|

Getting your Trinity Audio player ready...

|

Trust Wallet has added zero-fee crypto purchases via Revolut, strengthening its position in Europe just weeks after Revolut’s valuation soared to $75 billion.

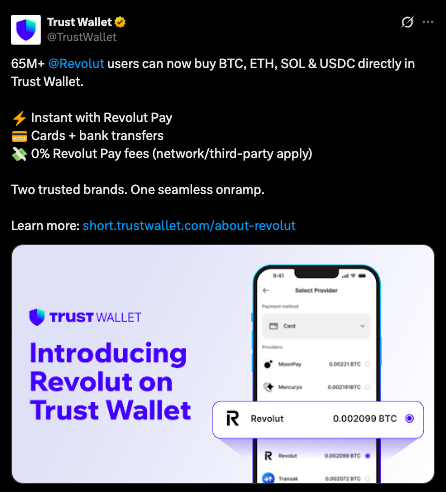

Trust Wallet, the self-custodial crypto app backed by Binance co-founder Changpeng “CZ” Zhao, has launched a new integration with European fintech giant Revolut that allows users to buy crypto directly through the banking app. Announced Thursday, the update lets Trust Wallet users purchase Bitcoin, Ether and Solana through Revolut with no additional fees from Trust Wallet and a minimum order size of €10.

New Fiat On-Ramp Targets Europe’s Expanding MiCA-Ready Market

The integration gives millions of Revolut users a new self-custody entry point into crypto, arriving shortly after the fintech secured regulatory approval in Cyprus to offer compliant crypto services across 30 European Economic Area markets under MiCA.

Purchases made through Revolut support several regional fiat currencies — including the euro, British pound, Czech koruna, Danish krone and Polish złoty — with a daily and per-transaction cap of €23,000. Trust Wallet said the rollout is designed to make crypto access faster and more localized for European users.

Stablecoins such as USDC are not supported at launch, but both companies expect to add them in later phases.

Zero Fees — With Caveats

Trust Wallet emphasized that the Revolut integration offers “zero-fee crypto purchases,” though Revolut’s own deposit methods can still carry fees. For example, cash deposits incur a 1.5% charge and are limited to $3,000 per month, while some card top-ups and bank transfers may also include service costs according to Revolut’s FAQ.

Still, the new pathway removes a significant portion of the friction typically associated with moving funds from fintech platforms into self-custody wallets.

Revolut’s $75B Valuation Underscores Fintech’s Crypto Momentum

The launch follows a major valuation milestone for Revolut. In late November, the company completed a private share sale that placed its valuation at roughly $75 billion — making it Europe’s most valuable private tech firm and one of the top 10 worldwide.

Also Read: SEC Clears Ondo — Now OUSG Will Anchor a New Wall Street Tokenized Liquidity Fund

Trust Wallet, meanwhile, continues to push into high-growth sectors such as prediction markets and real-world asset tokenization. The partnership with Revolut signals a broader trend: traditional fintech players are increasingly leaning into crypto rails as user demand shifts toward self-custody and decentralized services.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m your translator between the financial Old World and the new frontier of crypto. After a career demystifying economics and markets, I enjoy elucidating crypto – from investment risks to earth-shaking potential. Let’s explore!