|

Getting your Trinity Audio player ready...

|

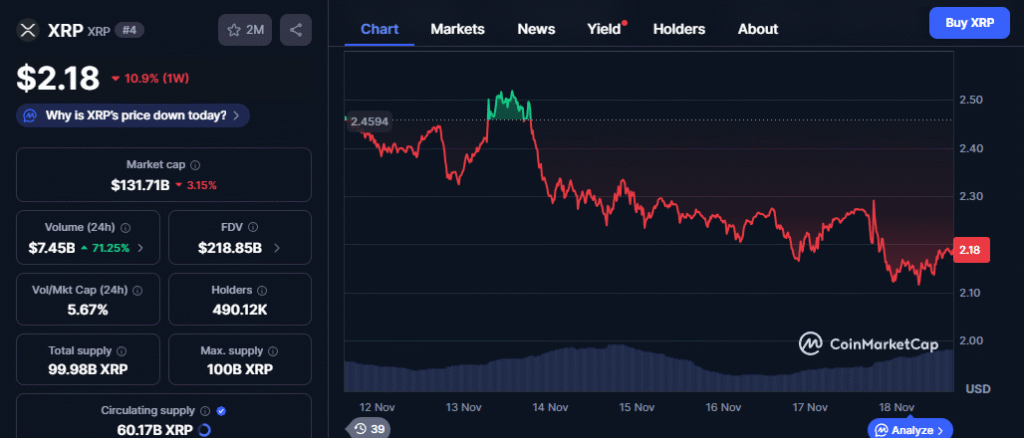

- XRP ETF saw $268M in first three days, showing strong institutional demand.

- Whale selling and market weakness caused XRP price to drop nearly 11%.

- Technical indicators suggest a potential market bottom may be near.

Canary Capital’s Spot XRP ETF (XRPC) made a historic debut on Nasdaq last week, attracting nearly $245 million in inflows on its first day and reaching a total of $268 million within three trading sessions. This marks one of the strongest ETF launches of 2025, highlighting significant institutional interest in the digital asset.

Yet, despite the record-breaking inflows, XRP’s price has fallen nearly 11% since November 13, trading around $2.14 at press time. Analysts point to whale selling and broader market weakness as key factors undermining the ETF’s influence.

Whales Offset Institutional Interest

Reports suggest that large XRP holders sold roughly 200 million tokens within 48 hours of the ETF launch. This profit-taking has dampened market sentiment, offsetting the positive signals from institutional investment. Glassnode data shows that only 58.5% of XRP’s supply is currently in profit, the lowest since November 2024. The market appears structurally fragile, with late buyers bearing significant losses.

Market Pressure and Institutional Lag

The wider cryptocurrency market has also weighed on XRP’s price. Over the past 41 days, the sector has lost $1.1 trillion in total market value, averaging a $27 billion daily decline. Experts note that institutional liquidity often takes time to influence prices. While ETF inflows signal growing long-term interest, the immediate price effects may remain muted until 2026.

Technical Indicators Hint at Potential Bottom

Despite recent losses, technical data suggests XRP may be approaching a market bottom. Its Net Unrealized Profit and Loss (NUPL) dropped to 0.32 on November 16, the lowest in a year. Historically, similar lows have coincided with strong rebounds — in April 2025, XRP rose 96% over three months after reaching a comparable NUPL level.

The XRPC ETF launch underscores growing institutional appetite for XRP, but short-term price dynamics remain challenging. Whale activity and broader market weakness have limited immediate upside. Investors should monitor technical indicators and market sentiment, which could signal an upcoming recovery as liquidity slowly translates into price action.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

Also Read: Europe Explores Blockchain Settlements: XRP Could Become Key Liquidity Rail

I’m your translator between the financial Old World and the new frontier of crypto. After a career demystifying economics and markets, I enjoy elucidating crypto – from investment risks to earth-shaking potential. Let’s explore!