|

Getting your Trinity Audio player ready...

|

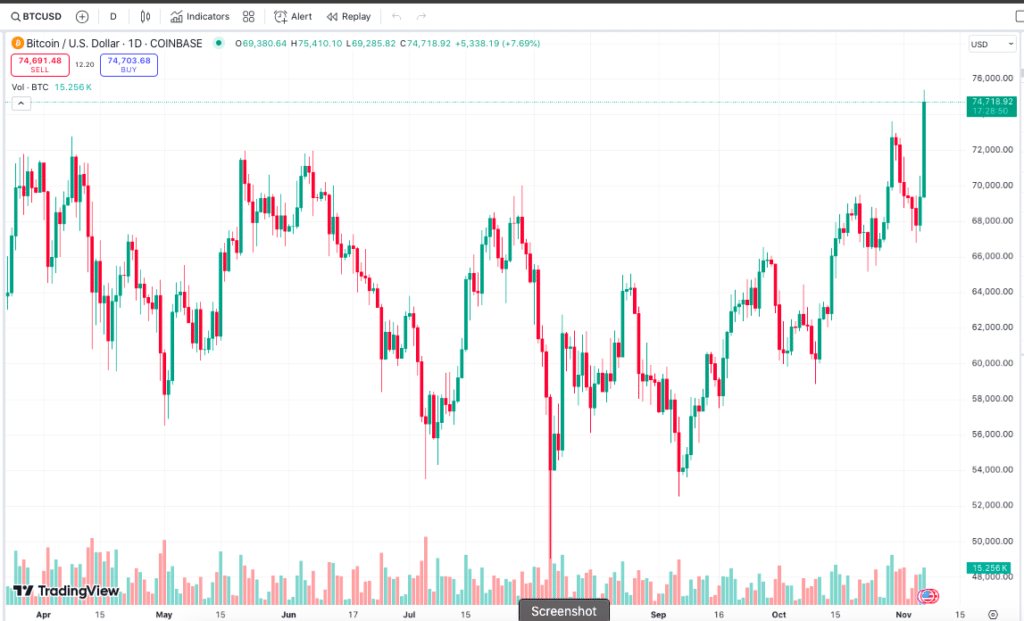

Bitcoin (BTC) has soared to new heights, breaking past $73,800 for the first time since March 2024 and briefly hitting $75,000 as early results from the U.S. presidential election show Donald Trump in the lead. This fresh all-time high comes amid heightened trading activity and volatility in the cryptocurrency market, with traders rallying around BTC as political developments unfold.

Bitcoin Hits Historic High Amid Election Volatility

In a pre-dawn trading session on Nov. 6, Bitcoin reached a record-breaking $75,000.85 on Coinbase, surpassing its previous peak of $73,800. According to data from TradingView, Bitcoin was trading at around $74,339 by 3:08 am UTC, up 7.2% over the last 24 hours. This marks a strong performance for Bitcoin, as it surged over 3% early in the New York trading session before continuing its upward momentum throughout the night.

The cryptocurrency market has historically been sensitive to global events, and the U.S. election is proving to be no exception. Early results reported by the Associated Press show Trump ahead with 198 electoral college votes compared to 112 for Kamala Harris, the Democratic candidate. Both candidates need at least 270 electoral votes to claim victory, making the race highly unpredictable and further fueling market speculation.

Is Trump’s Lead Fueling Bitcoin’s Rally?

Crypto analysts and traders have long speculated about the impact of a Trump victory on Bitcoin’s price. Throughout the 2024 campaign, Trump’s Republican platform has leaned toward more favorable cryptocurrency regulations, which has bolstered optimism among crypto investors. Prominent Bitcoin analyst Tuur Demeester linked Bitcoin’s rally to Trump’s rising odds, suggesting that favorable election news for the former president aligns with positive price movements in BTC.

The bitcoin price is closely tracking the US elections. Each time there's good news for Trump, it moves up. pic.twitter.com/mMgifTaBWx

— Tuur Demeester (@TuurDemeester) November 5, 2024

Supporting this theory, data from the decentralized prediction market Polymarket shows Trump’s odds of winning the election above 60%, with Harris lagging at under 39%. As Trump’s predicted victory odds climb, Bitcoin appears to follow suit, reflecting the belief that a more crypto-friendly administration could fuel further growth in digital assets.

ETF Outflows Reflect Growing Market Tensions

Despite the recent price spike, some indicators show signs of caution in the Bitcoin market. On Nov. 4, major Spot Bitcoin ETFs experienced rare and substantial outflows, with investors pulling $541.1 million from funds like Fidelity, ArkInvest, and Grayscale’s GBTC. Notably, however, BlackRock’s iShares Bitcoin Trust (IBIT) saw inflows of $38.3 million, signaling that some institutional investors remain bullish.

In addition, Bitcoin options markets have seen a surge in protective measures as traders hedge against potential price swings. Tony Stewart, founder of Pelion Capital, noted a rise in protective options trading. Cointelegraph analyst Marcel Pechman observed that traders appear bullish in the near term, particularly for November 7, 15, and 29, with most bets targeting prices between $72,000 and $75,000. However, a noticeable purchase of $64,000 puts suggests that some market participants are preparing for possible downside risks.

Also Read: Mt. Gox’s $2.2 Billion Bitcoin Transfer Sparks Market Fears Amid U.S. Election-Driven Volatility

Will Bitcoin’s Rally Hold?

As the U.S. election unfolds, Bitcoin’s recent rally underscores its appeal as a hedge against political uncertainty. Traders are closely watching the outcome, as a clear Trump lead could fuel more optimism in the crypto market. Nonetheless, Bitcoin’s recent performance comes with a note of caution, as the combination of election volatility and recent ETF outflows indicates potential for short-term fluctuations.

While analysts and investors remain bullish, market dynamics suggest a cautious approach to navigating Bitcoin’s next moves. As events develop and investor positioning adjusts, Bitcoin’s price trajectory will likely reflect both political influences and the ongoing appetite for cryptocurrency as a resilient alternative in times of uncertainty.

This election-fueled rally highlights the increasing intersection of politics and crypto, and investors are bracing for an active month as Bitcoin charts new territory and potential risks emerge.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m your translator between the financial Old World and the new frontier of crypto. After a career demystifying economics and markets, I enjoy elucidating crypto – from investment risks to earth-shaking potential. Let’s explore!