|

Getting your Trinity Audio player ready...

|

Bitcoin mining creates new bitcoins and secures the network through computational work. Miners use specialized ASIC hardware to solve mathematical puzzles, earning rewards for validating transactions and adding new blocks to the blockchain.

This process has transformed from accessible CPU mining into a competitive industry requiring significant capital and cheap electricity. Understanding mining mechanics reveals how Bitcoin maintains security and controlled supply.

Transaction Validation and Network Security

Miners validate Bitcoin transactions using the SHA-256 hashing algorithm. When someone sends bitcoin, the transaction enters a mempool where miners select and bundle transactions into blocks.

To create a valid block, miners must generate a hash below the current difficulty target. The first successful miner adds their block to the blockchain and receives the block reward plus transaction fees.

This proof-of-work system prevents double-spending and transaction manipulation. Altering past transactions requires controlling over 50% of the network’s hash rate—currently requiring hundreds of thousands of ASIC miners running continuously.

The network automatically adjusts difficulty every 2,016 blocks (roughly two weeks) to maintain 10-minute block intervals regardless of total mining power.

Mining Economics and Profitability Factors

Three variables determine mining profitability:

Network Difficulty: Increases as more miners join, requiring more computational power to find blocks. Higher difficulty reduces individual miner rewards.

Electricity Costs: ASIC miners consume substantial power 24/7. Successful operations locate near cheap energy sources like hydroelectric plants or renewable energy facilities in regions like Kazakhstan and west Texas.

Bitcoin Price: Block rewards pay 3.125 BTC currently, making Bitcoin’s market value critical for profitability calculations.

Mining farms dominate the industry with warehouse facilities housing thousands of ASICs. These operations achieve economies of scale impossible for individual miners, creating high barriers to entry.

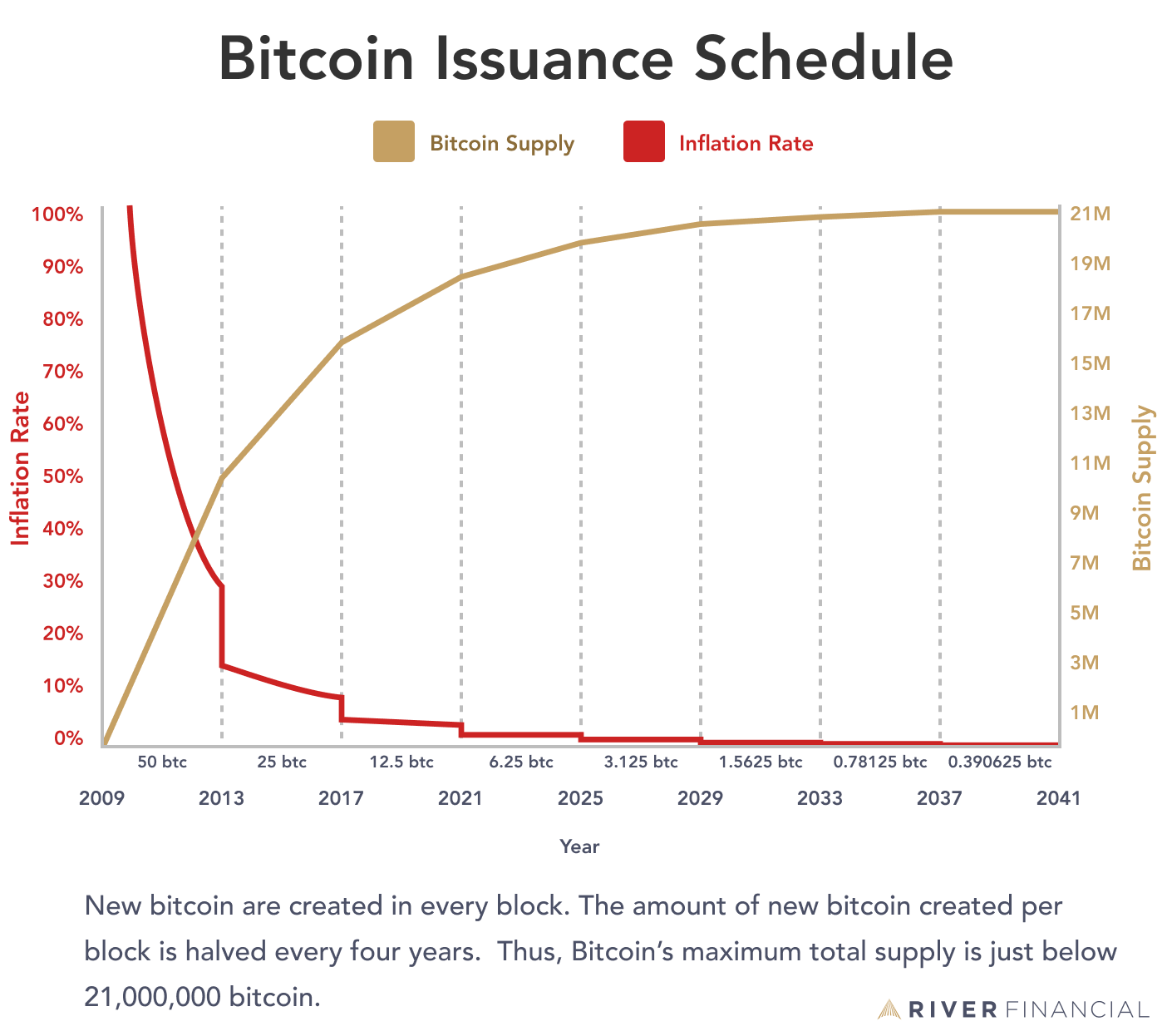

The block reward halves every 210,000 blocks, reducing from the original 50 BTC to today’s 3.125 BTC. This mechanism ensures only 21 million bitcoins will exist, with the final coins mined around 2130.

Mining Pools and Participation Strategies

Solo mining faces astronomical odds due to network competition. A single miner might never find a block independently.

Mining pools combine computational resources from multiple miners, distributing rewards proportionally based on contributed hash power. This provides steady income streams versus the uncertainty of solo operations.

Pool participants pay management fees but receive predictable payouts. Large mining operations sometimes avoid pools to collect full block rewards and eliminate fees.

Alternative Options:

- Hosted Mining: Third parties manage hardware and operations for fees, making mining accessible without technical expertise

- Altcoin Mining: Dogecoin and other cryptocurrencies offer different mining opportunities, some allowing merged mining of multiple coins simultaneously

- ASIC Rental: Some platforms allow renting mining power without hardware ownership

Industry Evolution and Current State

Bitcoin mining progressed through distinct phases:

- 2009-2012: CPU mining accessible to anyone

- 2013: ASIC introduction commercialized mining

- 2014-Present: Industrial-scale operations dominate

Modern mining requires specialized knowledge, significant capital, and access to cheap electricity. Environmental concerns drive adoption of renewable energy sources, with many operations now carbon-neutral.

Also Read:

As block rewards decrease through halvings, transaction fees will eventually become miners’ primary revenue source. This transition may further consolidate the industry around the most efficient operations.

Bitcoin mining remains essential for network security and monetary policy execution. The industry continues evolving toward sustainability while maintaining the computational power necessary to secure the world’s largest cryptocurrency network.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses

I’m a crypto enthusiast with a background in finance. I’m fascinated by the potential of crypto to disrupt traditional financial systems. I’m always on the lookout for new and innovative projects in the space. I believe that crypto has the potential to create a more equitable and inclusive financial system.