|

Getting your Trinity Audio player ready...

|

Bitcoin’s sudden dip below $90K has ignited intense debates within the crypto community, dividing opinions on whether this signals the end of the bull market or presents an exciting opportunity for savvy investors. As the price of Bitcoin drops, the market sentiment shifts toward fear, yet history shows that such corrections can pave the way for rebounds. With the Crypto Fear & Greed Index currently sitting at 46—leaning more towards fear—the question on everyone’s mind is whether this is the start of a downtrend or simply a temporary dip in a longer bullish cycle.

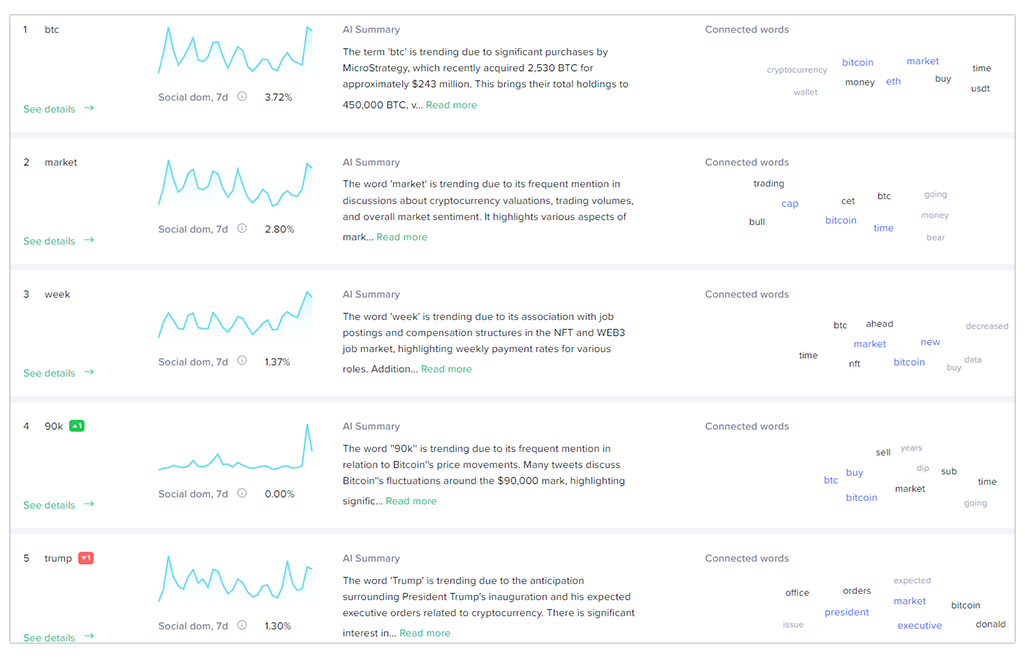

Social media is playing a crucial role in shaping market sentiment during this pivotal moment. The terms “buy,” “sell,” and “money” are flooding social platforms, highlighting the intensity with which investors are analyzing every move. Keywords like “btc” and “90K” are trending, reflecting the widespread discussions surrounding Bitcoin’s latest price movement. While fear spreads quickly, optimism follows when traders see potential for profit in what others may view as chaos. This creates a cycle of rapid emotional shifts, where even brief dips are seen as opportunities by the more risk-tolerant.

In addition to market speculation, politics have begun to influence crypto sentiment. The growing conversation around a potential “Trump pump” has stirred curiosity about how Donald Trump’s potential return to power could impact the crypto market. Some believe his policies could fuel a surge in crypto prices, while others remain cautious, acknowledging the uncertainty of the political landscape. Regardless of political factors, market trends in both crypto and traditional stocks have many investors paying close attention to short-term shifts, with phrases like “week” and “cap” gaining traction.

🗣️ The top trending topics in crypto are heavily revolving around Bitcoin's temporary drop to under $90K and Trump's inauguration next week. Regarding the former, the fact that '$90K' was being spammed across social media was a great fear signal that would foreshadow a bounce. pic.twitter.com/gL2GY1Lm6S

— Santiment (@santimentfeed) January 14, 2025

As Bitcoin recovers from its dip, the future remains uncertain. However, for those willing to take calculated risks, history often rewards the bold. Whether driven by politics, social media, or the market’s cyclical nature, the current moment offers both fear and potential. Are you ready to make your move?

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

Also Read: MicroStrategy Expands Bitcoin Holdings with $243 Million Purchase, Bringing Total to 450,000 BTC

I’m your translator between the financial Old World and the new frontier of crypto. After a career demystifying economics and markets, I enjoy elucidating crypto – from investment risks to earth-shaking potential. Let’s explore!