|

Getting your Trinity Audio player ready...

|

- Bitcoin’s divergence from tech stocks may reflect tightening global liquidity.

- Institutional outflows suggest a growing risk-off sentiment in crypto.

- Key support near $60K could determine Bitcoin’s next major move.

The widening gap between Bitcoin and major tech stocks is raising new questions about market stability. According to Arthur Hayes, co-founder of BitMEX, the recent divergence between Bitcoin and the Nasdaq 100 could be an early sign of tightening dollar liquidity — and a warning that broader credit stress may be approaching.

Hayes argues that Bitcoin often reacts faster than equities to shifts in monetary conditions. While stocks tend to price future earnings expectations, crypto markets respond more directly to changes in available capital. In his view, Bitcoin is acting as a “fire alarm” for the global fiat system, signaling strain before traditional assets reflect it.

Why the Bitcoin–Nasdaq Correlation Is Breaking

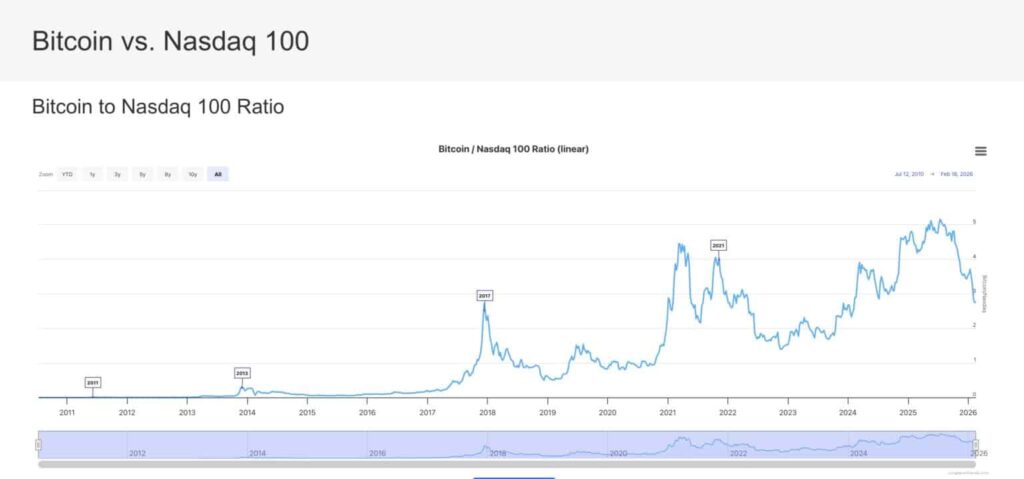

Since 2020, Bitcoin and technology stocks have frequently moved together, both benefiting from abundant liquidity and investor appetite for risk. That pattern is now weakening. The Nasdaq remains resilient, supported by optimism around artificial intelligence and corporate earnings, while Bitcoin has struggled to recover from its late-2025 highs.

Hayes believes the divergence reflects a tightening financial environment. Programs such as liquidity drains and higher real borrowing costs — often influenced by institutions like the Federal Reserve — can reduce available capital faster than equity markets initially acknowledge. Crypto, with its global and speculative nature, tends to react first.

Recent data supports this view. Institutional flows into crypto products have weakened, with roughly $1.7 billion in recent outflows. That shift suggests investors are reducing exposure to risk assets sensitive to liquidity conditions.

Institutional Behavior Adds Complexity

Despite falling prices, not all investors are retreating. Many Bitcoin ETF holders have absorbed significant drawdowns yet continue holding their positions. This split between cautious short-term capital and patient long-term investors complicates the outlook.

At the same time, rising exchange reserves hint that some participants may be preparing to sell, potentially adding downward pressure if liquidity tightens further.

Key Bitcoin Price Levels to Watch

Traders are focusing on critical technical zones to gauge whether Hayes’ concerns will materialize. The $60,000 level has emerged as a psychological support. A sustained drop below it could expose Bitcoin to declines toward the $50,000 range.

Also Read: How a Single Cloudflare Bug Took Down Coinbase, Ledger, BitMEX and 20% of All Webpages

However, the longer-term trajectory may hinge less on charts and more on macro conditions. If credit stress linked to AI-driven economic disruption emerges across banking and employment data, Bitcoin could remain under pressure. If not, renewed liquidity could stabilize the market.

The Bitcoin–Nasdaq divergence is more than a chart anomaly — it may be an early signal of changing financial conditions. While the stock market remains confident, Bitcoin’s weakness suggests liquidity risks could be building beneath the surface. Whether this proves to be a temporary disconnect or the first stage of a broader credit tightening will shape crypto’s next major move.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m your translator between the financial Old World and the new frontier of crypto. After a career demystifying economics and markets, I enjoy elucidating crypto – from investment risks to earth-shaking potential. Let’s explore!