As the broader cryptocurrency market continues its upward trajectory, with Bitcoin and Ethereum leading the charge, the performance of Terra tokens, LUNA and LUNC, has been a mixed bag.

While the broader market is experiencing a renewed surge in bullish sentiment, Terra tokens have struggled to keep pace. This divergence can be attributed to several factors, including the tokens’ controversial past and ongoing regulatory scrutiny.

Terra Classic (LUNC) Price Analysis

LUNC, the remnant of the original Terra project, has shown some resilience in recent months. However, its price action remains confined to a narrow range, indicating a lack of significant buying pressure. Technical indicators such as the DMI and MACD suggest a potential bearish trend, with the price likely to face resistance at the upper boundary of its current trading channel.

A downward correction towards the $0.000112 support level cannot be ruled out.

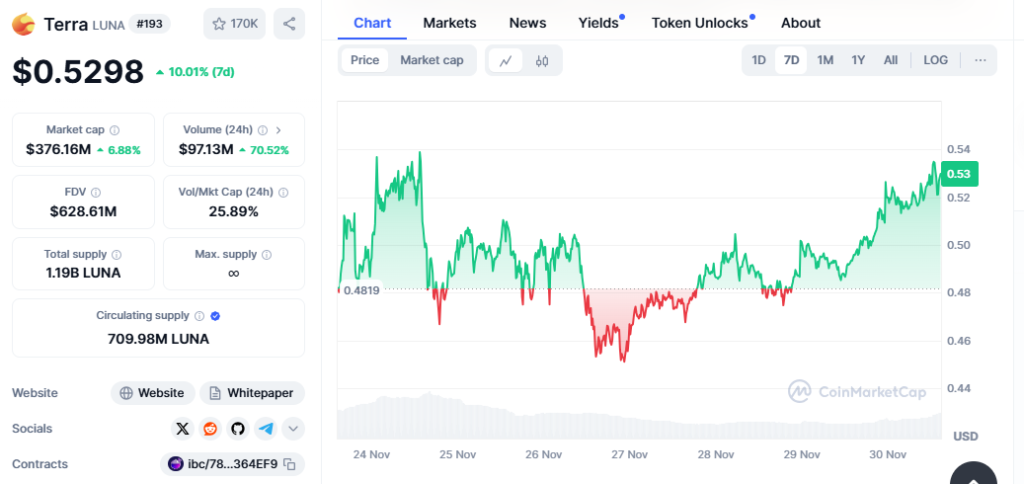

Terra (LUNA) Price Analysis

LUNA, the native token of the Terra 2.0 blockchain, has experienced a significant price surge in recent weeks. However, the buying pressure seems to be waning, and the price action appears to be consolidating within a range.

A bullish breakout could propel the price towards the $0.56 resistance level. If the bulls manage to sustain momentum above this level, a further rally towards the $0.67 to $0.69 resistance zone is possible.

While the broader cryptocurrency market is experiencing a bullish resurgence, Terra tokens, LUNA and LUNC, have failed to capitalize on the positive sentiment. Technical indicators suggest that both tokens may face challenges in the near future.

Investors should exercise caution and conduct thorough research before making any investment decisions. The future of Terra tokens remains uncertain, and their performance will largely depend on the broader market trends and the success of the Terra 2.0 ecosystem.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.