|

Getting your Trinity Audio player ready...

|

- Bitcoin ETFs logged nearly $200M in outflows, the largest in two weeks.

- Basis trade unwinds and falling volumes contributed to selling pressure.

- Exchange balances hit multi-year lows, signaling long-term accumulation.

U.S. spot bitcoin ETFs recorded their sharpest daily outflows in two weeks on Thursday, signaling renewed caution among institutional investors as volatility picked up across the crypto market. The withdrawal wave coincided with tightening futures-spot spreads, declining ETF volumes, and broader macro uncertainty ahead of key U.S. economic events.

Major Issuers Lead the Pullback

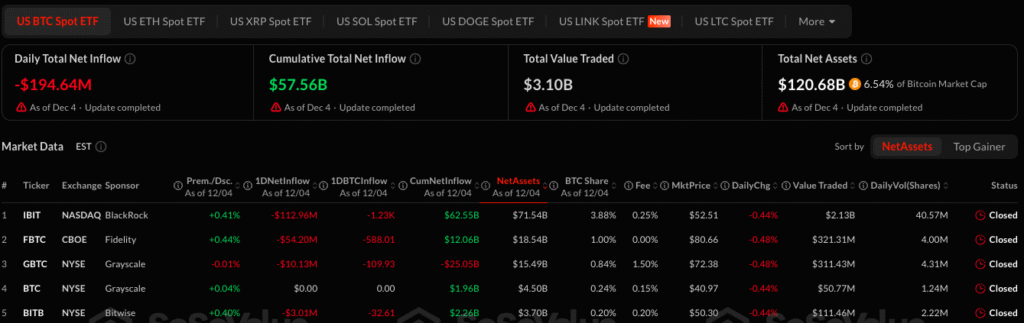

According to data from SoSoValue, U.S. spot bitcoin ETFs posted $194.6 million in net outflows, marking the largest daily withdrawal since Nov. 20. BlackRock’s IBIT, typically one of the most stable performers, led the exodus with $112.9 million leaving the fund. Fidelity’s FBTC followed with $54.2 million in outflows, while VanEck’s HODL, Grayscale’s GBTC, and Bitwise’s BITB also saw redemptions.

Thursday’s downturn extended a smaller $14.9 million outflow on Wednesday and accompanies steadily declining ETF trading volumes. Activity fell to $3.1 billion on Thursday, down from $4.2 billion the previous day and $5.3 billion on Tuesday — a sign that investor participation may be cooling as markets await clearer direction.

Volatility and Basis Trades Drive Selling Pressure

Bitcoin itself slipped 1.4% over the past 24 hours to trade near $91,989 early Friday. The asset had briefly dropped to the mid-$84,000 range earlier in the week before recovering.

Nick Ruck, director at LVRG Research, said the ETF weakness is largely tied to basis trade unwinds, as the futures-spot spread compressed below breakeven. “Arbitrage desks were forced to sell holdings amid heightened market volatility,” Ruck noted, adding that the mechanics of these trades often amplify short-term pressure when spreads tighten.

Investors are now watching upcoming U.S. inflation data and the Federal Reserve’s December 10 rate decision, where a potential 25-basis-point cut could help calm sentiment if it signals a broader shift toward easing.

Supply Tightens as Exchange Balances Hit Multi-Year Lows

Despite outflows at the ETF level, some on-chain indicators point to underlying strength. Timothy Misir, head of research at BRN, highlighted that bitcoin balances on exchanges have fallen to roughly 1.8 million BTC, the lowest since 2017. He said accumulation remains steady and the price is stabilizing above key metrics — but emphasized that the market still needs a decisive breakout into the $96,000–$106,000 range to confirm momentum.

Ethereum ETFs Also Reverse

Spot Ethereum ETFs mirrored the cautious tone, posting $41.6 million in outflows on Thursday after a strong $140.2 million inflow the day before. Grayscale’s ETHE led withdrawals with $30.9 million, underscoring the broader hesitation across digital-asset funds.

Also Read: Uniswap Unlocks Access for 40M+ Revolut Users as Fiat-to-Crypto On-Ramps Go Live

The latest rotation out of bitcoin and Ethereum ETFs reflects a market in wait-and-see mode. With volatility rising, spreads tightening, and traders preparing for macro catalysts, institutional flows may remain uneven — at least until policy signals and price structure offer clearer direction.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m your translator between the financial Old World and the new frontier of crypto. After a career demystifying economics and markets, I enjoy elucidating crypto – from investment risks to earth-shaking potential. Let’s explore!