|

Getting your Trinity Audio player ready...

|

- DAT firms are entering a high-risk “Darwinian phase” as equity premiums collapse into discounts.

- Galaxy warns the leverage model has reversed, exposing firms to extreme downside.

- Consolidation, restructuring, and long-term stagnation are now the base-case outcomes.

Bitcoin treasury firms, once hailed as one of the market’s most elegant ways to gain leveraged exposure to Bitcoin without touching derivatives, are now facing the harshest test of their short existence. According to new analysis from Galaxy Research, the business model that fueled extraordinary equity premiums, rapid issuance, and aggressive balance-sheet expansion has begun to unravel. The shift marks the start of what Galaxy calls a “Darwinian phase” — a period in which only the most resilient companies are likely to survive.

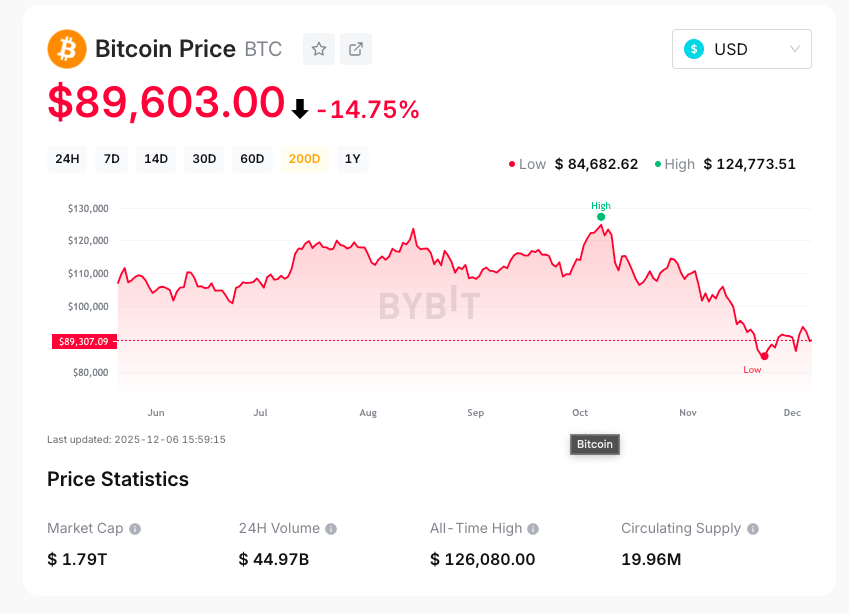

The deterioration has been sharp. As Bitcoin fell from its early-October peak near $126,000 to recent lows around $80,000, the underlying mechanism that allowed digital asset treasury (DAT) companies to outperform spot Bitcoin broke down completely. What had been a flywheel of high premiums, cheap capital, and fast BTC-per-share growth is now reversing — and in some cases, violently.

A Business Model Built on Premiums — Until They Disappeared

The heart of the DAT trade is simple: If a company’s stock trades above its Bitcoin net asset value (NAV), it can issue new shares, use the proceeds to buy more BTC, and increase BTC-per-share over time. As long as premiums remain high, this flywheel works exceptionally well. But once premiums collapse into discounts, the entire structure becomes a liability.

