|

Getting your Trinity Audio player ready...

|

- Miner demand–supply balance slips 6% but remains supportive.

- Trendline at $107K holds as critical BTC price support.

- NVT ratio and Open Interest signal healthier network activity.

Stay ahead with real-time updates and insights—Join our Telegram channel!

Bitcoin [BTC] continues to show resilience above $112,000, even as miner demand has slightly softened. The Miner Demand–Supply Balance slipped 6% from its all-time high, easing to 60%. While this still indicates demand outweighs issuance, the narrowing margin calls for cautious optimism.

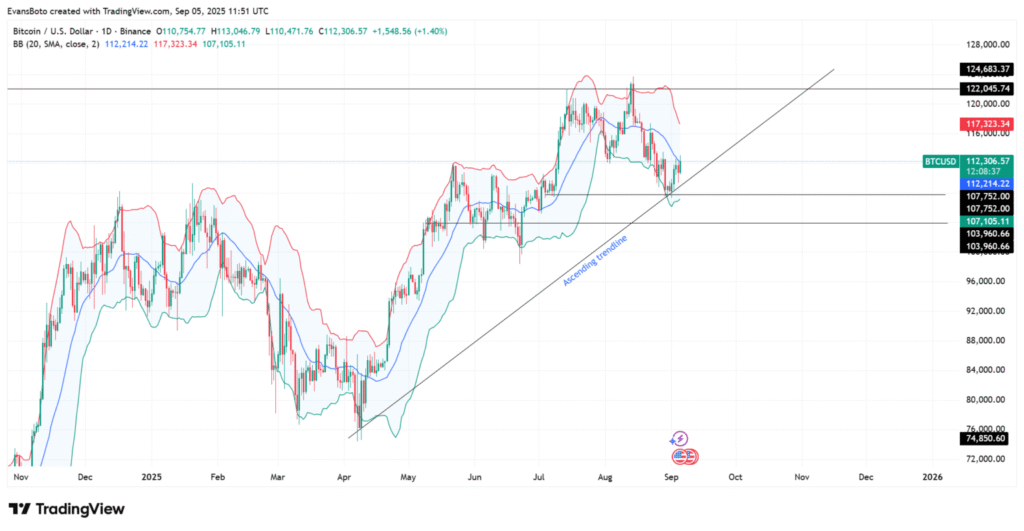

Price Support Holds Above Trendline

Despite moderating demand, Bitcoin’s price structure remains intact. The ascending trendline around $107,000 has acted as a strong defense zone, with recent rebounds confirming its importance. Currently trading at $112,306, BTC has reclaimed ground within its Bollinger Bands, signaling a healthy recovery.

Near-term resistance stands at $117,000, followed by $122,000 and $124,000. A decisive break above these levels could strengthen the bullish case, while a slip below $107,000 risks a deeper correction toward $104,000.

NVT Ratio Shows Healthier Network Strength

On-chain metrics continue to support Bitcoin’s neutral-to-bullish bias. The Network Value to Transaction (NVT) Ratio fell by 12.26% to 26.90, reflecting stronger transaction activity relative to valuation. This trend reduces overvaluation risks and suggests growing network utility—a constructive sign for longer-term sustainability.

Open Interest Points to Higher Volatility

Meanwhile, Open Interest in Bitcoin derivatives rose 2.66% to $42.15 billion, showing renewed activity from market participants. This expansion highlights increasing appetite for both long and short positions, often a precursor to larger moves. However, heightened positioning also raises liquidation risks if support levels fail.

Overall, Bitcoin remains in a cautiously bullish zone. The miner balance drop warrants attention, but strong trendline support, healthier on-chain activity, and growing Open Interest suggest that BTC can maintain momentum if buyers defend key levels. Investors should monitor $107,000 as the critical pivot for sustaining the uptrend.

Stay ahead with real-time updates and insights—Join our Telegram channel!

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses

Also Read: Asia’s First $1 Billion Bitcoin Treasury Fund Launched by Sora Ventures

I’m a crypto enthusiast with a background in finance. I’m fascinated by the potential of crypto to disrupt traditional financial systems. I’m always on the lookout for new and innovative projects in the space. I believe that crypto has the potential to create a more equitable and inclusive financial system.