|

Getting your Trinity Audio player ready...

|

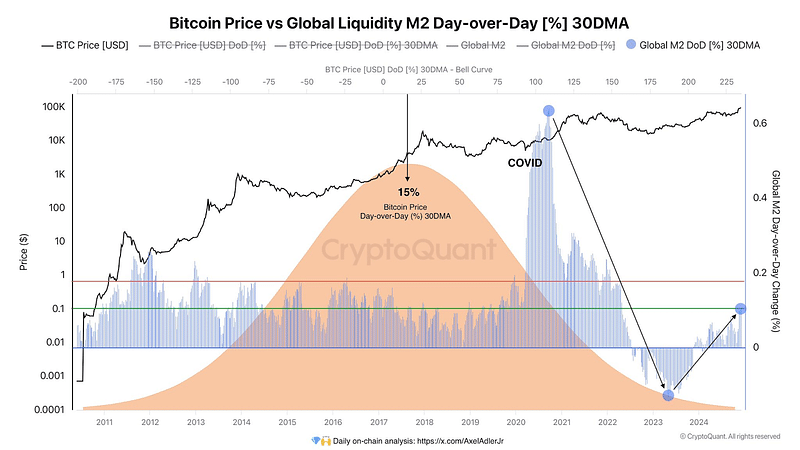

Global liquidity trends have consistently impacted asset prices, including Bitcoin (BTC). Analysis reveals a strong correlation between Bitcoin’s growth and liquidity inflows, measured by the M2 money supply, though with a slight delay.

Liquidity and Bitcoin’s Price Movements

Bitcoin’s price aligns closely with the Global M2 Day-over-Day (DoD) 30DMA metric. Historical data shows that liquidity injections, such as those during the COVID-19 crisis, preceded Bitcoin’s all-time high, demonstrating M2’s influence on bullish price action.

Despite the U.S. Federal Reserve’s ongoing Quantitative Tightening (QT) policy, global liquidity has seen a modest recovery. This has provided support for Bitcoin’s price rebound, suggesting that even in the absence of Quantitative Easing (QE), broader liquidity trends could foster bullish momentum.

Should the Federal Reserve intervene due to declining demand for U.S. Treasury securities (UST), M2 could rise sharply. Such a scenario would likely boost Bitcoin prices, potentially setting the stage for a breakout in 2024.

Market Sentiment Fuels Optimism

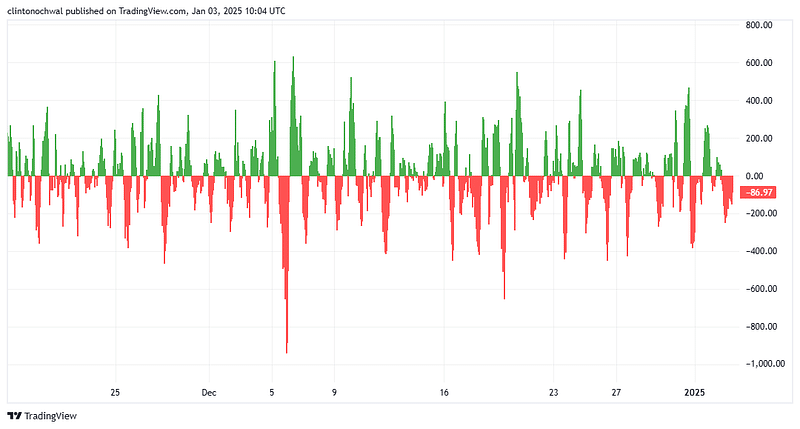

Bitcoin’s price trajectory is also influenced by market sentiment, as reflected in the Greed & Fear Index. This metric has shifted from extreme fear to neutral territory, signaling cautious optimism. Historically, such transitions have coincided with significant price rallies.

If sentiment continues to improve alongside rising global liquidity, traders may increase allocations to riskier assets like Bitcoin, further driving its growth. However, unexpected Federal Reserve tightening or geopolitical events could temper this optimism.

Social and Network Metrics Support Growth

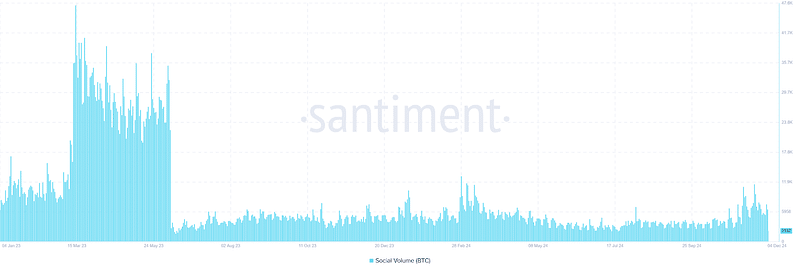

Social Volume, tracking Bitcoin mentions across social platforms, has been trending upward, albeit below 2021 bull market levels. This indicates growing interest, albeit without the exuberance seen in previous cycles.

Meanwhile, rising active addresses suggest renewed network demand, aligning with Bitcoin’s recent price recovery. Sustained increases in network activity could reinforce a bullish market outlook, while stagnation might signal hesitation.

The interplay between global liquidity, market sentiment, and network activity remains crucial for Bitcoin’s trajectory. If systemic risks prompt Federal Reserve action, Bitcoin could see accelerated gains, underscoring its sensitivity to capital shifts and liquidity trends.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

Also Read: BlackRock’s Record Bitcoin Sell-Off Sparks Market Jitters: Will BTC Bounce Back?