|

Getting your Trinity Audio player ready...

|

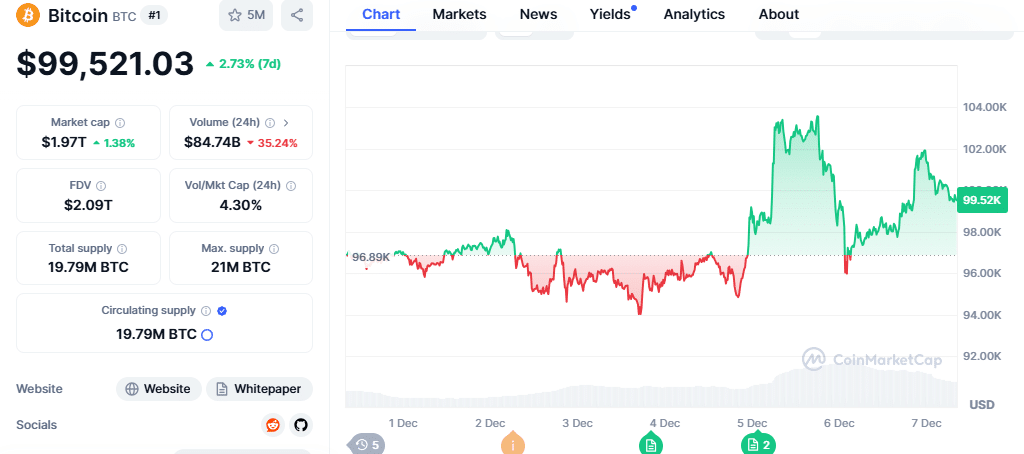

Bitcoin, the world’s largest cryptocurrency, has once again defied expectations, breaching the $100,000 mark. This monumental achievement has sent shockwaves through the crypto community, sparking debates about the future of digital assets. While some experts are predicting a meteoric rise towards unprecedented heights, a more cautious approach suggests a more tempered outlook.

The Psychology of the Market

The recent surge in Bitcoin’s price can be attributed to a perfect storm of factors, including increased institutional adoption, favorable regulatory developments, and a strong belief in the long-term potential of the cryptocurrency. However, the psychological impact of surpassing the $100,000 barrier cannot be underestimated. As FOMO (Fear Of Missing Out) grips the market, investors may be tempted to chase gains without considering the underlying fundamentals.

A Look Back at Bitcoin’s Halving Cycles

To understand the potential trajectory of Bitcoin’s price, it’s essential to examine historical trends. Bitcoin’s halving events, which occur roughly every four years, have historically led to significant price increases. However, the magnitude of these increases has gradually diminished over time. While the 2012 halving resulted in a staggering 7,900% price surge in 2013, the 2020 halving led to a more modest 594% increase in 2021.

This trend suggests that as Bitcoin matures, it may require more capital to generate the same level of price appreciation. Therefore, while a million-dollar Bitcoin may seem like a distant dream, a more realistic target for the next cycle could be between $130,000 and $190,000.

The Road Ahead

The future of Bitcoin is undoubtedly intertwined with broader macroeconomic factors and regulatory developments. The upcoming U.S. presidential election and potential policy changes could significantly impact the cryptocurrency market. A pro-crypto administration could fuel further adoption and investment, while a more restrictive regulatory environment could dampen enthusiasm.

While Bitcoin’s recent price surge is undoubtedly impressive, it’s crucial to maintain a level head and avoid excessive speculation. As always, it’s advisable to conduct thorough research and consult with financial advisors before making any investment decisions.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

Also Read: Mt. Gox Moves $2.8B in Bitcoin: What It Means for BTC Price and Creditor Payouts

I’m your translator between the financial Old World and the new frontier of crypto. After a career demystifying economics and markets, I enjoy elucidating crypto – from investment risks to earth-shaking potential. Let’s explore!