|

Getting your Trinity Audio player ready...

|

- PlanC predicts Bitcoin could reach $1M gradually by 2032.

- Institutional adoption may smooth out market volatility.

- Industry experts disagree on whether the rise will be fast or slow.

Stay ahead with real-time updates and insights—Join our Telegram channel!

Bitcoin’s path to $1 million per token may be less explosive than many expect. Pseudonymous analyst PlanC suggests that BTC could reach this milestone gradually over the next seven years, with smaller, manageable corrections instead of dramatic crashes. This “slow-grind” scenario challenges the notion of sudden, high-volatility surges and highlights Bitcoin’s growing adoption among institutional investors and traditional finance.

Slow and Steady Growth

PlanC speculates that Bitcoin might continue to rise in a predictable, almost “boring” fashion. According to the analyst, the cryptocurrency could experience 10–30% corrections and extended sideways trading without triggering the panic selling that often accompanies long consolidation periods. This steady trajectory contrasts sharply with some industry predictions of rapid, double-digit percentage jumps in value.

Stay ahead with real-time updates and insights—Join our Telegram channel!

Diverging Industry Predictions

Not everyone shares PlanC’s measured outlook. Samson Mow, founder of Jan3, predicts an “omega candle” that could push Bitcoin’s price up by $100,000 in a single day. Meanwhile, Coinbase CEO Brian Armstrong forecasts a $1 million Bitcoin by 2030, and Eric Trump believes the milestone is inevitable within the next several years. Conversely, Galaxy Digital CEO Mike Novogratz warns that a $1 million Bitcoin too soon could signal serious economic problems in the U.S., suggesting that timing matters as much as price.

Institutional Support and Market Dynamics

Swyftx lead analyst Pav Hundal notes that corporate treasuries, institutional desks, and sovereign buyers are providing a steady base of demand, which could smooth out Bitcoin’s volatility. However, he cautions that these “strong hands” aren’t immune to traditional market forces. If credit spreads widen or risk measures fluctuate, even institutional holders might be forced to sell, underscoring that the market is still in uncharted territory.

While the debate over Bitcoin’s speed toward $1 million continues, PlanC’s slow-and-steady projection emphasizes sustainable growth supported by institutional adoption. Whether the milestone arrives through gradual gains or sudden surges, the evolving market dynamics suggest that Bitcoin’s future remains both promising and unpredictable.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

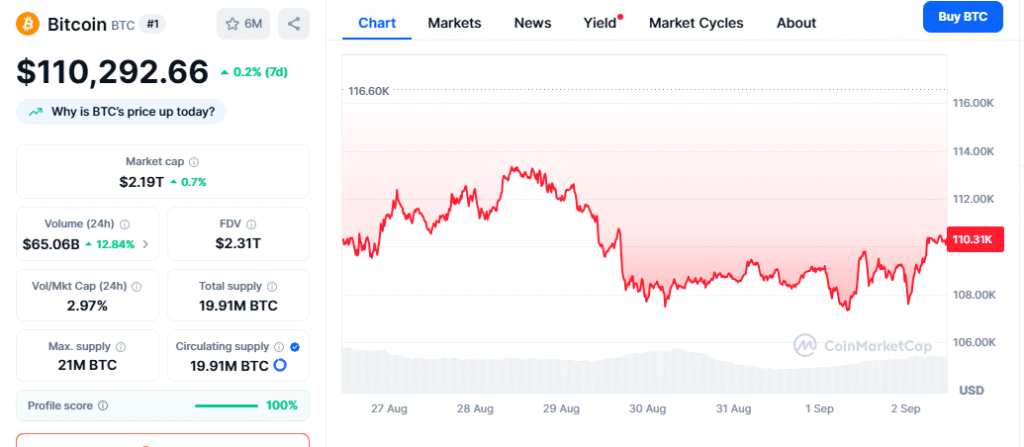

Also Read: Bitcoin Dips Below $110K as Schiff Warns $75K

I’m a crypto enthusiast with a background in finance. I’m fascinated by the potential of crypto to disrupt traditional financial systems. I’m always on the lookout for new and innovative projects in the space. I believe that crypto has the potential to create a more equitable and inclusive financial system.