|

Getting your Trinity Audio player ready...

|

The Bitcoin mining industry has been under pressure in recent weeks as the cryptocurrency’s price dipped below the crucial $50,000 mark. This downturn significantly impacted miners’ profit margins, triggering capitulation and increased coin outflows.

The surge in hash rate and mining difficulty exacerbated the challenges faced by smaller miners. As a result, the path to a sustained Bitcoin recovery has been fraught with obstacles. The $60,000 psychological resistance level has proven to be a formidable barrier.

While technical indicators suggest a potential shift in momentum, the road to breaking this resistance is still fraught with challenges. The Relative Strength Index (RSI) on the 12-hour chart has hovered near the neutral 50 level, indicating indecision. However, recent upward movement suggests a potential bullish bias.

The On-Balance Volume (OBV) has also shown positive signs, indicating increased buying pressure. This could propel Bitcoin towards the $63,000 mark, but a significant resistance level lies in wait.

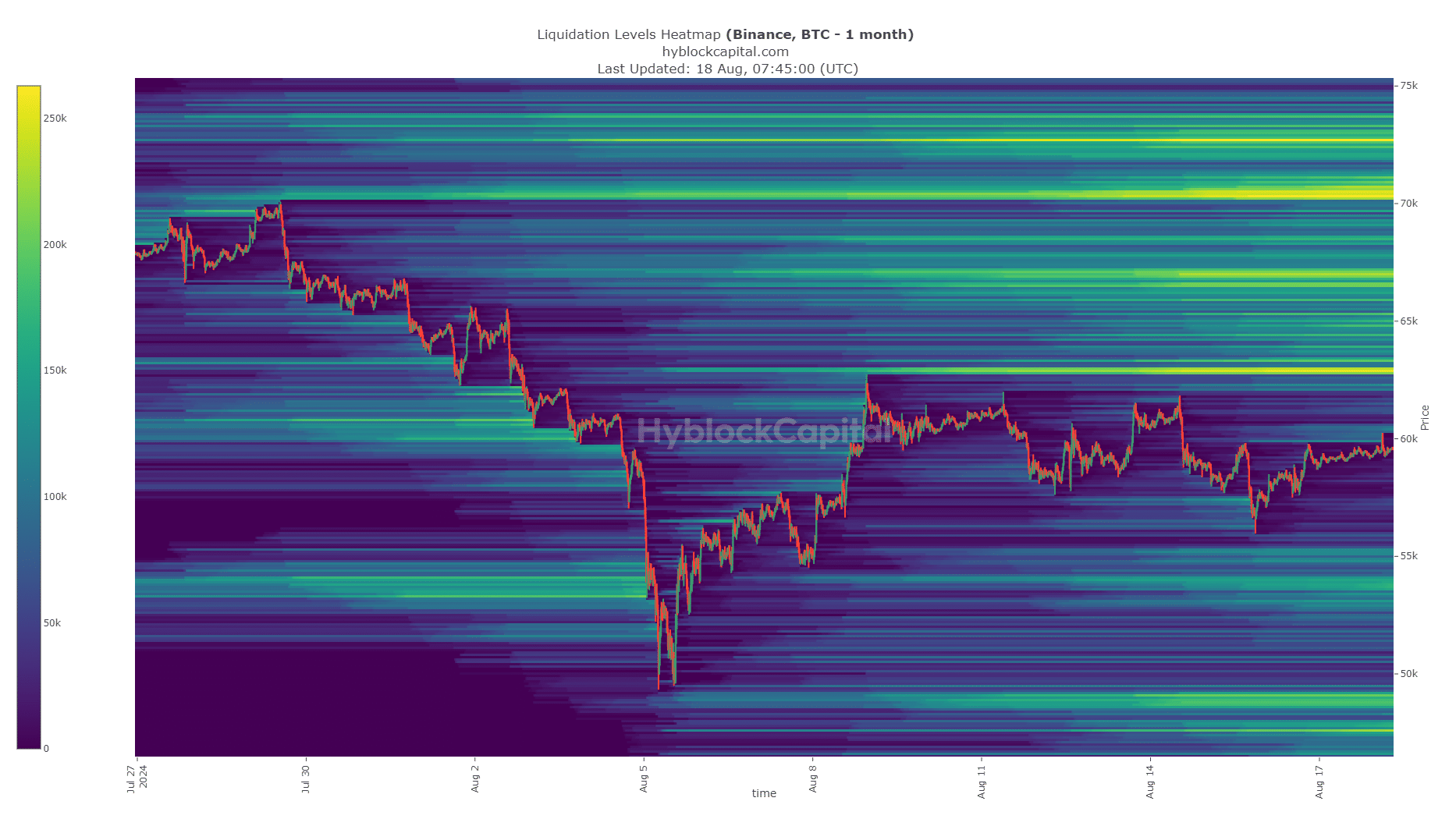

However, there’s a glimmer of hope for Bitcoin bulls. The liquidation heatmap reveals a concentration of liquidation levels at $63,000 and $67,100. This suggests that a price surge to these levels could trigger a cascade of liquidations, potentially fueling a further rally.

Despite these positive signs, it’s crucial to remember that the overall market structure for Bitcoin remains bearish on the weekly timeframe. A decisive break above $69,500 would be necessary to shift the balance of power in favor of the bulls.

As Bitcoin navigates these turbulent waters, traders and investors must remain vigilant and closely monitor price action and technical indicators. The battle between bulls and bears is far from over.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m a crypto enthusiast with a background in finance. I’m fascinated by the potential of crypto to disrupt traditional financial systems. I’m always on the lookout for new and innovative projects in the space. I believe that crypto has the potential to create a more equitable and inclusive financial system.