollars, send a clear message, and potentially even save the U.S. long term.”

Unfortunately there currently is no candidate who can fix this.

— Brian Armstrong (@brian_armstrong) March 12, 2024

You can buy Bitcoin though as a way to vote with your dollars, send a clear message, and potentially even save the U.S. long term. A return to the gold standard. https://t.co/S7EHClEixa

Corporate adoption may also help Bitcoin regain its status as a valuable financial tool. Bloomberg cited Goodfood CEO Jonathan Ferrari, who noted that companies investing in Bitcoin could boost stock liquidity and attract investors. Even Bitcoin critic Peter Schiff acknowledged, “Bitcoin is digital gold, which is better than analog gold.”

Also Read: Bitcoin Hits $90K as Crypto Market Cap Reclaims $3 Trillion

While Bitcoin’s role in global finance is evolving, one thing is clear: its volatility remains a defining characteristic, and its future in the financial system remains uncertain.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m your translator between the financial Old World and the new frontier of crypto. After a career demystifying economics and markets, I enjoy elucidating crypto – from investment risks to earth-shaking potential. Let’s explore!