|

Getting your Trinity Audio player ready...

|

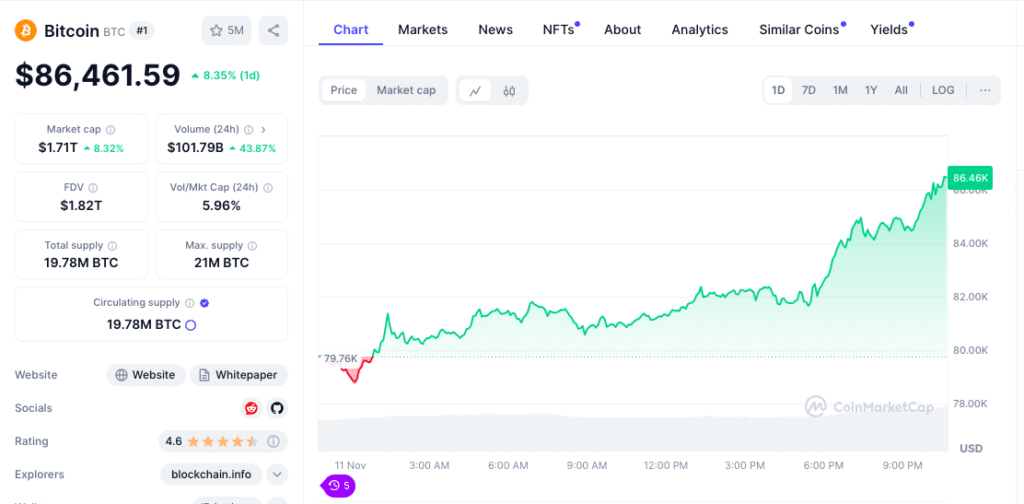

Bitcoin (BTC) has continued its meteoric rise, recently breaching the $86,000 mark, just 17% shy of the coveted six-figure price point. This surge, unprecedented in the cryptocurrency’s history, has been fueled by a perfect storm of bullish factors, including the recent US presidential election.

A New Era for Bitcoin?

The recent US election has sent shockwaves through global markets, and Bitcoin appears to be a prime beneficiary of the resulting volatility. As investors seek refuge in alternative assets, the cryptocurrency’s perceived value has soared. Analysts are increasingly optimistic about Bitcoin’s potential to hit $100,000 before the year’s end.

Also Read: MicroStrategy Acquires 27,200 BTC in Two Weeks, Now Holds $22.87B in Bitcoin as Price Soars to $82K

The Role of Political Climate

The political climate in the US is widely seen as a significant factor in Bitcoin’s price surge. The newly elected administration is expected to be more crypto-friendly, potentially introducing policies that could foster blockchain innovation.

This bullish sentiment is echoed by industry leaders. Brian Armstrong, CEO of Coinbase, hailed the recent election as a victory for crypto, predicting a more pro-crypto Congress. Other experts, like Andrey Lazutkin of Tangem Wallet, anticipate a regulatory environment that encourages US-based crypto companies to thrive.

Institutional Investment Fuels the Rally

Institutional investment has also played a crucial role in Bitcoin‘s recent price surge. The launch of Bitcoin ETFs has attracted significant capital from traditional investors, driving demand for the cryptocurrency.

As the crypto market matures, it is increasingly becoming an integral part of the global financial landscape. The recent surge in Bitcoin’s price is a testament to its growing appeal as a store of value and a hedge against inflation.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m your translator between the financial Old World and the new frontier of crypto. After a career demystifying economics and markets, I enjoy elucidating crypto – from investment risks to earth-shaking potential. Let’s explore!