Crypto exchange giant Binance has once again reduced the circulating supply of Terra Classic (LUNC) by burning another 1.149 billion tokens. This latest burn, executed on August 1, is part of Binance’s ongoing commitment to support the LUNC community’s recovery efforts.

The burned tokens represent half of the trading fees generated from LUNC pairs on the exchange during July. However, despite this significant reduction in supply, LUNC’s price has failed to gain traction, continuing its downward trend.

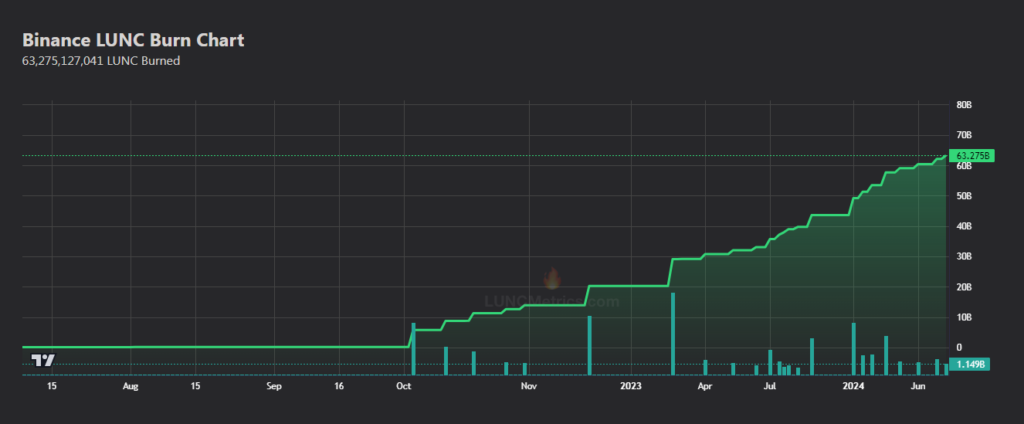

While Binance remains the largest burner of LUNC, having eliminated over 63 billion tokens since May 2022, the token’s overall supply remains astronomical at over 6.7 trillion. Other entities such as DFLUNC Protocol, KuCoin, MEXC, and Bybit have also contributed to the burn efforts, but the combined impact has been insufficient to significantly impact the price.

The data reveals a declining trend in Binance’s monthly burns. After incinerating a record 5.5 billion LUNC tokens in January, the exchange has seen a consistent decrease in the amount burned each month. This suggests that trading volume for LUNC on Binance might be declining, impacting the overall burn rate.

The crypto community is closely watching LUNC’s price action, as it remains a test case for the effectiveness of burn mechanisms in reviving a severely devalued token. With a long road ahead to reduce the excessive supply, the LUNC community faces an uphill battle to restore investor confidence and drive price appreciation.

In conclusion, the recent surge in trading volume for Cardano, both in the derivatives and spot markets, reflects the market’s keen interest in the cryptocurrency as it navigates a critical support level. Whether ADA will hold the line or falter remains to be seen, but for now, all eyes are on the $0.38 mark.