|

Getting your Trinity Audio player ready...

|

Bitcoin (BTC) has struggled to break past key resistance levels over the past week, fluctuating between $95,000 and $98,000. As of this writing, BTC is trading at $95,936, marking a 2.55% daily decline and extending its bearish outlook on the weekly charts by 1.56%.

Despite this period of consolidation, institutional investors are capitalizing on the opportunity to accumulate BTC at relatively lower prices. Popular crypto analyst Ali Martinez has pointed to a rising institutional demand, citing the Coinbase Premium Index as an indicator of increasing buying pressure.

The Coinbase Premium Index has flipped positive over the past week, signaling a potential rise in US institutional demand for #Bitcoin $BTC! pic.twitter.com/AUtuMeP9pE

— Ali (@ali_charts) February 11, 2025

Institutional Demand for Bitcoin on the Rise

The Coinbase Premium Index has remained positive over the past week, signaling stronger demand for BTC on Coinbase compared to Binance. This suggests that U.S.-based institutional investors are leading the accumulation phase. When institutions increase their holdings, it typically reflects a bullish outlook on Bitcoin’s long-term prospects.

Further reinforcing this bullish sentiment is a noticeable decline in selling pressure from Bitcoin miners. Crypto analyst Alphractal has noted that after a period of high miner liquidations, the selling activity has dropped below average levels, reducing the BTC supply in circulation.

