|

Getting your Trinity Audio player ready...

|

- The DOJ will not retry the first NFT insider trading case after a major appeals court ruling

- The decision raises questions about how U.S. law applies to digital assets

- Binance is moving to comply with EU rules as MiCA deadlines approach

The U.S. Justice Department has formally stepped away from its case against former OpenSea product manager Nathaniel Chastain, closing a chapter that once marked a legal first for the crypto industry. At the same time, Binance has moved to secure regulatory footing in Europe, applying for a MiCA license in Greece ahead of looming compliance deadlines.

Together, the developments highlight how enforcement priorities and regulatory clarity around digital assets continue to evolve on both sides of the Atlantic.

DOJ Ends Prosecution After Appeals Court Reversal

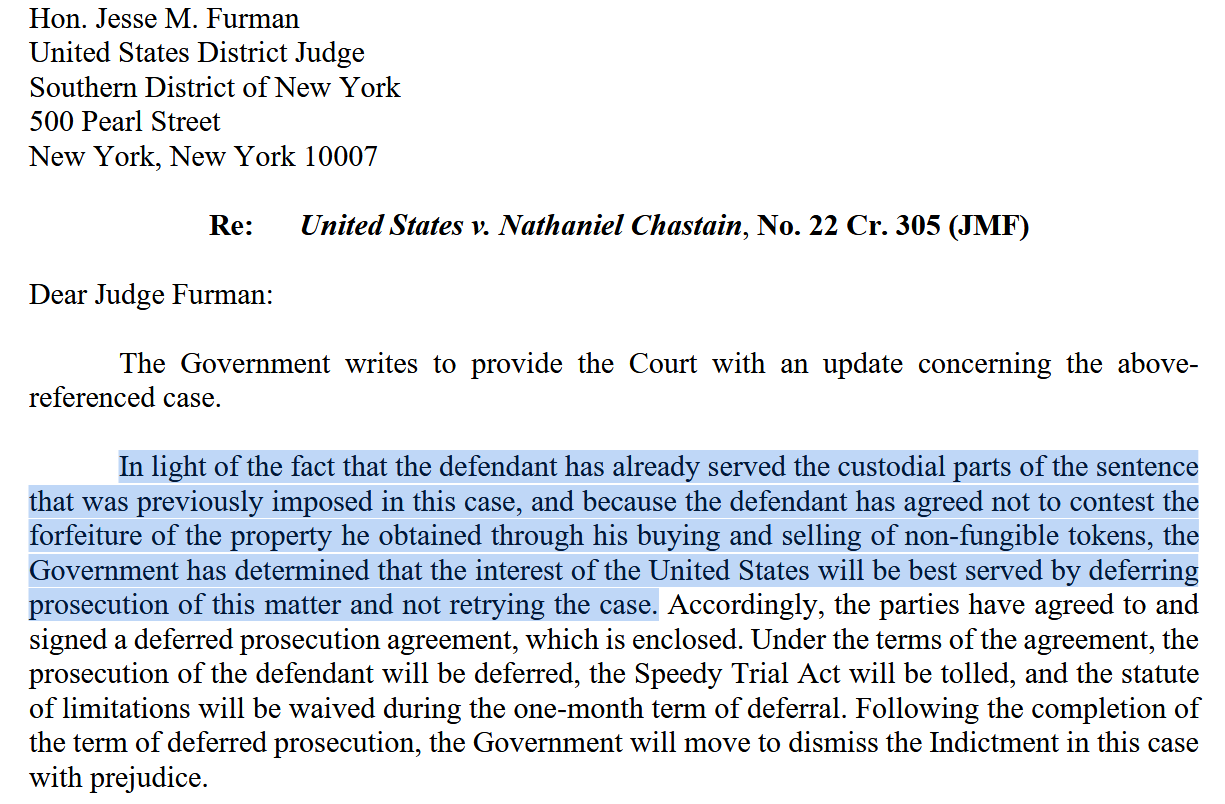

Federal prosecutors confirmed this week that they will not retry Chastain on wire fraud and money laundering charges after a U.S. appeals court overturned his 2023 conviction. Instead, the parties entered a short deferred prosecution agreement, after which the case will be dismissed.

In a letter to the Manhattan federal court, U.S. Attorney Jay Clayton said the decision reflected Chastain’s partial completion of his original sentence, including three months in prison, and his agreement to forfeit 15.98 Ether allegedly linked to the conduct.

The appeals court ruled in July that the jury received flawed instructions and that NFT homepage placement data did not qualify as “property” under federal wire fraud statutes — a key blow to the government’s theory of the case.

A Landmark Case With Lasting Implications

Chastain’s prosecution was the first insider trading case involving digital assets in U.S. history. Prosecutors argued he used confidential knowledge of NFT homepage features to buy assets before they were promoted and later sell them at higher prices.

While the case is now ending quietly, crypto advocates have pointed to the overturned conviction as evidence that existing financial crime laws may not neatly apply to NFTs and other digital assets without clearer legislative definitions.

Binance Seeks MiCA License in Greece

In Europe, Binance confirmed it has applied for authorization under the EU’s Markets in Crypto-Assets Regulation (MiCA) through Greece’s Hellenic Capital Market Commission. The move comes after France’s AMF warned that Binance remains unlicensed under MiCA as the June 30 transition deadline approaches.

Under the framework, crypto firms operating without approval must cease operations in non-compliant jurisdictions by July. While Greece has yet to issue its first MiCA license, other countries — including Germany and the Netherlands — have already approved dozens of firms.

Also Read: Binance Australia Brings Back PayID and Bank Transfers—Here’s Why It Matters

A Shifting Regulatory Landscape

Taken together, the dropped OpenSea case and Binance’s MiCA application reflect a broader recalibration in crypto oversight. As courts scrutinize enforcement theories and regulators push standardized licensing, the industry is moving toward clearer — if still uneven — rules of engagement.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m your translator between the financial Old World and the new frontier of crypto. After a career demystifying economics and markets, I enjoy elucidating crypto – from investment risks to earth-shaking potential. Let’s explore!