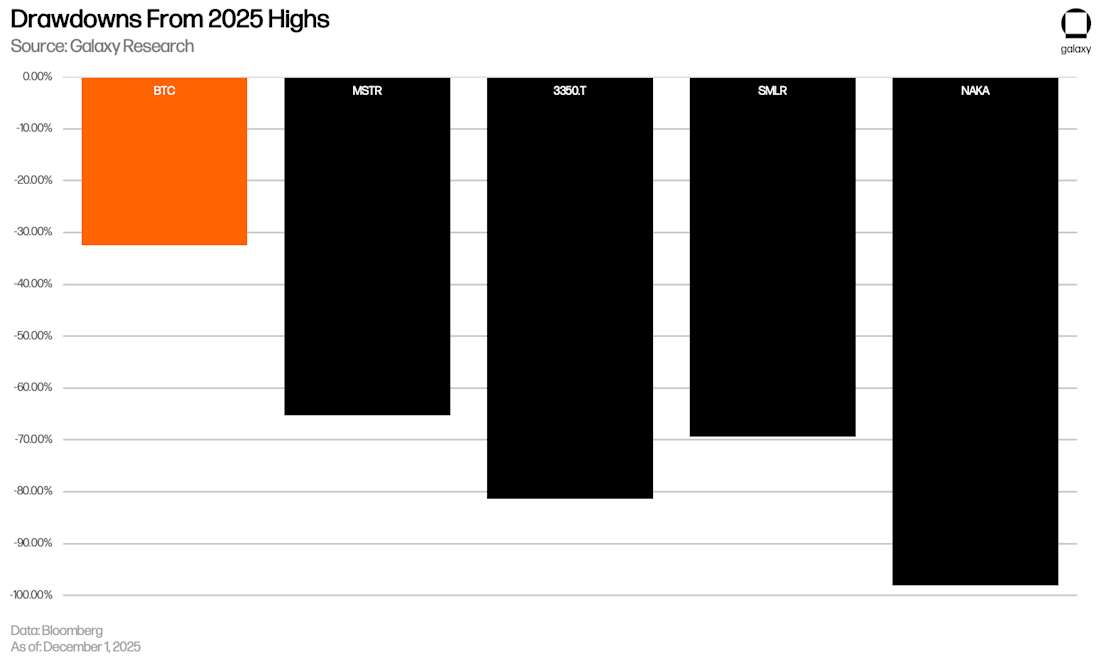

That breaking point hit hard this quarter. DAT stocks that enjoyed double-digit premiums over the summer have now flipped to steep discounts — even though Bitcoin itself is “only” down around 30% from its highs. Galaxy notes that equity drawdowns have been far more severe because the embedded leverage in these firms exaggerates every move.

Many DAT companies had accumulated their largest Bitcoin positions when BTC traded above $107,000, leaving them deep underwater. Galaxy points in particular to Japanese-listed Metaplanet and Nakamoto, both of which saw hundreds of millions in paper gains evaporate. One firm, NAKA, has now collapsed more than 98% from peak valuations, a plunge Galaxy compares to “memecoin-style wipeouts.”

October’s Deleveraging Was the Breaking Point

Galaxy’s report emphasizes that the collapse did not happen in isolation. The October 10 deleveraging event — which aggressively unwound futures open interest and drained liquidity across spot markets — accelerated the structural shift.

When Bitcoin went from a momentum-driven climb to a fast drop, investors fled risk. Liquidity evaporated, spreads widened, and DAT equities, which behave like leveraged BTC proxies, bore the brunt of the damage.

“For treasury companies whose equities had been serving as leveraged crypto trades, the shift has been intense,” Galaxy wrote. “The same financial engineering that amplified upside has magnified downside.”

What Happens Next? Galaxy Outlines Three Scenarios

With premiums gone and issuance effectively impossible, Galaxy sees three potential paths for DAT companies:

1. A Prolonged Period of Discounted Valuations

Galaxy’s base case is a multi-quarter stretch of compressed valuations where BTC-per-share growth stagnates and equities trade consistently below NAV. Under this scenario, DAT stocks would offer more downside than Bitcoin itself, with far less upside.

2. Consolidation and Restructuring

Firms that:

- loaded up on debt,

- issued heavily at peak premiums,

- or bought BTC near the top

could face solvency pressure. Galaxy suggests that some firms may be acquired, recapitalized, or forced into restructuring if the market stays soft.

This scenario mirrors previous cycles in crypto mining, where overleveraged firms collapsed while survivors emerged stronger.

3. A Recovery — but Only If Bitcoin Hits New Highs

A bullish turnaround is still possible, Galaxy notes, but only for companies that:

- preserved liquidity,

- limited issuances,

- and maintained healthy balance sheets.

If Bitcoin makes new all-time highs, these firms could re-accelerate BTC-per-share growth. However, most overextended players would not benefit meaningfully from a rebound.

Strategy Raises $1.44 Billion in Defensive Move

One of the largest DAT players, Strategy, has moved to shore up its finances. CEO Phong Le said the company raised a $1.44 billion cash reserve, funded through stock issuance, to reassure investors that dividend and debt obligations are safe even during prolonged Bitcoin weakness.

The reserve secures at least 12 months of dividends, with plans to extend that runway to 24 months. Strategy’s defensive stance signals how seriously treasury firms are taking liquidity stress — and how difficult conditions have become.

Also Read: Two Long-Dormant Casascius Coins Wake After 13 Years, Unlocking $179 Million in Bitcoin

Meanwhile, Bitwise CIO Matt Hougan pushed back on speculation that Strategy may be forced to sell Bitcoin, saying such fears are “flat wrong.”

A Darwinian Shakeout Is Underway

Galaxy’s conclusion is blunt: the era of effortless BTC-per-share expansion is over. The DAT trade is now behaving like a classic leverage cycle — booming when capital flows freely, turning destructive when risk appetite collapses.

The firms that survive this phase will likely be those that:

- avoided aggressive leverage,

- managed issuance responsibly,

- preserved liquidity, and

- maintained realistic balance sheets during the boom.

Everyone else faces a steep uphill battle.

The next chapter for Bitcoin treasury firms will not be defined by marketing narratives or premium-driven euphoria — but by balance sheet resilience, capital efficiency, and disciplined financial management.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m the cryptocurrency guy who loves breaking down blockchain complexity into bite-sized nuggets anyone can digest. After spending 5+ years analyzing this space, I’ve got a knack for disentangling crypto conundrums and financial markets.