|

Getting your Trinity Audio player ready...

|

- Whale and shark wallets have sold over 81,000 BTC in eight days.

- Retail accumulation is rising despite falling prices.

- Mining stocks are plunging as earnings disappoint and Bitcoin slides.

Bitcoin is under renewed pressure as large holders continue to offload coins, retail investors step in aggressively, and crypto-related stocks slide on weak earnings and falling prices. Fresh data from Santiment and market performance across mining equities paint a picture of a market leaning increasingly risk-off — a dynamic analysts say has historically aligned with bear-cycle conditions.

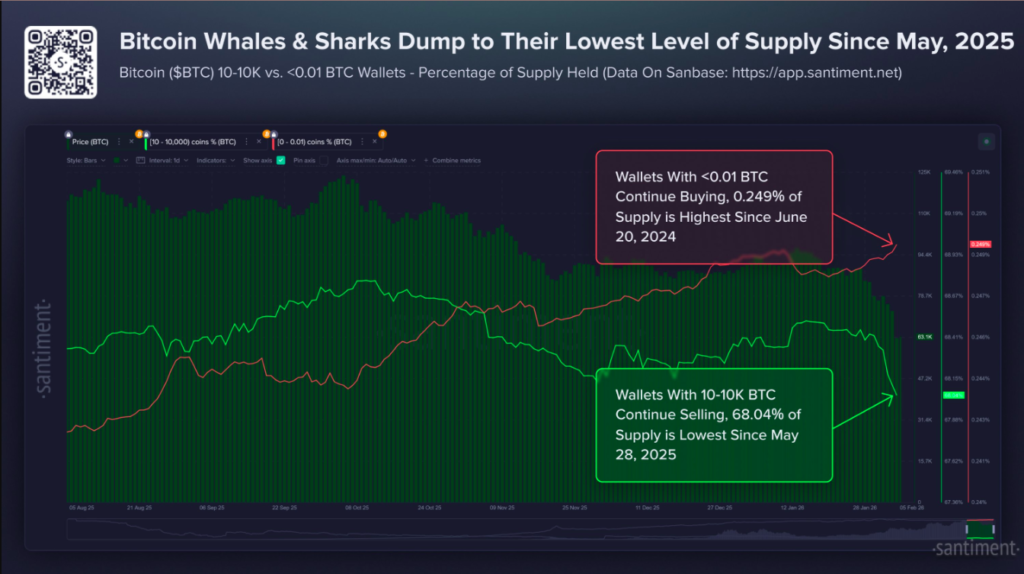

Whales Reduce Bitcoin Exposure to Nine-Month Low

Large Bitcoin holders are now controlling the smallest share of supply since late May, according to crypto analytics firm Santiment. Wallets holding between 10 and 10,000 BTC — often labeled “whale and shark” wallets — collectively account for about 68.04% of Bitcoin’s circulating supply, a nine-month low.

Santiment said this cohort has sold roughly 81,000 BTC over the past eight days alone, coinciding with Bitcoin’s sharp drop from around $90,000 to near $65,000 — a decline of about 27%. At the time of writing, Bitcoin is trading close to $64,800, recovering slightly from a brief dip below $60,000.

Market participants closely track large-holder behavior because sustained distribution by whales is often interpreted as reduced confidence in near-term price upside.

Retail Accumulation Grows as Sentiment Turns Extreme

While large holders have been selling, smaller investors are moving in the opposite direction. Santiment noted that “shrimp wallets,” defined as addresses holding less than 0.1 BTC, have reached a 20-month high in count and now control about 0.249% of total supply — roughly 52,000 BTC.

Santiment warned that this pattern — whales distributing while retail accumulates — is “what historically creates bear cycles,” as inexperienced buyers absorb supply during falling prices.

Broader sentiment indicators echo the caution. CryptoQuant CEO Ki Young Ju said that “every Bitcoin analyst is now bearish,” while the Crypto Fear & Greed Index has plunged to 9 out of 100, its lowest reading since the market turmoil surrounding the Terra collapse in mid-2022.

Mining Stocks Slide on Earnings Misses and Price Weakness

The sell-off has spilled into crypto equities. Bitcoin has fallen about 12% in the past 24 hours and nearly 29% over the past month, while the total crypto market capitalization dropped almost 9% in a single day.

CleanSpark shares plunged more than 19% during Thursday’s session and slid further after hours after reporting quarterly revenue below expectations and posting a large net loss. IREN also missed estimates, with its stock falling sharply as the company highlighted its growing focus on AI infrastructure over Bitcoin mining.

Other major miners, including RIOT Platforms and MARA Holdings, recorded double-digit losses, underscoring how closely mining valuations remain tied to Bitcoin’s price and network economics following the 2024 halving.

Bitcoin’s current structure — whale distribution, retail accumulation, collapsing sentiment, and falling mining stocks — reflects a market under stress. While past cycles show such conditions can eventually set the stage for long-term bottoms, near-term data suggests caution remains dominant. For now, traders appear focused less on upside and more on managing downside risk.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m your translator between the financial Old World and the new frontier of crypto. After a career demystifying economics and markets, I enjoy elucidating crypto – from investment risks to earth-shaking potential. Let’s explore!