|

Getting your Trinity Audio player ready...

|

A Comprehensive 2026 Comparison of Ethereum Scaling Solutions

Updated February 2026 | In-Depth Analysis

Ethereum’s layer-2 scaling solutions have matured significantly since their early deployments, with Polygon, Arbitrum, Optimism, and Base now processing more daily transactions than Ethereum mainnet combined. This comprehensive analysis examines transaction costs, security models, ecosystem development, and real-world performance across these four leading L2 networks as of February 2026. Whether you’re a developer choosing where to deploy, an investor evaluating opportunities, or a user seeking the most cost-effective network, understanding the technical and economic trade-offs between these platforms is essential for navigating the evolving Ethereum scaling landscape.

Executive Summary: Key Findings

Market Position (as of Feb 2026):

- Arbitrum: $11.2B TVL, 42% L2 market share, 3.2M daily active addresses

- Polygon: $6.8B TVL, 26% market share, 2.8M daily active addresses

- Base: $4.3B TVL, 16% market share, 1.9M daily active addresses

- Optimism: $3.7B TVL, 14% market share, 1.1M daily active addresses

Critical Differentiators:

- Security Model: Arbitrum and Optimism use optimistic rollups (7-day withdrawal); Polygon uses proof-of-stake with 3-hour checkpoints; Base uses optimistic rollups with Coinbase backing

- Transaction Costs: Polygon leads at $0.01-0.05; Base averages $0.10-0.30; Arbitrum and Optimism range $0.20-0.80 depending on Ethereum mainnet gas

- Decentralization: Arbitrum and Optimism are more decentralized; Base relies on Coinbase infrastructure; Polygon is semi-centralized with validator set

- Ecosystem Maturity: Arbitrum has 800+ dApps; Polygon has 53,000+ dApps; Base has 400+ dApps; Optimism has 600+ dApps

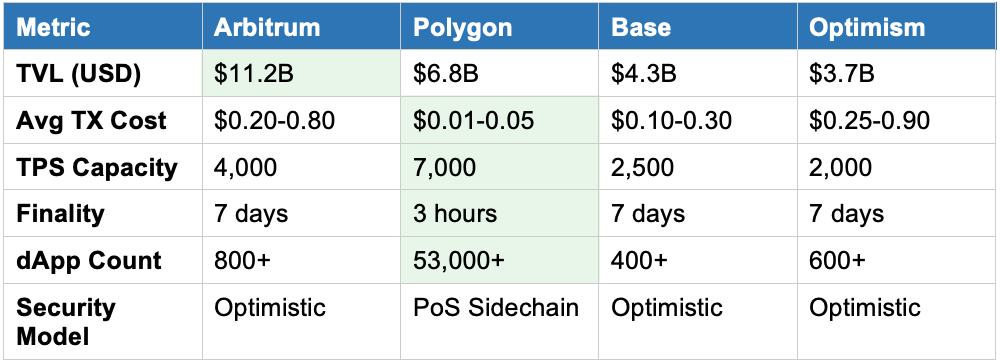

At-a-Glance Comparison: Layer-2 Networks 2026

Deep Dive: Network-by-Network Analysis

Arbitrum: The DeFi Powerhouse

Arbitrum One, launched by Offchain Labs in August 2021, has emerged as the market leader among Ethereum layer-2 solutions by total value locked and daily transaction volume. The network processes over 2 million transactions daily and has attracted major DeFi protocols including GMX, Uniswap V3, and Aave.

Technical Architecture:

Arbitrum uses optimistic rollup technology with fraud proofs. Transactions are assumed valid unless challenged within a 7-day dispute window. The network recently upgraded to Arbitrum Nitro, which uses WebAssembly (WASM) for faster execution and lower costs. Block times average 0.25 seconds, providing near-instant transaction confirmation for users, though final settlement to Ethereum mainnet takes 7 days.

Cost Structure Analysis:

Transaction costs on Arbitrum are directly correlated to Ethereum mainnet gas prices because the network must post batched transactions to L1. During peak Ethereum activity (50+ gwei), Arbitrum transactions can cost $0.50-0.80. During low activity periods (15-20 gwei), costs drop to $0.15-0.25. Simple swaps average $0.30, while complex DeFi interactions like providing liquidity or leveraged farming range from $0.50-1.20.

