|

Getting your Trinity Audio player ready...

|

IMF warns stablecoin market surging past $260 billion threatens monetary sovereignty in developing nations

Stablecoins have tripled in market capitalization since 2023, reaching $260 billion for the two largest issuers. According to a new IMF report, this growth offers faster, cheaper payments but poses serious risks to economic stability in developing nations.

Digital Dollar Dominance

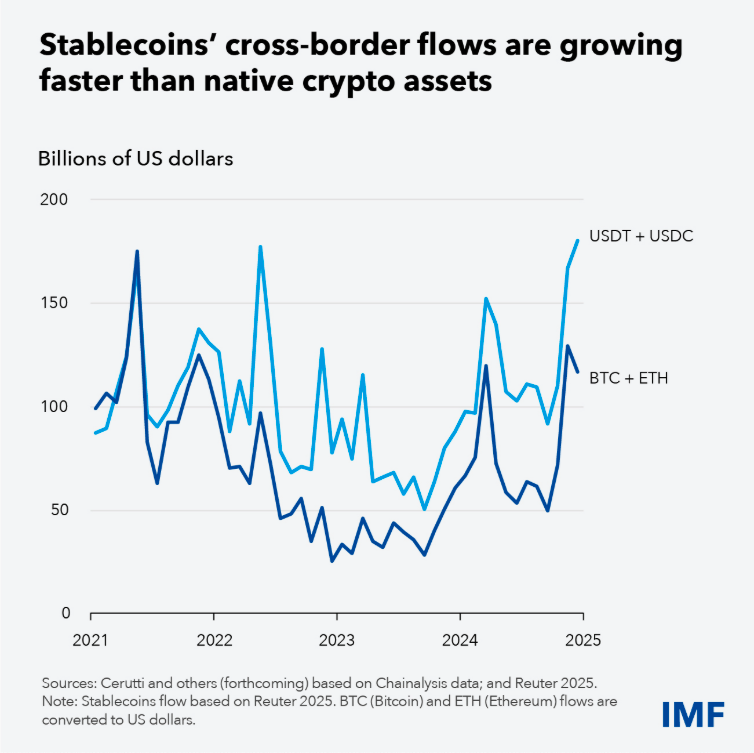

Stablecoin trading volume hit $23 trillion in 2024, up 90 percent year-over-year. Asia leads in absolute volume, surpassing North America. But relative to GDP, Africa, the Middle East, and Latin America show the highest adoption rates. Most flows originate from North America.

The IMF report notes stablecoins now wield influence beyond their 10 percent of Bitcoin’s market cap due to deep connections with mainstream financial markets.

The Remittance Problem

Cross-border payments cost up to 20 percent of the amount sent. Traditional international transfers move through networks of correspondent banks using different data formats and operating schedules, creating delays, high costs, and low transparency.

Stablecoins solve this through blockchain technology—a single source of truth that simplifies processes and cuts costs. In developing countries where banks find it unprofitable to operate, stablecoins could provide digital financial access for the first time.

The IMF reports many developing countries are already leapfrogging traditional banking through mobile phones and tokenized money. Competition from stablecoins could force established payment providers to lower costs and innovate.

The Risks

Most stablecoins are backed by US Treasury bonds and liquid assets. If users lose confidence in redemption ability—due to asset devaluation or other concerns—mass withdrawals could trigger fire sales of reserve assets, disrupting financial markets.

The bigger threat for emerging economies is currency substitution. When citizens can easily access dollar-backed stablecoins on their phones, they may abandon national currencies. This digital dollarization happens faster than traditional forms because stablecoins eliminate physical cash requirements and are harder for governments to control.

The IMF warns this “decreases a country’s central bank ability to control its monetary policy and serve as lender of last resort.”

Capital Flight Risk

Stablecoins create a frictionless channel for bypassing capital controls that emerging markets use to maintain financial stability. During crises, this accelerates destabilizing outflows, leaving developing nations more vulnerable to volatility from larger economies.

The pseudonymous nature of blockchain transactions enables money laundering and terrorist financing. Without robust safeguards, stablecoins undermine financial integrity standards.

Regulatory Fragmentation

If dozens of competing stablecoins emerge on different networks with limited interoperability and varying regulations, the result could be greater fragmentation than integration.

A recent Financial Stability Board report shows regulatory approaches “increasingly converging toward treating stablecoins as payment instruments.” However, major jurisdictions diverge on key issues. This regulatory arbitrage lets issuers locate operations where oversight is weakest.

The cross-border nature creates massive data gaps. Regulators lack visibility into stablecoin holder locations, hampering their ability to monitor flows, maintain accurate statistics, or respond to crises.

Policy Response

The IMF and Financial Stability Board recommend: safeguard against currency substitution, maintain capital flow controls, ensure robust regulation, implement financial integrity standards, and strengthen global cooperation.

Some jurisdictions are considering providing stablecoin issuers access to central bank liquidity facilities—blurring lines between traditional finance and crypto.

Commercial banks are issuing their own stablecoins and partnering with central banks to integrate blockchain technology. Some experts argue improving traditional systems—like linking existing fast payment networks—may be more practical than replacing the entire financial architecture.

What’s Next

The IMF compares the current development stage to the early internet. The ultimate impact remains unclear.

Also Read: 13.4 Million Crypto Tokens Are Dead — And Most Failed by Design

Tokenization and stablecoins are here to stay. The question is whether they democratize finance and reduce costs, or fragment the global monetary system and increase vulnerability in developing nations.

The answer depends on whether policymakers, regulators, and the private sector can balance innovation with stability through cross-border coordination.

As the stablecoin market continues exponential growth, the window for getting the framework right is closing.

Based on “How Stablecoins Can Improve Payments and Global Finance” by Tobias Adrian, Marcello Miccoli, and Nobuyasu Sugimoto, International Monetary Fund, December 4, 2025