|

Getting your Trinity Audio player ready...

|

- Over $330M liquidated in 24 hours, mostly from shorts.

- Bulls must hold $108,650 support to keep Q4 upside alive.

- Leverage remains stacked, leaving both sides at risk of a squeeze.

Stay ahead with real-time updates and insights—Join our Telegram channel!

Bitcoin [BTC] is stuck in a dangerous balance as September closes, with traders caught between stacked leverage and thin liquidity. Despite a short squeeze that liquidated hundreds of millions in bearish bets, momentum has yet to swing firmly in favor of bulls.

$330 Million in Shorts Wiped Out, But Momentum Weak

According to CoinGlass, more than $330 million in crypto positions were liquidated in the past 24 hours, with 53% coming from short traders. It marked the second straight day of short squeezes, but the move still pales compared to last week’s $2 billion long wipeout.

Even with Bitcoin down roughly 9% from its all-time high, the market hasn’t yet locked into a new direction. Open Interest has climbed back above $80 billion, reflecting heavy leverage but also the risk of violent swings in either direction.

Market Split: Bulls Need Key Support Flip

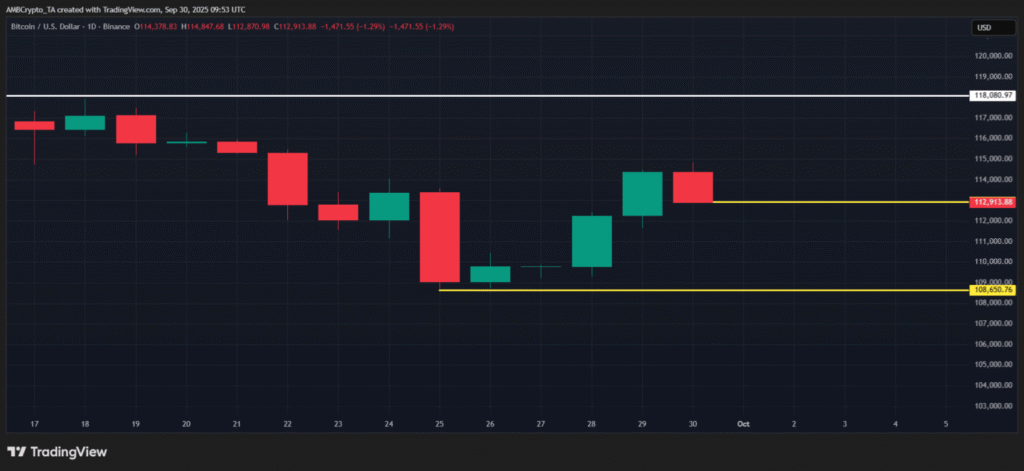

At the time of writing, Bitcoin traded near $112,913 after a 1.12% drop, briefly dipping below $112,000. For traders betting on upside, the crucial level is $108,650 — a close above that price could form the first higher low in weeks and give bulls a base to build momentum into Q4.

Without that flip, Bitcoin risks sliding lower as both sides continue to press leveraged bets. Binance’s long/short ratio is locked at 50:50, showing just how evenly split the market is.

Also Read: Bitcoin Eyes $140K as Dominance Falls, Altseason Set to Explode in Q4 2025

Short Clusters May Fuel Volatility

Data from Glassnode highlighted concentrated short positions between $110,000 and $111,000, forming a liquidation cluster. If bulls can defend support, those clusters could trigger another sharp squeeze higher. But thin bids mean BTC could first dip lower before such a move plays out.

Bitcoin’s setup remains fragile heading into Q4. A successful defense above $108,650 could open the door for a bullish recovery, while a breakdown risks prolonging the leverage loop. For now, both bulls and bears remain on edge as the market braces for its next decisive move.

Stay ahead with real-time updates and insights—Join our Telegram channel!

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m a crypto enthusiast with a background in finance. I’m fascinated by the potential of crypto to disrupt traditional financial systems. I’m always on the lookout for new and innovative projects in the space. I believe that crypto has the potential to create a more equitable and inclusive financial system.