Ecosystem Strengths:

- DeFi Leadership: GMX processes $2B+ weekly volume; Radiant Capital has $500M TVL

- Developer Tools: Excellent documentation, Arbitrum Stylus enables Rust/C++ smart contracts

- Gaming Presence: 200+ games including The Beacon, Pirate Nation

- Institutional Adoption: BlackRock, Franklin Templeton using Arbitrum for tokenization pilots

Weaknesses:

- 7-day withdrawal period for bridging back to Ethereum (third-party bridges can reduce this for a fee)

- Higher fees than Polygon during Ethereum network congestion

- Sequencer centralization – currently operated by Offchain Labs (decentralization roadmap in progress)

Verdict: Best for DeFi power users and developers prioritizing security and decentralization over absolute lowest costs. The 7-day withdrawal period is a significant consideration for active traders.

Polygon: The Enterprise-Friendly Network

Polygon PoS (formerly Matic Network) operates as an independent proof-of-stake blockchain that checkpoints to Ethereum for security. Unlike true rollups, Polygon is technically a ‘commit chain’ or sidechain, trading some security assumptions for dramatically higher throughput and lower costs.

Technical Architecture:

Polygon uses a Proof-of-Stake consensus with 100 validators securing the network. Checkpoints are submitted to Ethereum every 30-60 minutes, creating a 3-hour finality period for withdrawals. Block times are 2 seconds, and the network can handle 7,000 transactions per second, though actual throughput averages 50-100 TPS due to validator coordination.

Cost Structure Analysis:

Polygon maintains the lowest transaction costs among major L2s. Simple transfers cost $0.005-0.01, swaps average $0.02-0.04, and complex DeFi operations rarely exceed $0.10. These costs are independent of Ethereum mainnet gas prices because Polygon is a sidechain. The network’s native MATIC token (now transitioning to POL) is used for gas fees, requiring users to maintain a small balance.

Ecosystem Strengths:

- Enterprise Partnerships: Nike, Starbucks, Reddit, Disney, Adobe using Polygon for NFTs and loyalty programs

- Web3 Gaming Hub: Home to 60% of blockchain gaming activity, including big titles

- Global Reach: Strong presence in India, Southeast Asia with localized developer support

- Massive dApp Count: 53,000+ applications (though many are low-activity)

- zkEVM Launch: Polygon zkEVM provides true rollup security (launched March 2023, now $1.2B TVL)

Weaknesses:

- Lower security guarantees than true rollups – relies on honest majority of 67 validators

- Potential for validator centralization (top 5 validators control 40% of stake)

- Network congestion during major NFT drops has caused temporary slowdowns

Verdict: Ideal for high-frequency trading, gaming, NFTs, and enterprise applications where ultra-low costs matter more than maximum decentralization. The 3-hour withdrawal period is significantly better than optimistic rollups’ 7 days.

Base: The Coinbase-Backed Challenger

Launched by Coinbase in August 2023, Base is built on the OP Stack (Optimism’s open-source technology) and benefits from the credibility and resources of the largest U.S. cryptocurrency exchange. The network has seen explosive growth, particularly in consumer-facing applications and social platforms.

Technical Architecture:

Base uses optimistic rollup technology identical to Optimism, with a 7-day challenge period. The key differentiator is Coinbase’s involvement: the exchange operates the sequencer and provides infrastructure support. Base also benefits from shared sequencer research between Optimism and Base through the OP Stack alliance. Block times are sub-second, with 2,500 TPS theoretical capacity.

Cost Structure Analysis:

Base transaction costs sit between Polygon and Arbitrum. Simple transfers cost $0.08-0.15, swaps average $0.20-0.35, and complex transactions range $0.40-0.70. Like Arbitrum, costs fluctuate with Ethereum mainnet gas prices. Coinbase has committed to not extracting MEV (miner extractable value) from Base, which benefits users but limits revenue for network sustainability.

