|

Getting your Trinity Audio player ready...

|

The cryptocurrency world is abuzz with anticipation as analysts predict a potential “Bull Run 2.0” for Bitcoin. Renowned analyst Mags has ignited excitement by suggesting that the current consolidation pattern closely mirrors the one that preceded Bitcoin’s previous all-time high.

Mags points to the similarities between the current monthly consolidation and the one that occurred before Bitcoin’s historic price surge. In the past, many investors turned bearish during such consolidation periods, only to be caught off guard by subsequent price rallies. This pattern has led Mags to speculate that a similar scenario could unfold again.

Daan Crypto Trades has also delved into Bitcoin’s price action, identifying a four-stage cycle. The first stage involved an initial rally from January to April 2023, followed by a consolidation phase from April to September 2023. The second rally occurred between September 2023 and March 2024, and the current stage is expected to continue until now.

While Daan Crypto Trades acknowledges the challenges of market timing, they warn that attempting to sell in anticipation of lower prices could lead to missed opportunities. Holding spot positions is often considered the safest approach, as it allows investors to capture potential upside without the risk of timing the market incorrectly.

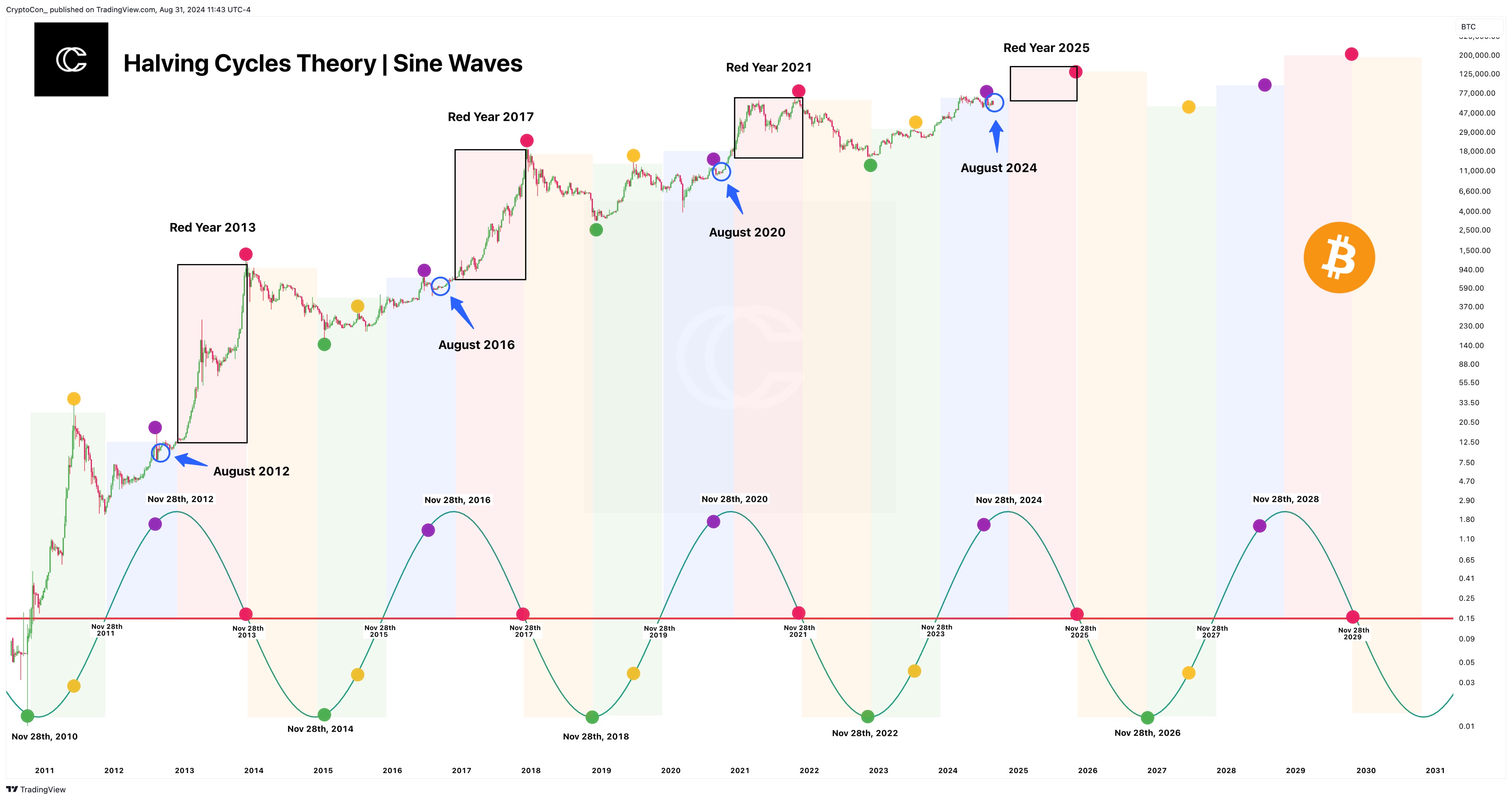

CryptoCon has offered a broader perspective on Bitcoin’s price action, suggesting that the current phase is typical of the end of a “Blue Year.” August has historically been a month of stagnation before major rallies, as evidenced by the years 2012, 2016, and 2020.

Furthermore, CryptoCon has revised its forecast for Bitcoin’s cycle top, raising it from $90,000-$130,000 to $110,000-$160,000. This upward revision reflects growing optimism about Bitcoin’s potential to reach new heights.

Also Read: Bitcoin’s (BTC) September Slump – Analysts Predict Potential 35% Drop Amid Bearish Trends

As the cryptocurrency market eagerly awaits the potential “Bull Run 2.0,” analysts’ predictions offer a glimpse into the exciting possibilities that lie ahead for Bitcoin. While the future remains uncertain, the consensus among many experts is that Bitcoin’s price is poised for a significant upward move.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m a crypto enthusiast with a background in finance. I’m fascinated by the potential of crypto to disrupt traditional financial systems. I’m always on the lookout for new and innovative projects in the space. I believe that crypto has the potential to create a more equitable and inclusive financial system.