|

Getting your Trinity Audio player ready...

|

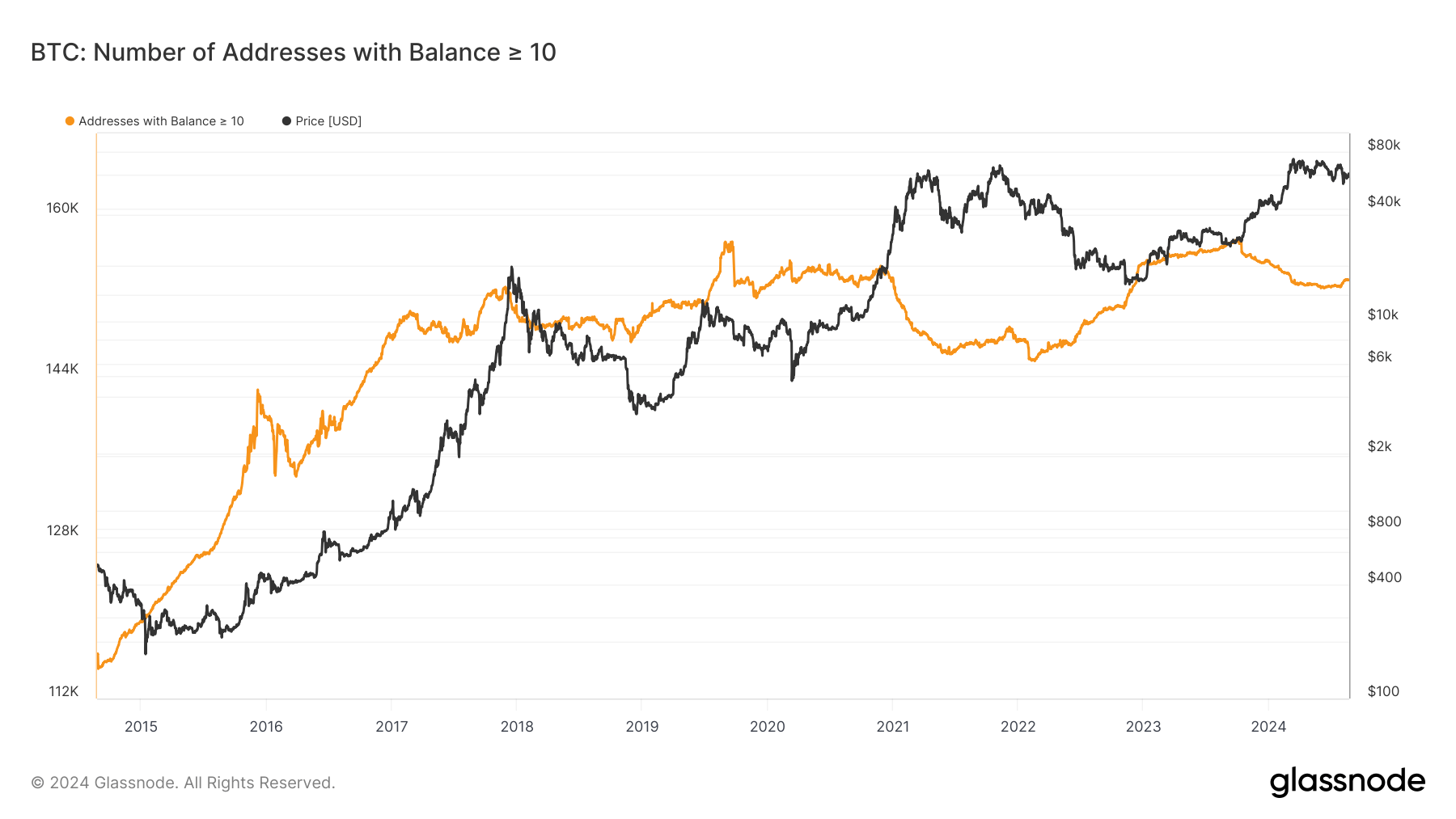

A recent surge in the number of Bitcoin addresses holding at least 10 BTC (known as “whales”) has caught the attention of market analysts and investors alike. After a significant decline throughout much of 2024, these addresses have begun to accumulate Bitcoin once again, suggesting a renewed confidence in the cryptocurrency’s long-term prospects.

The year started with approximately 155,500 addresses holding 10 BTC or more. However, as Bitcoin’s price fluctuated, many of these whales took advantage of the market volatility to profit. By late March, the number of addresses had dropped to around 152,600, representing a notable decrease.

This divergence between Bitcoin’s price and the number of large holders suggested that smart money was taking profits. However, August brought a significant reversal. As Bitcoin’s price stabilized near $60,000, the number of addresses holding over 10 BTC began to climb, reaching levels close to 153,500.

Historically, the trend has been upward for addresses holding significant amounts of Bitcoin. Since 2015, as the cryptocurrency’s price soared from under $500 to over $60,000 by 2021, the number of whales has steadily increased. This long-term accumulation is often seen as a bullish indicator, suggesting that large holders have confidence in Bitcoin’s value proposition.

The mid-2024 drop in whale addresses can be attributed to short-term distribution or reallocation as the market adjusted to the Bitcoin halving. However, the recent resurgence suggests that the trend of accumulation among large holders is likely to continue. As Bitcoin’s price stabilizes and the market matures, whales may play an even more significant role in shaping its future.

The resurgence of Bitcoin whales is a positive sign for the cryptocurrency’s long-term prospects. It indicates that despite short-term fluctuations, there remains a strong belief in Bitcoin’s potential as a store of value and a digital asset. As the market continues to evolve, it will be interesting to see how these large holders influence Bitcoin’s price and overall trajectory.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m your translator between the financial Old World and the new frontier of crypto. After a career demystifying economics and markets, I enjoy elucidating crypto – from investment risks to earth-shaking potential. Let’s explore!