|

Getting your Trinity Audio player ready...

|

- Bitcoin Surpasses $81K, Crypto Market Hits New Heights Greed Surges

The cryptocurrency market is buzzing with heightened optimism today as Bitcoin (BTC) breaks through the $80,000 barrier, reaching a historic all-time high (ATH) of $81,858.29 earlier today. Although the price has slightly corrected, settling at $81,073.67 at the time of writing, this bullish momentum signals a new chapter in the cryptocurrency landscape. As Bitcoin’s price ascends, the market cap of the entire crypto industry has risen to an impressive $2.71 trillion, reflecting a surge of investor confidence.

Bitcoin’s Meteoric Rise and Macroeconomic Factors

Bitcoin’s recent price surge can be attributed to a series of macroeconomic shifts and market dynamics. Notably, the victory of former U.S. President Donald Trump, along with a sharp increase in futures premiums, appears to be fueling the current bullish sentiment. Additionally, Bitcoin’s open options bets have seen a significant spike, with $1.6 billion in outstanding contracts now on the table. This is a clear indication of the rising speculative interest in BTC.

Bitcoin’s dominance within the crypto market has also strengthened. With a market cap now exceeding $1.6 trillion, BTC commands nearly 59.4% of the entire cryptocurrency space. This dominance reflects not only its price surge but also its growing acceptance as a store of value. Bitcoin’s performance is further bolstered by the inflow of institutional funds, with recent days seeing ETF inflows totaling $1.63 billion.

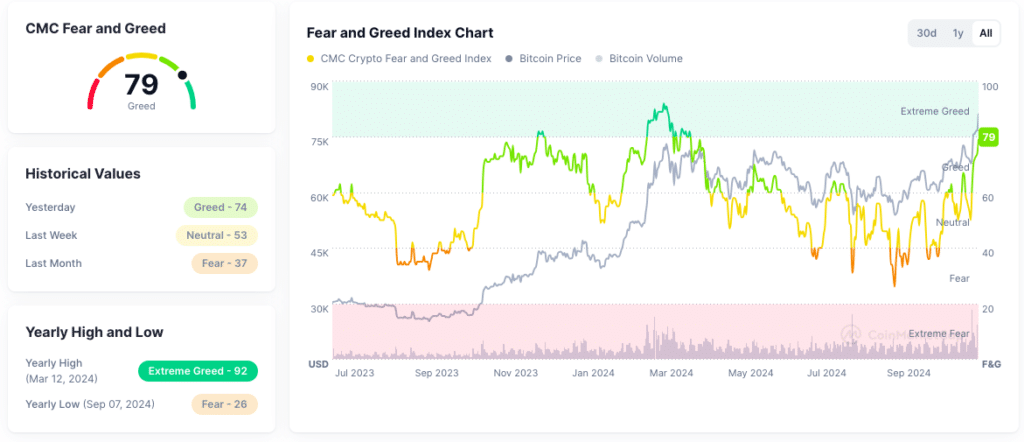

The Fear & Greed Index, a widely followed sentiment gauge for the crypto market, has spiked to 79, signaling a shift toward “Greed.” This indicates that investors are increasingly confident in the future of Bitcoin and the broader market. While this optimism is encouraging, it also signals the possibility of heightened volatility as market conditions evolve.

Altcoins Struggle Amid Bitcoin’s Surge

Despite Bitcoin’s impressive gains, the altcoin market has experienced some turbulence. Ethereum (ETH), the second-largest cryptocurrency by market cap, has seen a slight dip of 2.31%, trading at $3,111.49. Solana (SOL) has also followed suit, falling by 1.32% to $204.62, while XRP posted a 2.44% loss, bringing its price down to $0.5721. These declines highlight the uneven performance across the altcoin sector as Bitcoin continues to dominate market attention.

For Ethereum enthusiasts, the shift in ETH’s price could indicate a period of consolidation, though many still remain optimistic about its long-term potential, especially with Ethereum’s ongoing developments in scalability and smart contract capabilities.

Also Read: Dogecoin (DOGE) Soars – Technical Analysis and On-Chain Signals Point to Potential 50% Rally

Top Gainers and Losers

The altcoin market isn’t without its bright spots. Dogecoin (DOGE) has surged by an impressive 21.97%, reaching $0.2788, thanks to renewed investor interest. Other top gainers include Dogwifhat, which climbed 18.18%, and Floki, which rose by 15.31%. These gains demonstrate that there is still significant excitement within the altcoin space, even as Bitcoin takes center stage.

On the flip side, some tokens have experienced significant declines. Lido DAO, for example, saw a 13.73% drop to $1.25, while Helium and Neiro also faced losses of 8.04% and 8%, respectively. These downturns highlight the volatility of the altcoin market and the importance of due diligence when navigating this dynamic space.

As Bitcoin continues to break records and the broader market cap reaches new heights, the crypto space is entering an exciting phase of growth. However, with the Fear & Greed Index reaching extreme levels of optimism, investors should remain cautious about potential corrections. As always, it is essential to stay informed and vigilant in the fast-moving world of cryptocurrencies. Keep an eye on Bitcoin’s price trajectory and the broader market trends to navigate this ever-evolving financial landscape.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m your translator between the financial Old World and the new frontier of crypto. After a career demystifying economics and markets, I enjoy elucidating crypto – from investment risks to earth-shaking potential. Let’s explore!