|

Getting your Trinity Audio player ready...

|

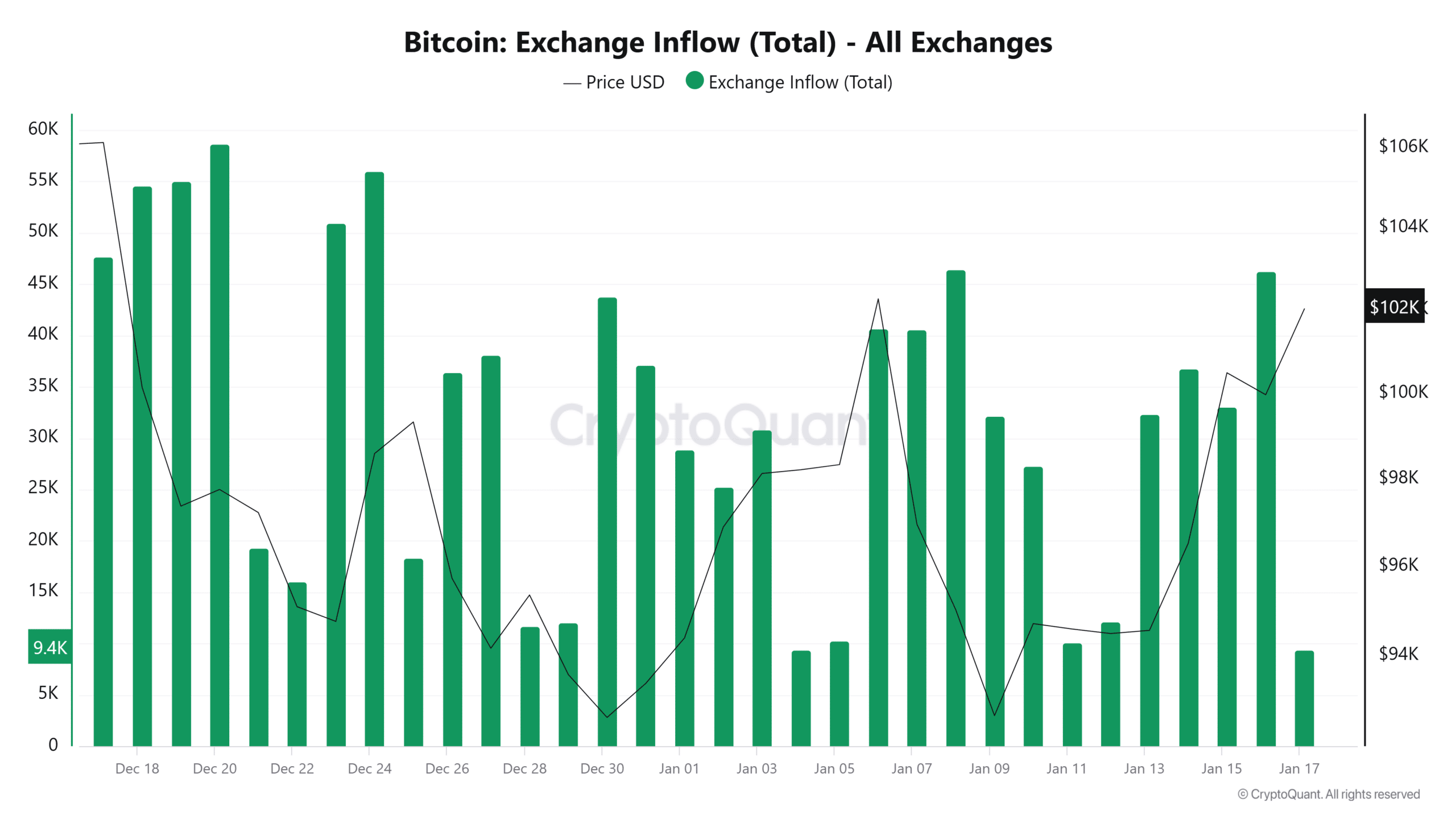

Bitcoin (BTC) has broken above the $100,000 mark, reigniting the crypto market’s attention and drawing in long-term holders. As the flagship cryptocurrency, Bitcoin’s price movement often sets the tone for the wider market. Since January 11th, Bitcoin has seen a sharp increase in exchange inflows, signaling renewed interest from both retail and institutional investors.

The surge in inflows echoes a similar pattern seen on January 6th when Bitcoin briefly hit a record high of $102,000. This raises the question: could we be on the brink of another rally?

BTC Exchange Inflows: A Sign of Renewed Activity

The recent spike in exchange inflows suggests that Bitcoin is experiencing a re-engagement phase. Traditionally, this uptick points to increased trading activity, often driven by long-term holders who had previously grown cautious during market uncertainty. As Bitcoin continues its bullish momentum, these holders appear to be positioning themselves for potential gains, driven by the fear of missing out (FOMO).

Large Transactions Fuel Market Optimism

In addition to the inflows, large Bitcoin transactions have surged over the past week. This uptick reflects growing participation from institutional players and high-net-worth individuals. Historically, such large transactions have preceded significant price movements, as major players typically fuel volatility. Their increased activity provides further evidence that Bitcoin’s price could continue its upward trajectory.

Can FOMO Propel Bitcoin to New Heights?

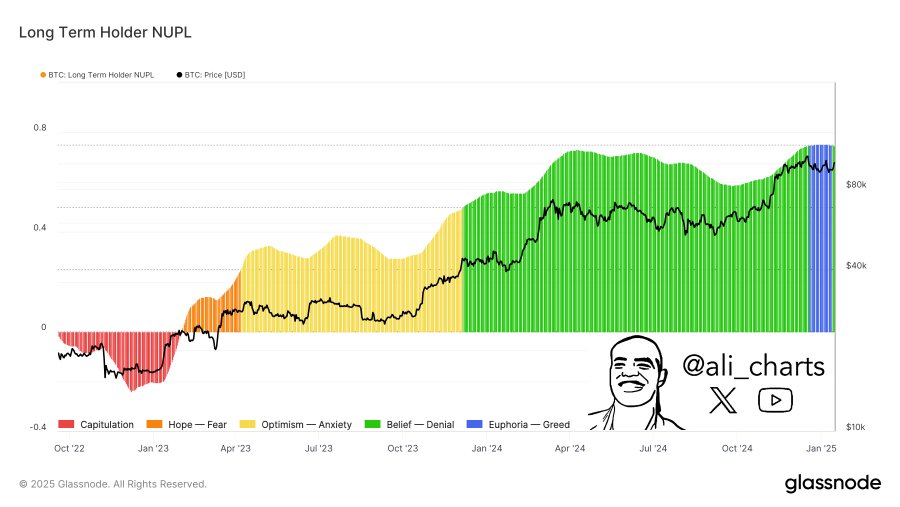

At the time of writing, Bitcoin was trading above $101,000, with a clear path for further gains in the near future. Holder sentiment has shifted toward greed, signaling potential for even higher prices. The psychological allure of Bitcoin crossing the $100K threshold is bound to attract additional attention, which could lead to increased buying pressure.

However, the road to higher prices may face resistance, including challenges from altcoin dominance and the next major resistance level. Despite these hurdles, Bitcoin‘s current momentum could be the spark for another explosive rally, potentially breaking through the forming bullish pennant.

Also Read: Trump’s Inauguration and the Bitcoin Act: Could a National Bitcoin Reserve Reshape the U.S. Economy?

As Bitcoin continues to push toward new highs, all eyes will be on whether the FOMO-driven surge can sustain the rally and break past critical resistance points.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

Crypto and blockchain enthusiast.