|

Getting your Trinity Audio player ready...

|

Bitcoin (BTC) climbed above $61,000 on Friday as investors eagerly awaited the Federal Reserve’s annual Jackson Hole symposium. The event, scheduled for later in the day, is expected to provide clues about the central bank’s monetary policy stance, which could significantly impact the price of risk assets, including bitcoin.

Despite remaining within a relatively narrow trading range between $59,000 and $61,000 over the past two weeks, bitcoin’s upward momentum has been gaining traction. Traders are particularly focused on the potential implications of the Jackson Hole symposium, where Federal Reserve Chair Jerome Powell is scheduled to deliver a keynote address.

Other major cryptocurrencies, such as ether (ETH), Solana’s SOL, BNB Chain’s BNB, and XRP, experienced minimal price fluctuations over the past 24 hours. The broader CoinDesk 20 (CD20) index, which tracks the largest tokens by market capitalization, rose by 1.7%. Cardano’s ADA and Avalanche’s AVAX saw more significant gains, with ADA up 3% and AVAX jumping 10% after being added as a network option for Franklin Templeton’s OnChain U.S. Government Money Market Fund.

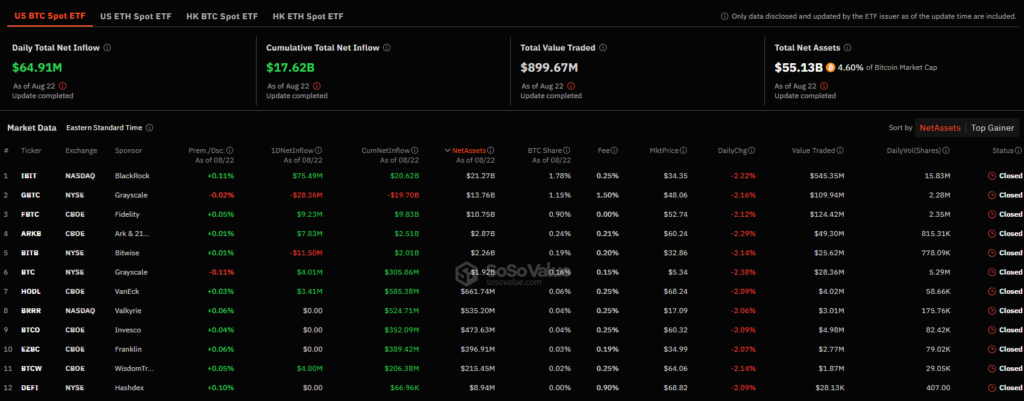

Meanwhile, spot bitcoin exchange-traded funds (ETFs) listed in the United States continued to attract inflows, extending a winning streak to six days. BlackRock’s IBIT ETF led the way with the highest inflows, totaling $75 million. While this positive trend suggests growing institutional interest in bitcoin, some market participants remain cautious, citing the potential for a slowdown in inflow rates as a bearish indicator.

SoSoValue Data

Ethereum ETFs, on the other hand, have experienced a record outflow streak of six days, reflecting a disappointing start to their first month of trading. These ETFs have lost just over $800,000 on Thursday, bringing their cumulative outflows to over $458 million since their launch on July 23.

The Jackson Hole meeting is expected to provide valuable insights into the Federal Reserve’s monetary policy direction, which will ultimately influence the pricing of risk assets, including bitcoin. Market participants are closely watching for any indications of potential rate cuts, which could bolster bullish sentiment among traders.

Also Read: Bitcoin Staking Frenzy Drives Transaction Fees Up 120x – Babylon Platform’s Record-Breaking Launch

While Powell is widely expected to confirm a pivot to lower borrowing costs next month, some analysts remain cautious, suggesting that he may want to maintain some flexibility in his policy stance. Overall, the Jackson Hole symposium is likely to have a significant impact on the cryptocurrency market, and investors are closely monitoring developments for potential price movements.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.