|

Getting your Trinity Audio player ready...

|

Key Takeaways:

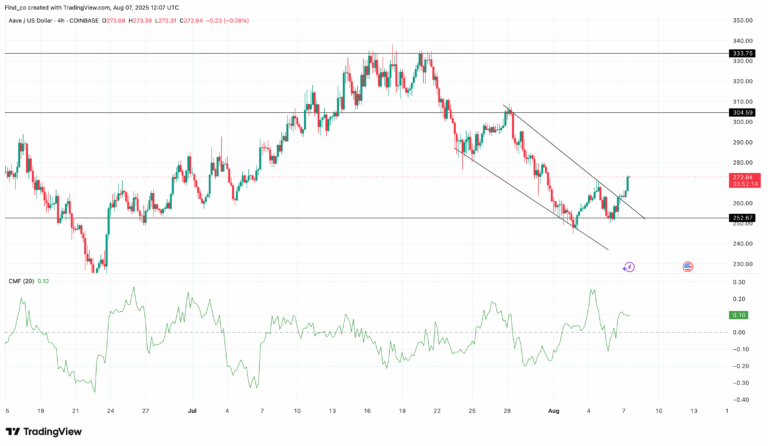

- AAVE broke out of a descending channel, signaling potential upward reversal.

- Rising TVL near $35B strengthens AAVE’s fundamentals and demand.

- Key resistance at $339.49 must be breached to confirm rally toward $400.

After a steep price correction that sent AAVE tumbling to around $273, fears emerged that the DeFi altcoin might fall below the critical $200 support level. However, recent price action and key technical indicators now suggest that AAVE is staging a comeback and could soon challenge previous highs near $400.

Technical Breakout Signals Bullish Reversal

On the 4-hour chart, AAVE has broken out of a descending channel — a pattern that often marks the end of a downtrend and the start of upward momentum. Buyers are regaining control, supported by a rising Chaikin Money Flow (CMF) indicator that has crossed above zero, signaling increasing buying pressure and institutional interest.

If this momentum holds, AAVE could target interim resistance levels at $304.59 and $333.75 on its way back up. The daily chart confirms this bullish setup, showing a breach above a key resistance trendline. Additional indicators like the Money Flow Index (MFI) rebounding from oversold territory and the Awesome Oscillator (AO) printing green bars further support the case for a sustained recovery.

Strengthening Fundamentals with Rising TVL

Beyond price charts, AAVE’s fundamentals are also improving. Its Total Value Locked (TVL), a crucial metric indicating the capital locked in its lending pools, has surged to nearly $35 billion. A higher TVL points to increased platform usage, better liquidity, and potentially higher demand for the coin token.

This fundamental strength adds weight to the technical signals, suggesting that the token’s price recovery may be backed by genuine growth in the ecosystem.

What’s Next for AAVE?

If bullish momentum continues, AAVE could break the key resistance at $339.49 and push toward $400. In a strong market, it might even rally as high as $578.87. However, if selling pressure returns, AAVE risks dropping toward the lower channel trendline near $223.25.

With a blend of positive technical indicators and rising protocol usage, AAVE is positioned for a potential rebound. Traders and investors should watch the $339 resistance closely as a key level to confirm a sustained bullish trend.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

Also Read: Aave Scam Alert: Phishing Sites Spread via Google Ads After $60B Milestone

I’m your translator between the financial Old World and the new frontier of crypto. After a career demystifying economics and markets, I enjoy elucidating crypto – from investment risks to earth-shaking potential. Let’s explore!