BTC Charts Indicate Potential Breakout

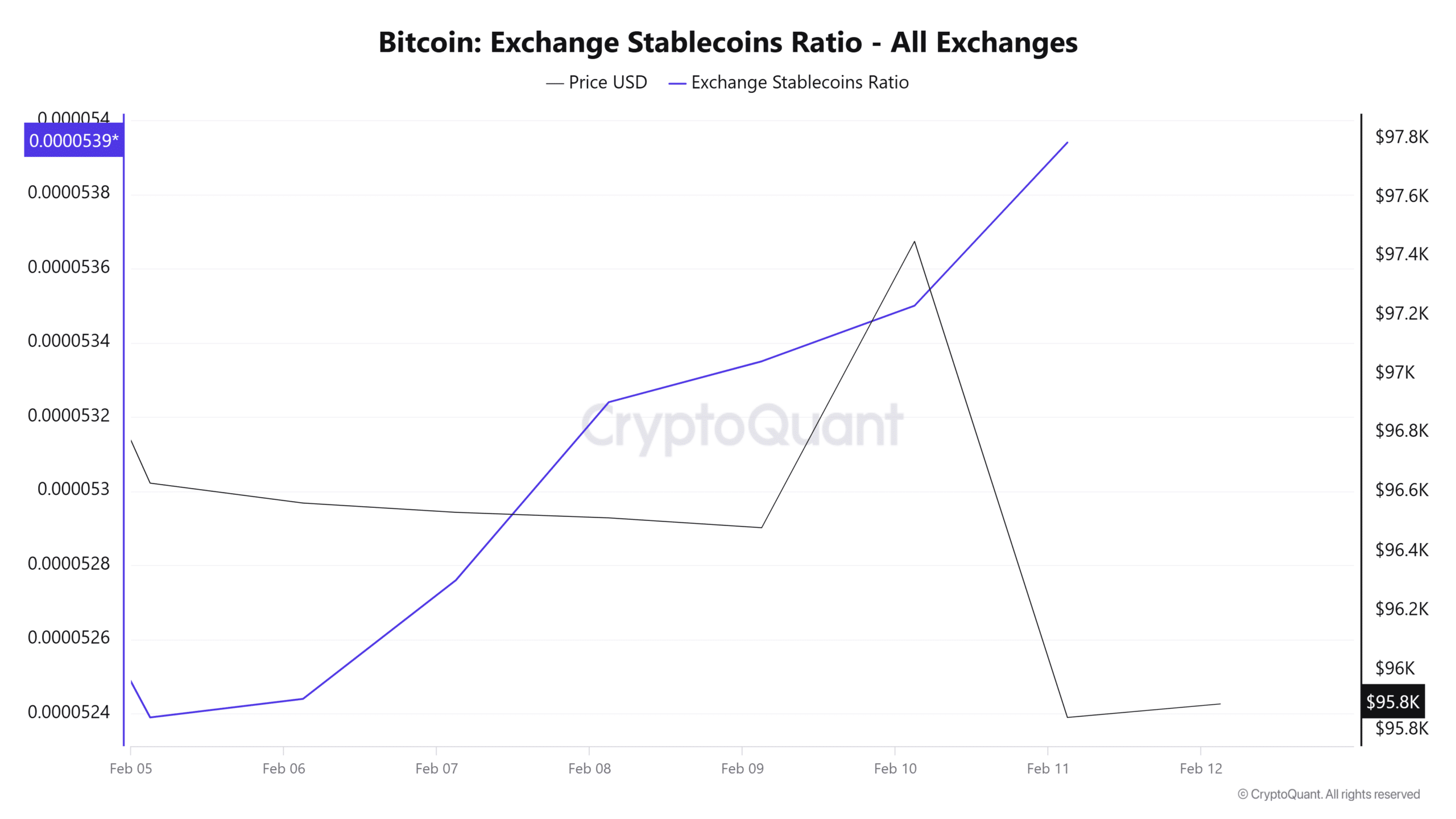

In addition to reduced miner selling, Bitcoin’s exchange stablecoin ratio has surged. Institutions often use stablecoins like USDT or USDC to purchase BTC, making an increase in stablecoin supply a key indicator of potential buying power in the market.

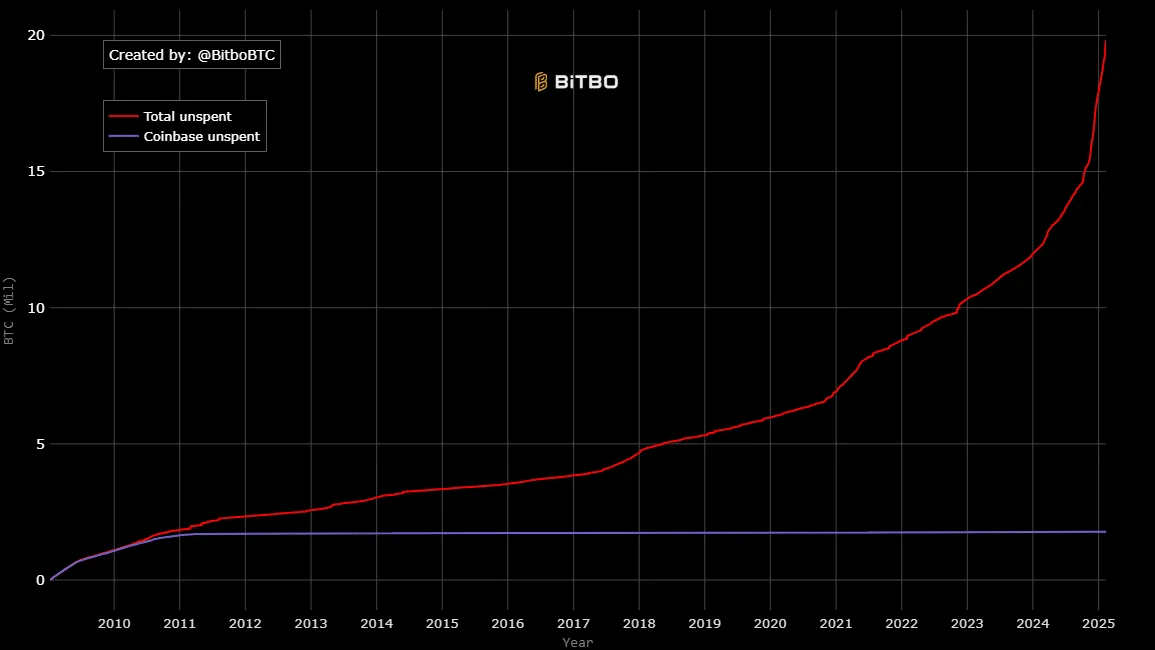

Another crucial factor is the stability of dormant BTC holdings. While total unspent BTC has been steadily rising, Coinbase’s unspent coins have remained unchanged, suggesting that long-term holders are refraining from selling despite short-term volatility.

Bitcoin’s Next Move: $100K or a Pullback?

With institutions accumulating BTC and selling pressure waning, Bitcoin appears primed for a potential breakout. If buying momentum continues, BTC could breach the $98,405 resistance level and attempt to cross the $100,000 threshold. However, with short-term holders still selling, a pullback could see BTC retrace to $95,031 before another push higher.

Also Read: Cathie Wood Predicts $1.5M Bitcoin by 2030 as Institutional Adoption Surges

As institutional confidence strengthens, Bitcoin’s long-term trajectory remains bullish, reinforcing its status as a key asset in global financial markets.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m your translator between the financial Old World and the new frontier of crypto. After a career demystifying economics and markets, I enjoy elucidating crypto – from investment risks to earth-shaking potential. Let’s explore!