|

Getting your Trinity Audio player ready...

|

Bitcoin (BTC) has once again defied expectations, surging 16% in just two days to surpass the $93,000 mark. This historic milestone has sparked intense debate among market analysts, with some expressing concerns about potential profit-taking by miners and others maintaining a bullish outlook.

A Closer Look at Miner Behavior

Julio Moreno, head of research at CryptoQuant, noted that some Bitcoin miners began taking profits on November 12th. However, this activity remained within normal levels and did not significantly impact the overall market sentiment.

Some large Bitcoin miners have started to take profits.

— Julio Moreno (@jjcmoreno) November 12, 2024

Selling is still small. pic.twitter.com/f1tFG2FKnT

Despite this minor profit-taking, several key metrics suggest that Bitcoin’s bullish momentum remains strong.

Macroeconomic Factors and Bitcoin’s Resilience

One such factor is the rising US Treasury yields. As investors demand higher returns on fixed-income securities, it indicates a decline in confidence in the US fiscal position. This, in turn, can drive investors towards alternative assets like Bitcoin, which is perceived as a hedge against inflation and economic uncertainty.

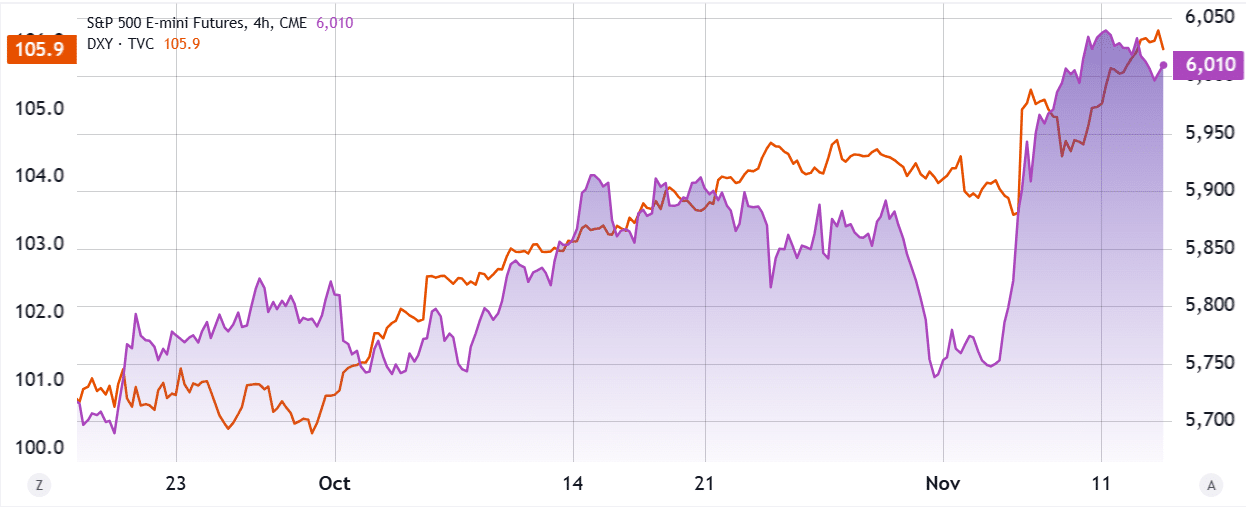

Contrary to popular belief, the recent strengthening of the US dollar against other major currencies has not negatively impacted Bitcoin’s price. In fact, a strong US dollar is often correlated with strong stock market performance, which only loosely correlates with Bitcoin’s price.

Bitcoin Derivatives Signal Further Upward Momentum

Bitcoin derivatives data also points to a bullish outlook. The Bitcoin futures premium, a key indicator of market sentiment, currently stands at 13%, suggesting moderate optimism among whales and arbitrage desks. This is a positive sign, especially considering Bitcoin’s recent all-time high.

Furthermore, the Bitcoin skew, which measures the cost of hedging with protective put options, remains neutral, indicating that professional traders are not overly concerned about an imminent price correction.

A Bright Future for Bitcoin

With a crypto-friendly US administration and a Republican majority in Congress, the stage is set for further Bitcoin price gains. Additionally, proposals like Senator Cynthia Lummis’s suggestion to increase US Treasury Bitcoin reserves could potentially propel BTC prices above the $100,000 mark.

While short-term volatility is inevitable, the long-term outlook for Bitcoin remains bullish, driven by its unique properties as a decentralized, digital asset with limited supply. As the world grapples with economic uncertainty, Bitcoin’s appeal as a store of value and a hedge against inflation is likely to continue to grow.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m your translator between the financial Old World and the new frontier of crypto. After a career demystifying economics and markets, I enjoy elucidating crypto – from investment risks to earth-shaking potential. Let’s explore!