|

Getting your Trinity Audio player ready...

|

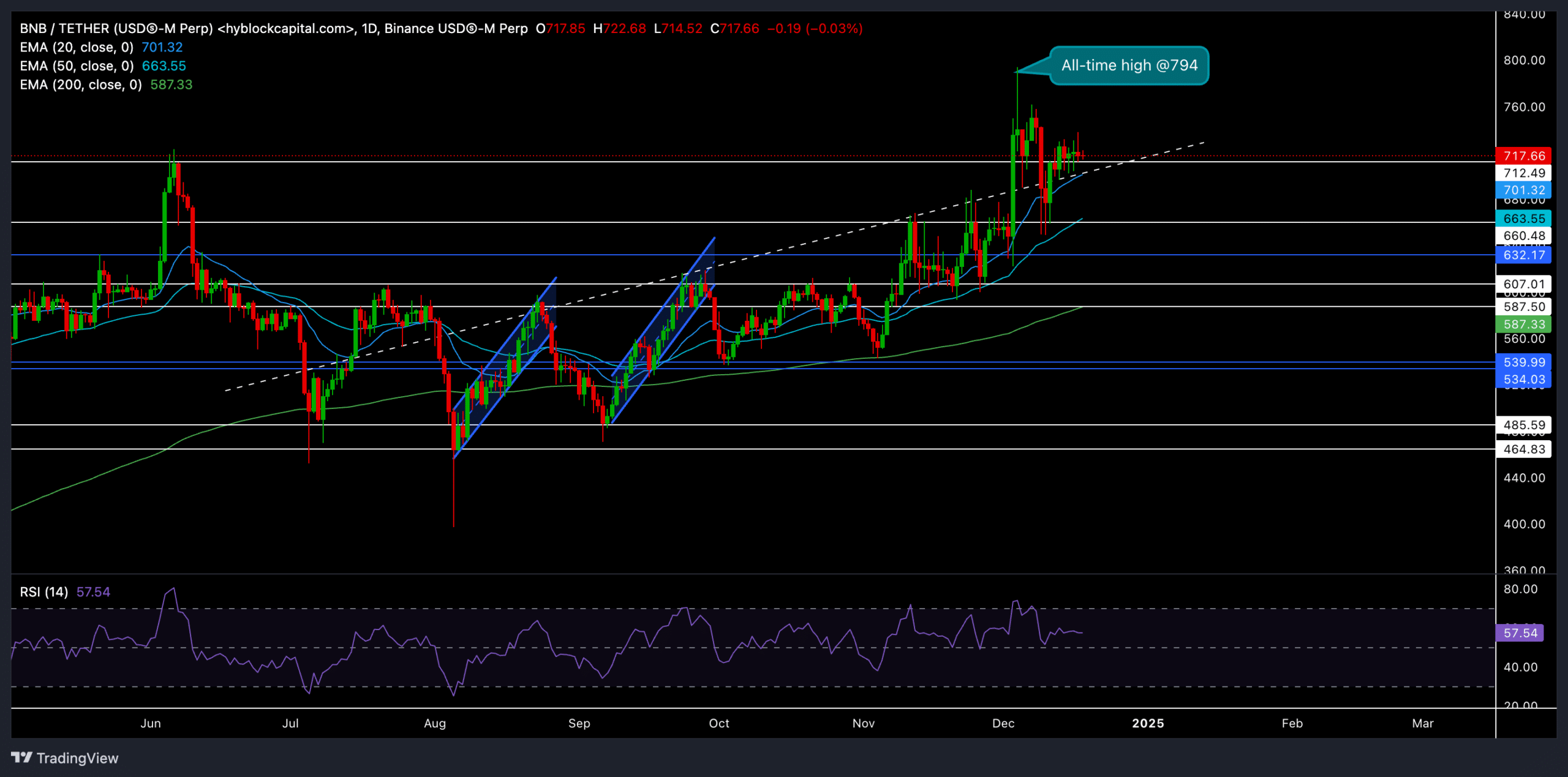

Binance Coin [BNB] achieved a remarkable all-time high (ATH) of $794 on December 4, riding the wave of a bullish cryptocurrency market fueled by Bitcoin’s [BTC] surge. Currently trading at $715.86, BNB has entered a consolidation phase near critical support zones, highlighting a crucial juncture for the token’s price trajectory.

