|

Getting your Trinity Audio player ready...

|

The cryptocurrency market is poised for heightened volatility today as a massive options expiry looms. A total of $2.04 billion worth of Bitcoin (BTC) and Ethereum (ETH) options contracts are set to expire, prompting traders to closely monitor key price levels and potential market movements.

Bitcoin and Ethereum Options Expiry Breakdown

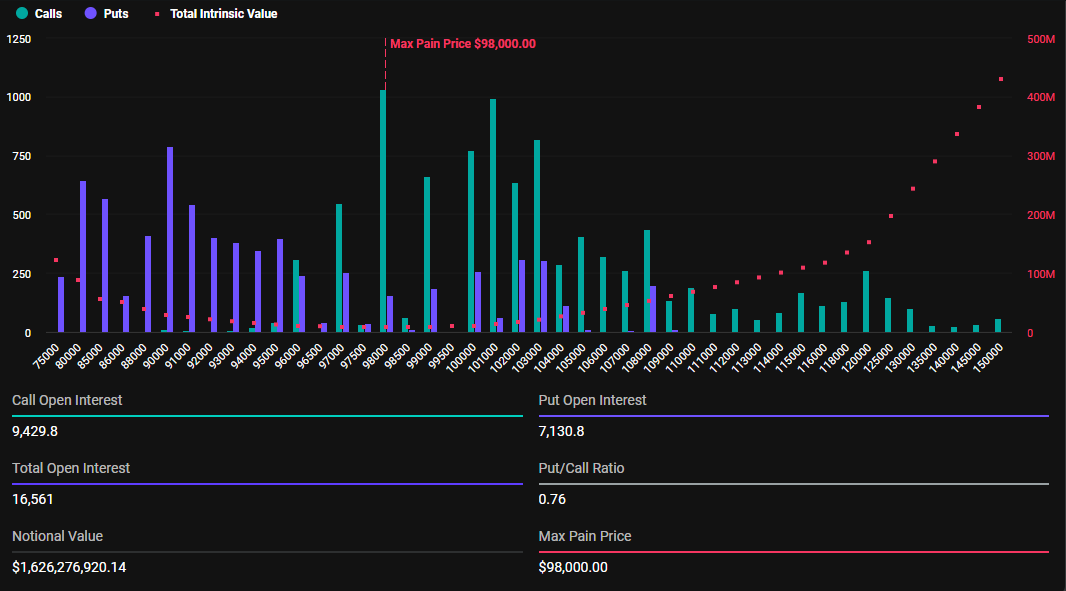

Bitcoin options expiring today carry a notional value of $1.62 billion, comprising 16,561 contracts. These contracts have a put-to-call ratio of 0.76 and a maximum pain point of $98,000, indicating a higher number of call options relative to puts.

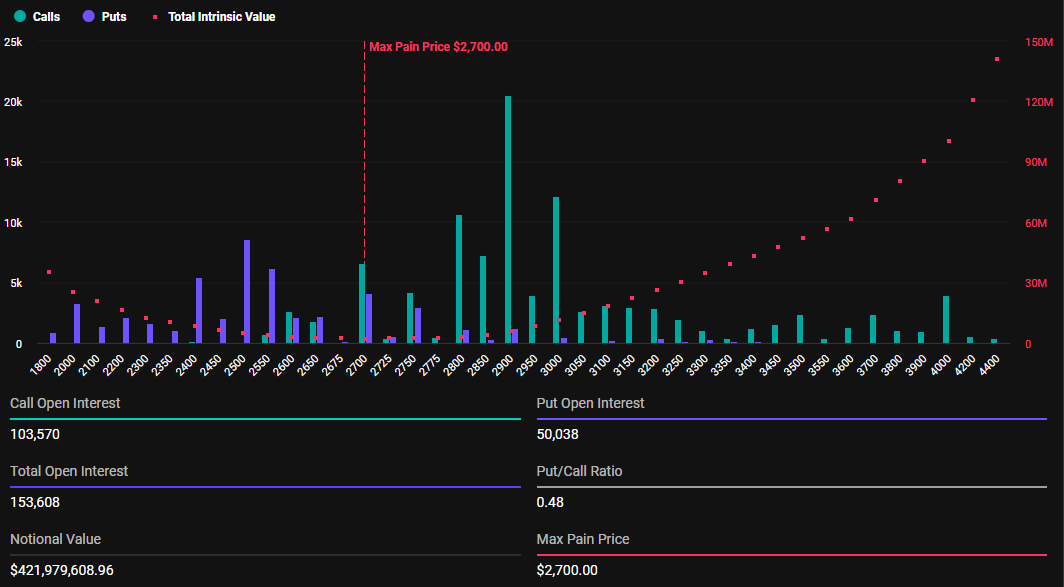

Meanwhile, Ethereum options include 153,608 contracts, valued at $421.97 million. With a put-to-call ratio of 0.48 and a max pain point of $2,700, ETH options suggest a dominance of bullish bets.

At the time of writing, BTC trades at $98,215, up 1.12% from Friday’s session, while ETH hovers at $2,746, marking a slight 0.20% dip. Given the put-to-call ratios, traders expect a bullish sentiment; however, the max pain theory suggests prices may gravitate toward the strike prices to minimize payouts for option holders, potentially triggering short-term corrections.

Market Sentiment and Volatility Outlook

Analysts at Greeks.live have observed a “cautiously bearish” sentiment, with low volatility keeping traders on edge. They note that Bitcoin’s $96,500 level is a key threshold, with skepticism about BTC’s ability to sustain upward momentum.

Deribit has also warned that while low volatility may seem reassuring, markets often react swiftly, and traders should brace for sudden price swings.

Bitcoin Price Outlook: Key Support and Resistance Levels

BTC currently trades around $98,243, sitting above a crucial support zone between $93,700 and $91,000. Historically, this range has seen strong buying interest, suggesting it could act as a defense against further declines. However, a major resistance level at $103,991 continues to cap gains, making it a critical hurdle for any breakout attempt.

Technical indicators reflect a mixed outlook. Bitcoin’s RSI stands at 50.84, signaling neutral momentum, while price action suggests a short-term bearish trend. If BTC holds above $93,700, a push towards the $100,000 milestone remains plausible. Conversely, a break below $91,000 could trigger a decline towards the $88,000-$85,000 range.

Also Read: Coinbase CEO: Bitcoin is a Memecoin with Tokenization Potential

As the expiration nears, traders should prepare for heightened volatility, with BTC and ETH potentially facing short-term corrections before resuming their broader trends.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m a crypto enthusiast with a background in finance. I’m fascinated by the potential of crypto to disrupt traditional financial systems. I’m always on the lookout for new and innovative projects in the space. I believe that crypto has the potential to create a more equitable and inclusive financial system.