|

Getting your Trinity Audio player ready...

|

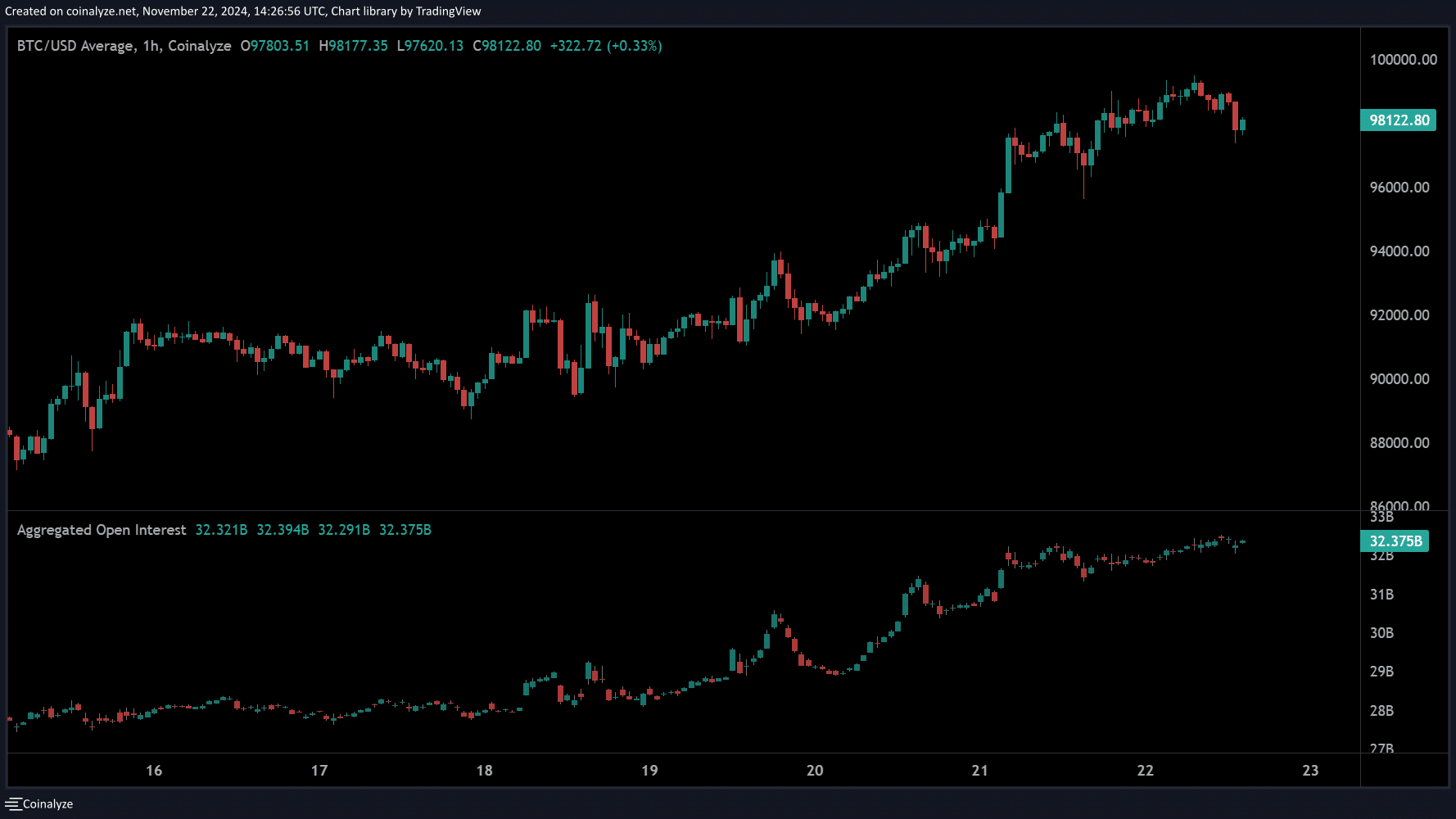

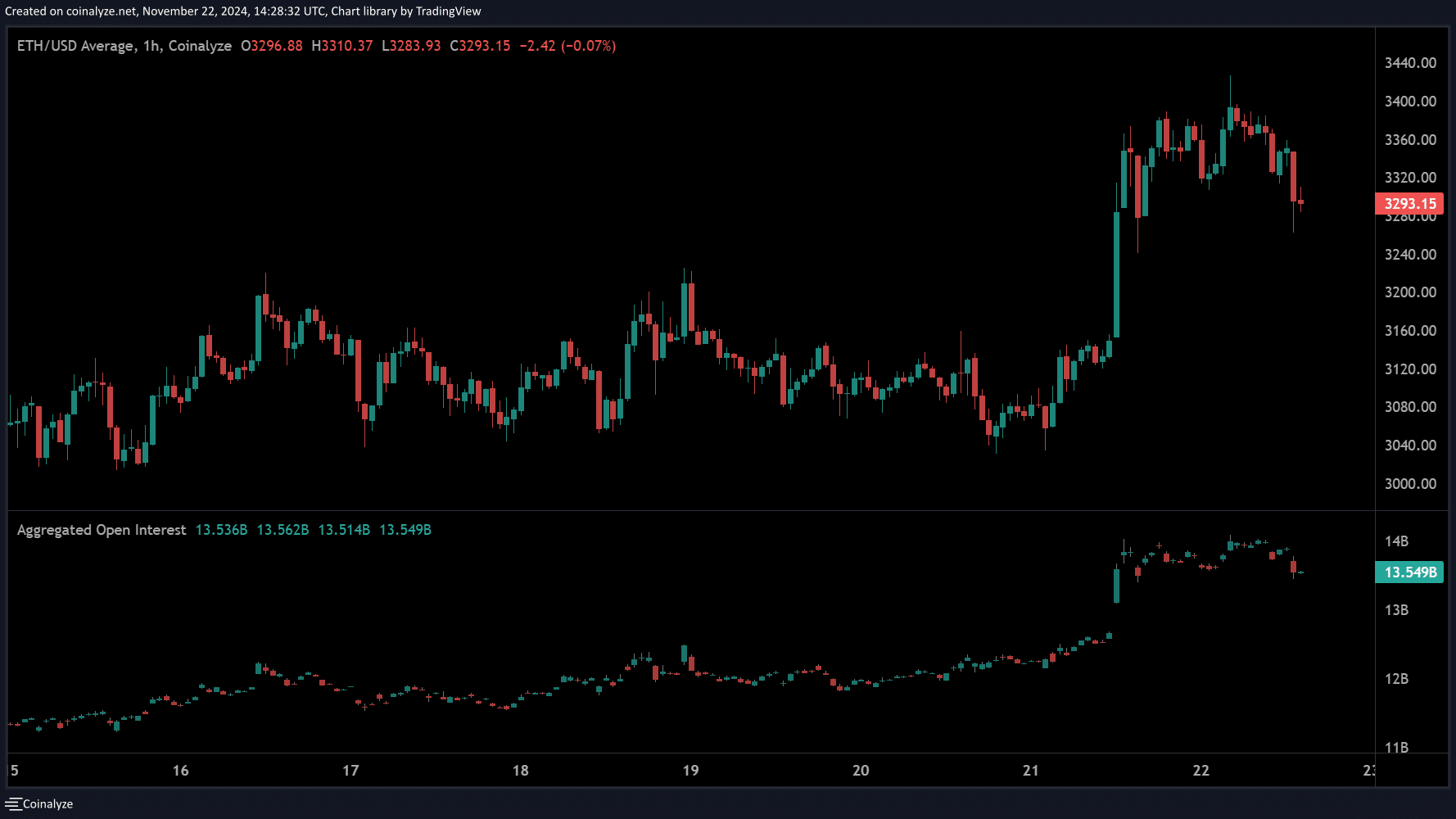

In a significant development for the cryptocurrency market, Bitcoin and Ethereum futures contracts have witnessed a surge in open interest (OI), reaching new all-time highs over the past 24 hours. This surge comes on the heels of Bitcoin’s recent flirtation with the $100,000 mark.

Bitcoin Futures Dominance

As of November 22nd, Bitcoin’s open interest peaked at a staggering $57 billion. This metric, which measures the total value of outstanding futures contracts, indicates a substantial increase in market activity and investor interest. The Chicago Mercantile Exchange (CME) has emerged as a dominant player in the Bitcoin futures market, currently holding over 33% of the total open interest.

Ethereum Futures Gain Momentum

Ethereum, the second-largest cryptocurrency by market capitalization, has also experienced a notable surge in futures trading. Its open interest climbed by 12% to an all-time high of $20.8 billion within the same 24-hour period. Binance, the world’s largest cryptocurrency exchange by trading volume, holds the largest share of Ethereum futures open interest, accounting for over 31% of the total.

Implications of Rising Open Interest

The increase in open interest for both Bitcoin and Ethereum signifies growing institutional and retail investor participation in the cryptocurrency market. As more investors seek exposure to these digital assets, futures contracts offer a regulated and accessible way to trade cryptocurrencies.

However, it’s important to note that a high level of open interest can also indicate increased market volatility. As the market becomes more speculative, sudden price swings may occur, potentially leading to significant gains or losses for investors.

As the cryptocurrency market continues to evolve, it remains to be seen whether the current bullish trend will persist. Factors such as regulatory developments, macroeconomic conditions, and technological advancements will play a crucial role in shaping the future of Bitcoin and Ethereum.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

A lifelong learner with a thirst for knowledge, I am constantly seeking to understand the intricacies of the crypto world. Through my writing, I aim to share my insights and perspectives on the latest developments in the industry. I believe that crypto has the potential to create a more inclusive and equitable financial system, and I am committed to using my writing to promote its positive impact on the world.