BNB Defends Key Support Levels

BNB’s recent price movements demonstrate strong bullish resilience. On the daily chart, the token remains above its 20-day, 50-day, and 200-day Exponential Moving Averages (EMAs), signaling sustained upward momentum. However, after touching its ATH, BNB has consolidated over the past few days.

The $712 support level now acts as a vital threshold for bulls. A decisive close below this level could lead to a pullback toward the 50-day EMA at $663, which might provide strong dynamic support. Conversely, defending this level could pave the way for a retest of the $750–$760 resistance zone. A breakout above this range could push BNB into a new price discovery phase.

Indicators Show Room for Upside

The Relative Strength Index (RSI) stands at 57, indicating that BNB is not in the overbought zone and retains potential for further gains. Broader market sentiment, especially Bitcoin’s price movements, will play a critical role in shaping BNB’s short-term outlook.

Derivatives Data Reflects Bullish Interest

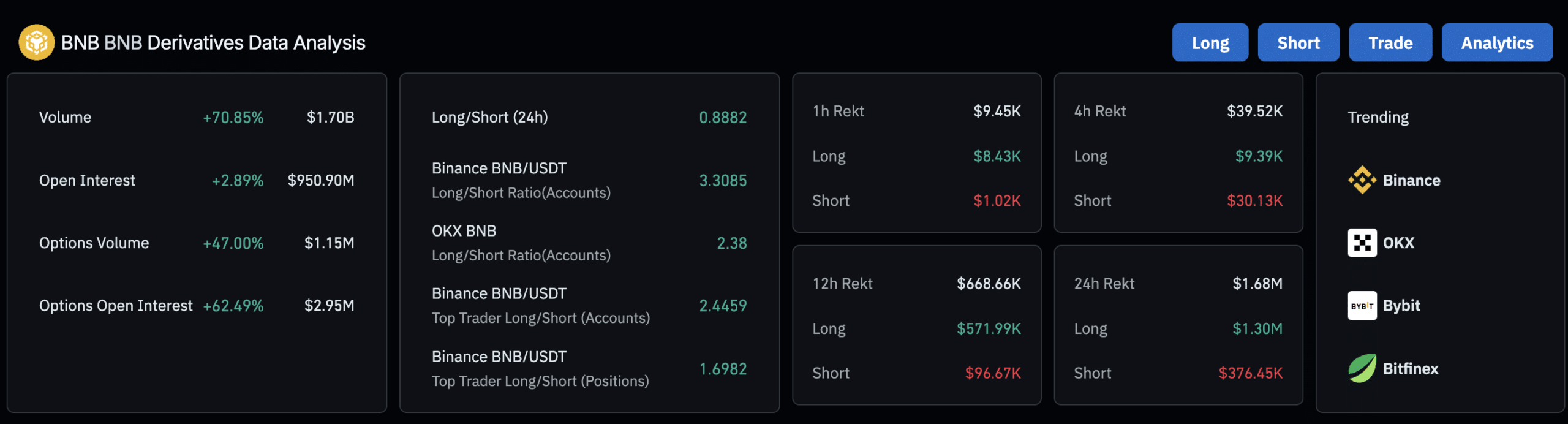

BNB’s derivatives market data underscores growing trader confidence. Trading volume has surged by 70.85% to $1.7 billion, while Open Interest rose by 2.89% to $950.9 million, highlighting increased activity and new positions. Notably, Options Open Interest jumped by an impressive 62.49%.

Despite a cautious long/short ratio of 0.8882, Binance traders exhibit optimism, with a ratio of 3.3085 favoring longs. Top traders further reinforce this sentiment with a long bias ratio of around 2.4.

Outlook: Key Levels to Watch

BNB’s consolidation near $712 suggests a potential rebound if the support holds. A sustained uptrend could see BNB challenging the $750–$760 zone, while a drop below $712 may invalidate the bullish setup, leading to a retest of the 50-day EMA.

Traders should closely monitor Bitcoin’s momentum and BNB’s action near these critical levels to make informed decisions.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m your translator between the financial Old World and the new frontier of crypto. After a career demystifying economics and markets, I enjoy elucidating crypto – from investment risks to earth-shaking potential. Let’s explore!