Ecosystem Strengths:

- Onramp Integration: Direct fiat on-ramps through Coinbase for 100+ countries

- Consumer Apps: Friend.tech, Farcaster driving real user adoption (not just crypto natives)

- Regulatory Clarity: Coinbase compliance infrastructure reduces regulatory uncertainty

- Rapid Growth: TVL increased 320% in 2024-2025; daily active users up 280%

Weaknesses:

- Heavy centralization – Coinbase controls sequencer, infrastructure

- Smaller ecosystem than Arbitrum or Polygon (though growing rapidly)

- No native token – relies on ETH, limiting governance participation

- Coinbase dependency risk – network tied to exchange’s fortunes

Verdict: Best for users prioritizing ease of use, regulatory compliance, and mainstream consumer applications. The Coinbase connection is simultaneously its biggest strength (onboarding, trust) and weakness (centralization).

Optimism: The Public Goods Advocate

Optimism, launched in June 2021, pioneered optimistic rollup technology and has positioned itself as a public goods-focused network. The Optimism Collective allocates significant resources to retroactive public goods funding, distinguishing it from purely profit-driven competitors.

Technical Architecture:

Optimism uses fraud proofs with a 7-day challenge window, identical to Arbitrum’s model. The network recently completed its Bedrock upgrade, dramatically reducing costs by 40-50% through improved data compression. Optimism has open-sourced its entire stack (OP Stack), allowing other chains like Base and Zora to build on the same technology. Block times are 2 seconds with 2,000 TPS capacity.

Cost Structure Analysis:

Post-Bedrock, Optimism fees are competitive with Arbitrum: simple transfers cost $0.15-0.30, swaps average $0.30-0.50, complex operations run $0.50-1.00. The network benefits from EIP-4844 (proto-danksharding) implemented in early 2024, which reduced data posting costs to Ethereum by 90%. However, fees still fluctuate with mainnet activity.

Ecosystem Strengths:

- OP Stack Adoption: 8+ chains using Optimism’s technology (Base, Zora, Mode, etc.)

- Public Goods Funding: $50M+ allocated to ecosystem projects via Retroactive Public Goods Funding

- Governance Innovation: Bicameral governance model (Token House + Citizens’ House)

- DeFi Presence: Velodrome, Synthetix, Perpetual Protocol

Weaknesses:

- Smaller TVL and user base than Arbitrum or Polygon

- OP token has unclear value accrual (primarily governance, not fees)

- Lost some mindshare to Base, which uses Optimism’s tech but has Coinbase backing

- Sequencer still centralized (though decentralization roadmap exists)

Verdict: Best for developers and users who value open-source ethos, governance participation, and supporting public goods. Strong technical foundation but faces stiff competition from both Arbitrum (DeFi) and Base (consumer apps).

Decision Framework: Which L2 Should You Choose?

For DeFi Traders & Yield Farmers:

Primary Choice: Arbitrum

Arbitrum offers the deepest DeFi liquidity, lowest slippage on large trades, and most mature lending/derivatives protocols. The 7-day withdrawal period is a non-issue if you’re farming long-term. GMX for perpetuals, Camelot for DEX trading, Radiant for lending.

Alternative: Polygon

If you’re making frequent small trades (<$1,000) where Arbitrum’s $0.50 fees eat into profits, Polygon’s $0.02-0.05 fees are more economical. QuickSwap and Uniswap V3 have good liquidity for major pairs.

For NFT Creators & Collectors:

Primary Choice: Polygon

Polygon dominates NFT activity with major marketplaces (OpenSea, Magic Eden) offering full support. Minting costs $0.01-0.05 vs $0.50+ on other networks. Enterprise brands (Nike, Starbucks, Reddit) have chosen Polygon for NFT campaigns.

Alternative: Base

For NFTs targeting mainstream U.S. audiences, Base’s Coinbase integration provides easiest onboarding. Friend.tech has proven consumer NFTs can succeed on Base.

For Gaming Applications:

Primary Choice: Polygon

Polygon’s combination of high throughput (7,000 TPS), low costs ($0.01 per transaction), and 3-hour finality makes it optimal for games requiring frequent microtransactions. 60% of blockchain gaming happens on Polygon.

