|

Getting your Trinity Audio player ready...

|

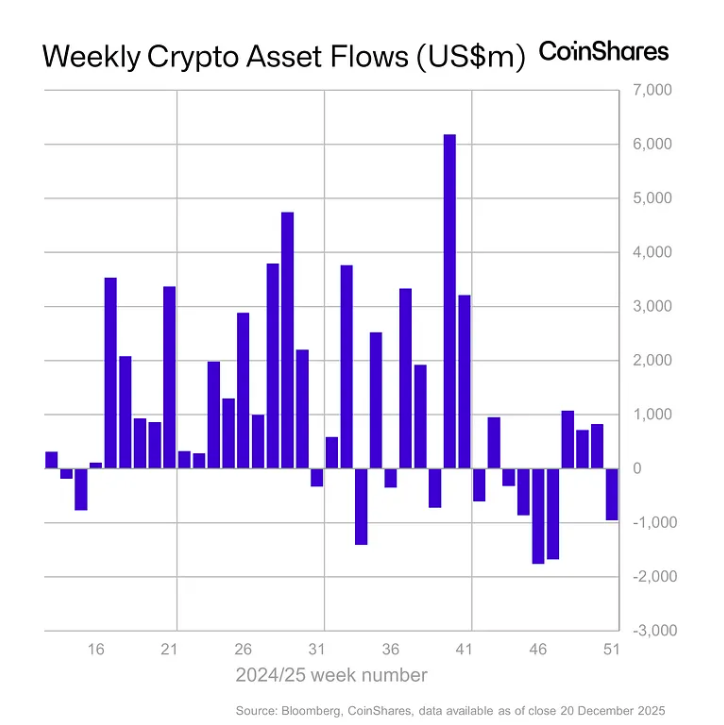

- Crypto ETPs saw $952M in outflows, ending a four-week inflow streak.

- U.S. regulatory delays weighed heavily on Ethereum and Bitcoin products.

- Solana and XRP continued to attract selective investor inflows.

Global crypto investment products recorded $952 million in net outflows last week, marking the first weekly decline in four weeks and signaling a sharp shift in institutional sentiment. The pullback comes as delays around the U.S. Clarity Act reignited regulatory uncertainty, pressuring flows across major crypto exchange-traded products.

According to CoinShares, the reversal erased three weeks of steady inflows and represented the largest monthly outflow figure so far this year. James Butterfill, CoinShares’ Head of Research, said the stalled legislative process in Washington has unsettled investors who were positioning for clearer regulatory guidance before year-end.

U.S. Leads Sell-Off as Clarity Act Delay Hits Confidence

The Clarity Act, designed to define regulatory responsibilities across the digital asset sector, had been widely expected to progress before the end of the year. Its delay has prolonged uncertainty around asset classification, exchange oversight, and issuer obligations — factors that remain critical for U.S.-listed crypto products.

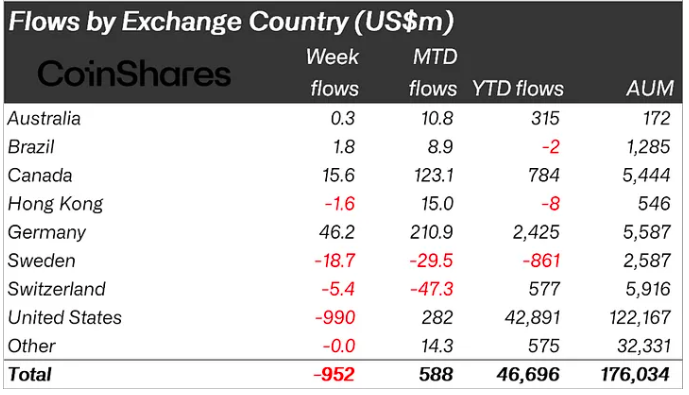

As a result, outflows were heavily concentrated in the United States, which saw $990 million exit crypto investment products over the week. In contrast, Canada and Germany recorded modest inflows of $46.2 million and $15.6 million, respectively, suggesting that non-U.S. investors remain comparatively resilient despite the broader global drawdown.

Ethereum Bears the Brunt of the Reversal

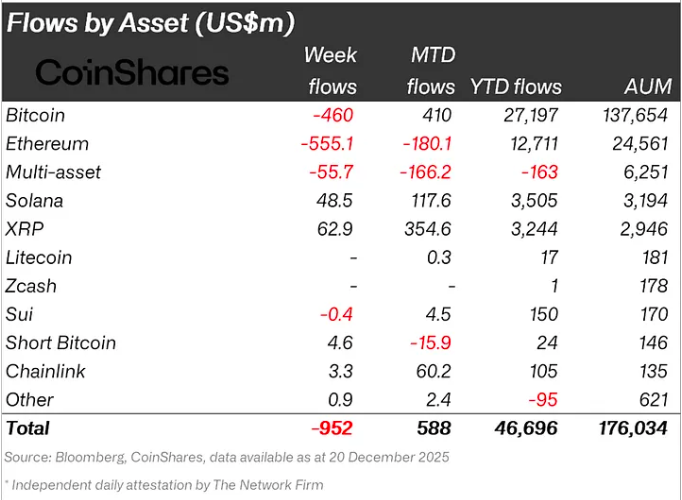

Ethereum-linked products saw the largest impact, with $555 million in weekly outflows. CoinShares noted that Ethereum stands at the center of regulatory debates, leaving it particularly sensitive to legislative delays. Despite the setback, year-to-date Ethereum inflows remain strong at $12.7 billion, well above 2024’s total of $5.3 billion.

Bitcoin products were not spared, logging $460 million in outflows. While Bitcoin continues to attract institutional interest, its year-to-date inflows of $27.2 billion remain well below the $41.6 billion recorded during last year’s cycle, signaling cooling demand from U.S. institutions that previously drove momentum.

Selective Strength in Solana and XRP

Not all assets saw capital exit. Solana attracted $48.5 million in inflows, while XRP brought in $62.9 million, extending a multi-week trend of relative strength. CoinShares suggested these inflows reflect selective positioning rather than broad-based risk appetite.

Also Read: Senate Confirms Michael Selig as CFTC Chair as Crypto Oversight Enters Pivotal Phase

Record Inflows Now Unlikely

Butterfill said it is now unlikely that crypto ETP inflows will surpass last year’s record. Total assets under management stand at $46.7 billion, below the $48.7 billion peak reached in 2024.

Despite the outflows, Bitcoin rose nearly 2% last week to trade around $89,700, while Ethereum held steady near $3,000 — underscoring the growing gap between price action and institutional flow trends.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m your translator between the financial Old World and the new frontier of crypto. After a career demystifying economics and markets, I enjoy elucidating crypto – from investment risks to earth-shaking potential. Let’s explore!