|

Getting your Trinity Audio player ready...

|

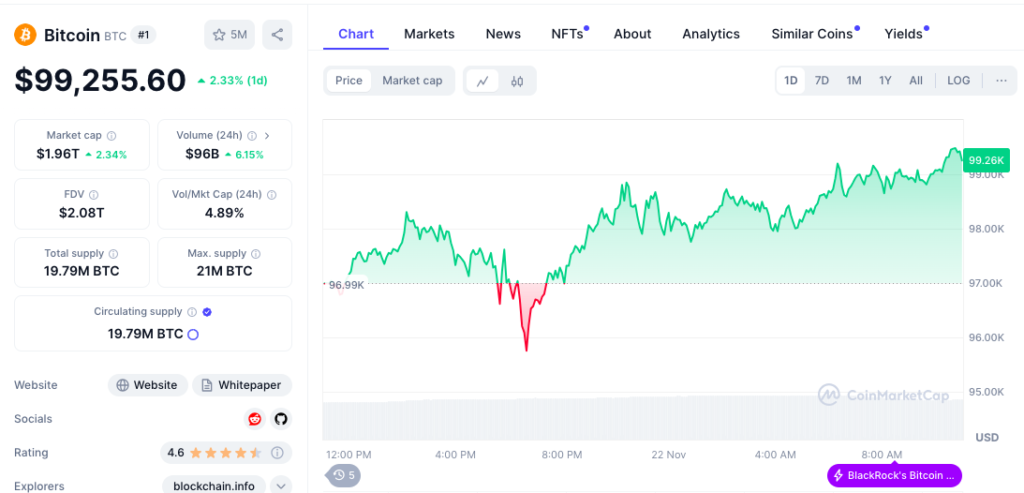

- Bitcoin (BTC) surged to over $99,000, maintaining dominance with 56% of the total crypto market cap.

- The crypto market reached a record $3.4 trillion, up 4.5% in 24 hours, fueled by BTC’s 2% spike.

- U.S. spot Bitcoin ETFs saw $1 billion in net inflows, led by BlackRock ($600M) and Fidelity ($300M).

Bitcoin (BTC) has led a significant rally in the cryptocurrency market, pushing prices above the $99,000 mark and boosting the overall market capitalization to a record high of $3.4 trillion. The renewed bullish sentiment is primarily driven by expectations of a crypto-friendly Trump administration taking office in January 2025.

BTC Dominance and ETF Inflows

Bitcoin’s dominance over the market, currently exceeding 56%, has been a major factor in the recent surge. The cryptocurrency has also benefited from significant inflows into Bitcoin spot exchange-traded funds (ETFs) in the U.S. BlackRock’s IBIT ETF, in particular, has seen substantial inflows of over $600 million, while Fidelity’s FBTC has attracted over $300 million.

Altcoin Rally

The strength of Bitcoin has also triggered a rally in other major cryptocurrencies:

- Ethereum (ETH): ETH prices have surged nearly 9% in the past 24 hours, boosting the broader DeFi sector. Ethereum-based memecoins like MOG and PEPE have also seen significant gains, capitalizing on ETH’s momentum.

- Solana (SOL): SOL has rallied 8% and reached new highs above $260, fueled by ETF filings in the U.S. and increased usage on the Solana blockchain.

- Cardano (ADA): ADA has gained 12%, making it one of the top performers among major cryptocurrencies.

- XRP: XRP has surged 25%, benefiting from the announcement of SEC Chair Gary Gensler’s resignation.

Bullish Outlook for Bitcoin

Market analysts and traders are optimistic about Bitcoin’s short-term outlook. QCP Capital, a prominent crypto trading firm, believes that continued strong demand for Bitcoin, coupled with easing monetary policies, will support prices as we approach the end of the year. The firm also noted significant demand for Bitcoin options with expiration dates in March, June, and September 2025, indicating long-term bullish sentiment among investors.

As the crypto market continues to evolve, it is essential to stay updated on the latest news and trends. Investors and traders should conduct thorough research and consider consulting with financial advisors before making any investment decisions.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.