Alternative: Arbitrum

For games with tokenized economies requiring deep DeFi integration (in-game DEXs, lending), Arbitrum’s DeFi ecosystem is superior. Also better for games targeting serious crypto gamers vs casual players.

For New Crypto Users (Onboarding):

Primary Choice: Base

Direct Coinbase onboarding (no bridge needed), familiar brand trust, and consumer-focused apps make Base the easiest entry point. Users can buy crypto on Coinbase and be on Base in one click.

Alternative: Polygon

For non-U.S. users or those without Coinbase accounts, Polygon’s wide exchange support and ultra-low fees provide good onboarding. Many CEXs offer direct Polygon withdrawals.

For Enterprise/Institutional Use:

Primary Choice: Polygon or Base

Polygon has proven enterprise traction (Starbucks, Nike, Reddit) and dedicated enterprise sales team. Base offers Coinbase’s compliance infrastructure and regulatory clarity. Arbitrum/Optimism lack enterprise-specific features.

Geographic Considerations: Regional L2 Adoption Patterns

North America:

Base dominates consumer adoption due to Coinbase’s 50M+ U.S. users. Arbitrum leads in institutional DeFi. Regulatory clarity from SEC/CFTC favors Base and established rollups over newer alternatives. Average user prefers Base’s simplicity over Arbitrum’s technical superiority.

Europe:

More balanced adoption across all four networks. MiCA regulations (implemented 2024) treat all L2s similarly, reducing Base’s compliance advantage. Strong Arbitrum presence in European DeFi. Polygon benefits from Enterprise adoption (Vodafone, Deutsche Telekom pilots).

Asia:

Polygon leads significantly due to early developer outreach in India, Southeast Asia. Binance’s integration of Polygon (not Arbitrum/Base) for withdrawals drives retail adoption. Gaming focus aligns with Asian market preferences. Base has minimal presence outside Japan/South Korea.

Latin America:

Polygon dominant due to remittance use cases and mobile-first adoption. Low transaction costs critical for smaller transaction sizes common in region. Base growing in Mexico/Brazil where Coinbase operates.

Africa: Polygon leads via mobile money integrations and developer communities in Nigeria, Kenya. Other L2s have minimal presence.

Future Outlook: 2026-2027 Predictions

Technology Evolution:

- ZK Rollup Integration: Polygon zkEVM gaining traction; zkSync and Starknet emerging as alternatives

- Interoperability: OP Stack enabling seamless Base ↔ Optimism bridging; Polygon implementing AggLayer for chain abstraction

- Decentralization: Arbitrum and Optimism launching decentralized sequencers in 2026 Q2-Q3

Competitive Dynamics:

The L2 landscape is consolidating around three ecosystems: Arbitrum (DeFi specialists), Polygon (enterprise/gaming), and the OP Stack family (Base/Optimism for consumer apps). Smaller L2s are struggling to differentiate or attract liquidity.

Key Questions for 2026-2027:

- Can Arbitrum maintain DeFi dominance as Base scales?

- Will Polygon successfully transition users from PoS to zkEVM?

- Does Base’s Coinbase dependency become a liability (regulatory pressure, outages)?

- Can Optimism differentiate beyond Base or get acquired?

Conclusion: No Single Winner

The layer-2 ecosystem has matured from experimental technology to production infrastructure handling billions in value and millions of users. Rather than one network dominating, we’re seeing specialization:

- Arbitrum owns sophisticated DeFi

- Polygon dominates gaming, NFTs, and enterprise

- Base captures mainstream consumers

- Optimism provides infrastructure and public goods focus

Your optimal choice depends on specific use case, geographic location, user base, and priorities around cost, speed, security, and decentralization. For most users, having presence across multiple L2s makes sense—the future is multi-chain, and interoperability is improving rapidly.

The competition between these networks ultimately benefits the entire Ethereum ecosystem by driving innovation, reducing costs, and expanding use cases beyond what Ethereum mainnet alone could support.

I’m your translator between the financial Old World and the new frontier of crypto. After a career demystifying economics and markets, I enjoy elucidating crypto – from investment risks to earth-shaking potential. Let’s explore!