|

Getting your Trinity Audio player ready...

|

The U.S. economy witnessed a slight inflation uptick in October, with prices rising 0.2% monthly, unsettling stock markets. This marked a halt to the S&P 500’s seven-day rally, reversing gains from the so-called “Trump trade” following the recent election. In stark contrast, Bitcoin (BTC) surged over 4%, closing at $95,883 after four consecutive days of losses.

Bitcoin’s Resilience Amid Economic Uncertainty

Bitcoin’s price movement highlights its divergence from traditional financial markets during times of economic stress. As inflation concerns resurface, driven by elevated consumption costs and tariffs, Bitcoin’s role as a hedge against economic uncertainty gains prominence. This is evident as U.S. investors prepare for Thanksgiving, sparking speculation about whether Bitcoin could reclaim its $99,000 all-time high.

On-Chain Data Suggests Market Strength

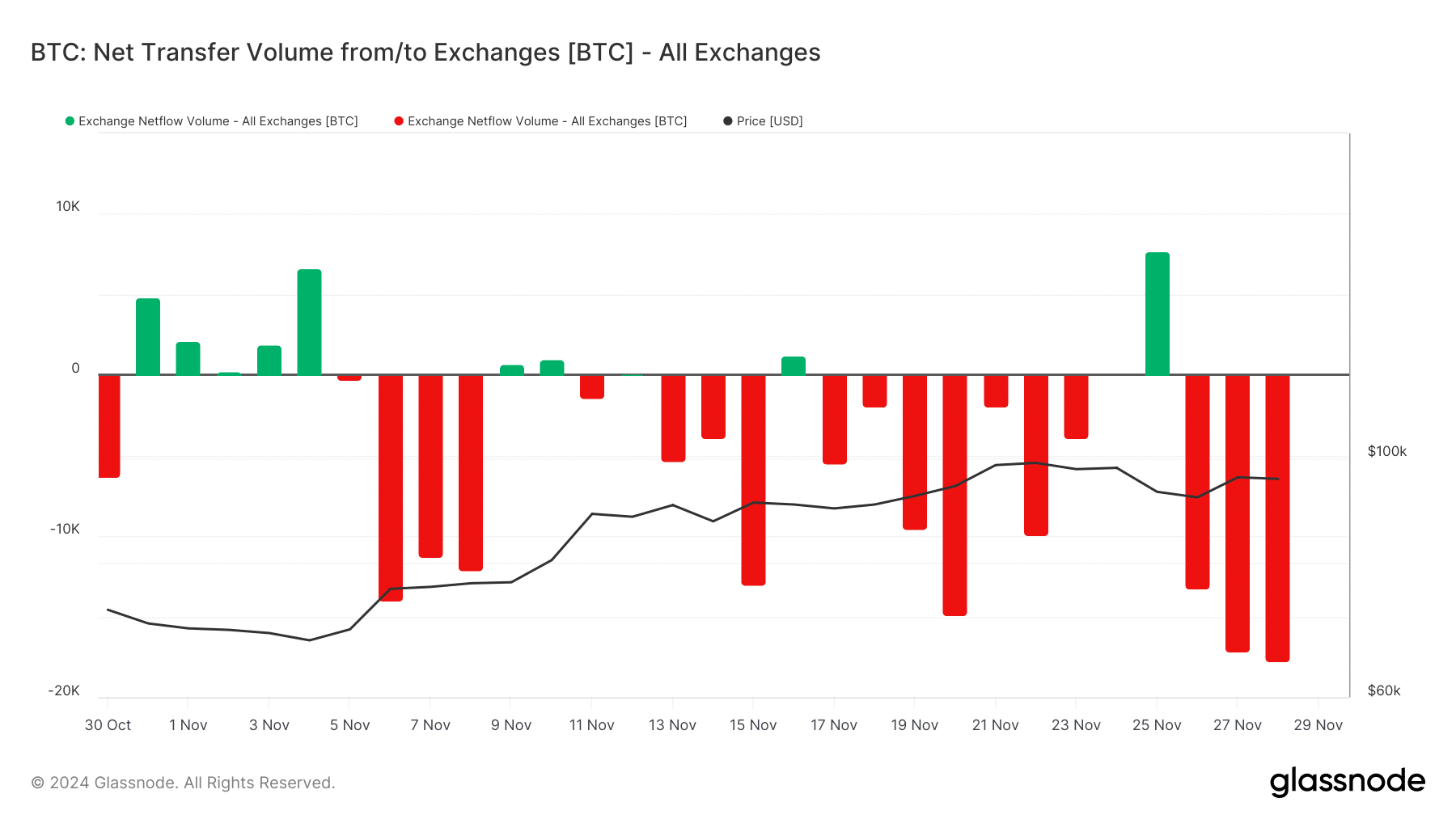

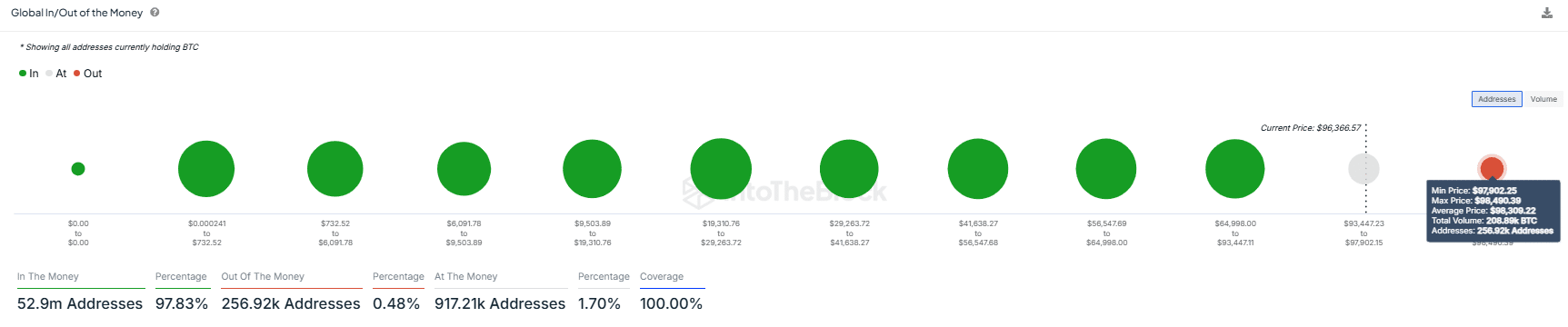

On-chain metrics provide insight into Bitcoin’s current rally. Approximately one million BTC, acquired at an average price of $93,447 across 917,000 wallets, signal strong investor confidence. Recent market activity shows retail investors accumulating over 13,000 BTC at an average price of $91,000, reinforcing a critical liquidity point and establishing $90,000 as a potential local bottom.

Additionally, institutional investors added to this momentum by withdrawing 20,000 BTC in the days leading to Thanksgiving. This trend underscores renewed optimism in the market, even as short-term holders offload positions.

$99,000 Resistance – A Make-or-Break Level

Despite the bullish sentiment, the $99,000 level remains a significant hurdle. On-chain data indicates resistance as traders assess high-risk price zones. A breakout above this level requires a combination of robust on-chain activity and favorable macroeconomic conditions.

A recent survey revealed a growing belief that the Federal Reserve will lower interest rates by 25 basis points in December, with market odds increasing to 64.7% from 55.7% the previous week. Such a decision could fuel Bitcoin’s upward trajectory, aided by institutional inflows, whale activity, and long-term holder commitment.

Outlook – Will Bitcoin Break $100K?

While Bitcoin’s resilience points to a possible rally, its ability to establish $99,000 as a new support level is critical. Investors holding BTC at higher averages will influence this movement, with their decisions shaping the asset’s near-term trajectory.

Monitoring on-chain datasets and macroeconomic shifts in the coming weeks will be essential. If Bitcoin holds within the $95,000-$97,000 range, the stage could be set for a historic breakthrough, potentially surpassing the $100,000 milestone.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m a crypto enthusiast with a background in finance. I’m fascinated by the potential of crypto to disrupt traditional financial systems. I’m always on the lookout for new and innovative projects in the space. I believe that crypto has the potential to create a more equitable and inclusive financial system.