|

Getting your Trinity Audio player ready...

|

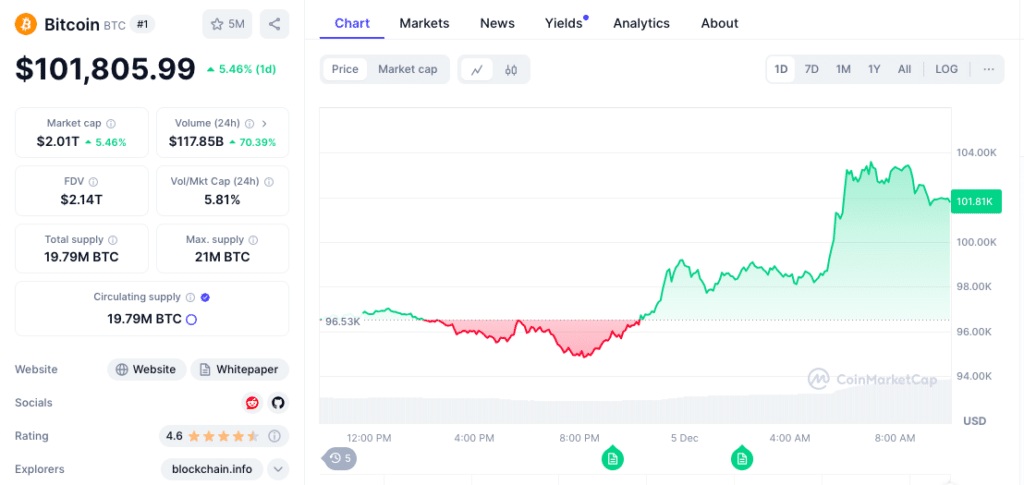

Bitcoin (BTC) has achieved a historic milestone, soaring to $100,000 for the first time in its history on December 5, 2024. The cryptocurrency, which has already made significant strides in the past few years, has gained 126% in value since January, driven by a combination of key factors including Bitcoin ETF demand, the halving event in April, and significant political developments in the United States.

Bitcoin’s Meteoric Rise in 2024

As of December 5, Bitcoin surpassed the psychological $100,000 mark, just weeks after hitting $90,000 on November 12. TradingView data shows that Bitcoin reached an all-time high of $104,000 shortly after crossing $100,000, signaling strong market momentum.

This remarkable surge in value comes after Bitcoin’s fourth halving in April, which reduced the supply of new Bitcoin entering the market. This tightening of supply has been a major catalyst for price appreciation, as scarcity often drives demand. In addition, Bitcoin has experienced over $31 billion in net inflows from spot Bitcoin exchange-traded funds (ETFs) in the United States, further fueling its rally.

Political and Institutional Support Driving Bitcoin’s Surge

The 2024 rally has also been supported by external factors, including political developments. Republican candidate Donald Trump’s victory in the U.S. presidential election has sparked speculation about a strategic Bitcoin national reserve, which could increase institutional demand. Trump’s administration is also expected to be more crypto-friendly, as evidenced by his recent nomination of crypto advocate Paul Atkins to replace Gary Gensler as the chair of the U.S. Securities and Exchange Commission (SEC).

Also Read: Ripple Vs. SEC Lawsuit Twist: Could Trump-Appointed Paul Atkins Drop the Case Against XRP?https://chainaffairs.com/ripple-vs-sec-lawsuit-twist-could-trump-appointed-paul-atkins-drop-the-case-against-xrp/

This shift in leadership could alleviate regulatory hurdles that have previously weighed on the industry, potentially fostering further growth. Trump’s pro-crypto stance is also reflected in his appointments of hedge fund manager Scott Bessent and Cantor Fitzgerald CEO Howard Lutnik to head the Treasury and Commerce departments, respectively. These appointments signal that the incoming administration may prioritize crypto adoption and regulation that benefits the digital asset space.

Bitcoin’s Performance in Context

While Bitcoin’s 2024 rally is impressive, it is not the most dramatic price surge in its history. In 2017, Bitcoin skyrocketed by 1,900%, rising from $1,000 in January to $20,000 in December. Similarly, during the COVID-19 pandemic, Bitcoin gained 1,250%, climbing from $5,100 in March 2020 to $69,000 in November 2021. However, the current market capitalization of Bitcoin, which has now reached $2 trillion, reflects its growing acceptance as a store of value and its increasing adoption by institutional players, including MicroStrategy’s Michael Saylor.

Bitcoin’s journey to $100,000 and beyond signals a new era for the cryptocurrency market. With growing institutional interest, political backing, and a more favorable regulatory environment, Bitcoin’s future appears promising. As the digital asset space continues to evolve, Bitcoin remains at the forefront, shaping the future of finance.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m your translator between the financial Old World and the new frontier of crypto. After a career demystifying economics and markets, I enjoy elucidating crypto – from investment risks to earth-shaking potential. Let’s explore!