|

Getting your Trinity Audio player ready...

|

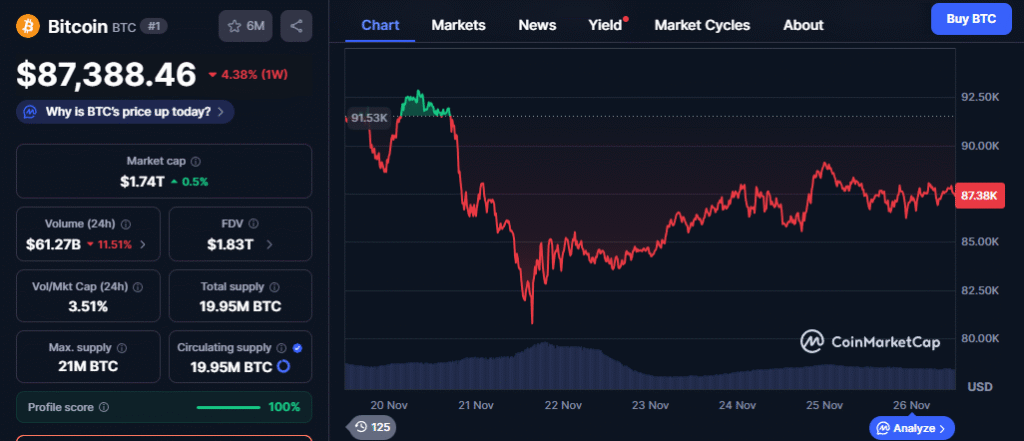

- Rising Fed rate-cut odds aren’t boosting Bitcoin as traders focus on unclear forward guidance.

- A rare U.S. dollar signal historically tied to BTC downside is adding new pressure.

- Short-term holders are selling heavily while long-term holders remain calm and profitable.

Bitcoin investors expecting a celebratory rally ahead of a likely Federal Reserve rate cut in December are instead facing growing pressure. Even as expectations for monetary easing surge, BTC continues to struggle under a complex mix of macro uncertainty, rare on-chain signals, and shifting political dynamics influencing the Federal Reserve’s future path.

Fed Rate-Cut Probability Rises — But BTC Fails to Respond

Prediction markets now indicate an 84% chance of a rate cut on December 10, with the Fed likely pausing in January. Under normal circumstances, this type of dovish shift would act as a tailwind for risk assets. But traders are increasingly concerned that the Fed has become less predictable.

The October 29 rate cut delivered little enthusiasm after policymakers offered no strong forward guidance. With December potentially marking a third consecutive cut, analysts warn markets may treat the move as already priced in — limiting Bitcoin’s upside.

Rare U.S. Dollar Signal Adds Pressure

A new report from 10x Research highlights a rarely triggered U.S. dollar indicator now flashing for only the fifth time in Bitcoin’s entire history. Every previous occurrence was followed by measurable downside in BTC, a pattern now weighing heavily on sentiment.

The Macro Trap: Why Bitcoin Isn’t Reacting as Expected

— 10x Research (@10x_Research) November 26, 2025

Bitcoin is once again trading at the intersection of Fed policy, U.S. dollar dynamics, and a liquidity narrative that looks far less straightforward than most investors assume.

While rate-cut odds for December have jumped… pic.twitter.com/8AxEPeTzL4

Adding to the complexity, expectations of a possible $600+ billion liquidity boost from the U.S. Treasury are not offering immediate relief. During past liquidity expansions, Bitcoin often dipped before eventually recovering — a reminder that liquidity alone doesn’t guarantee instant rallies.

Short-Term Bitcoin Holders Capitulate as Long-Term Holders Hold Firm

A growing divide between investor groups is emerging. Short-term BTC holders — those who bought within the past week to year — are now sitting below their collective break-even price for the first time in three years. Losses and liquidations are driving persistent selling pressure.

Meanwhile, long-term holders remain steady. With most of this group still comfortably profitable above the $50,000–$60,000 zone, deeper capitulation associated with market bottoms has not yet begun.

A new political factor is entering the conversation. Reports suggest the Trump team is preparing to influence future Federal Reserve appointments, pushing for accelerated rate cuts and potentially full-scale easing by early 2026. While this could be bullish for Bitcoin eventually, the near-term uncertainty is adding another layer of caution for investors.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

Also Read: Red November Meltdown: Why Bitcoin’s Chart Suddenly Flipped… And What Happens Next

I’m your translator between the financial Old World and the new frontier of crypto. After a career demystifying economics and markets, I enjoy elucidating crypto – from investment risks to earth-shaking potential. Let’s explore!