|

Getting your Trinity Audio player ready...

|

- ETH rebounded from $3,000, mirroring its 2020 correction pattern.

- Analysts cite whale accumulation and bullish technicals.

- Targets range from $4,500 to $4,950 if key support holds.

Ethereum (ETH) is showing early signs of recovery after a steep three-week correction, sparking fresh comparisons to its 2020 market reset. From a high near $4,960, ETH fell to $3,000 — a level analysts now view as a potential turning point.

Ethereum Mirrors 2020 Correction Pattern

Crypto analyst Galaxy noted that Ethereum’s recent price action mirrors the 2020 dip, when ETH dropped from $490 to $308 before launching into a major rally. In November 2025, ETH again touched a similar structure, bouncing from $3,064 to above $3,500. Galaxy suggests this could mark the start of another extended bullish phase.

The analyst emphasized that ETH’s ability to hold the $3,000–$3,100 support zone is critical. A sustained base at this level has historically triggered strong recoveries.

Analysts Call Recent Drop a “Fakeout”

Another prominent trader, Cas Abbe, described the November decline as a “fakeout” — a brief dip before a larger breakout. Abbe’s historical models show Ethereum often fakes weakness before major rallies, such as the Q2 2025 rebound from $1,800 to $2,800.

Similarly, Lark Davis highlighted ETH’s long-term trendline support near $3,000 and noted an upcoming MACD golden cross — a signal often preceding bullish reversals.

Whales Accumulate as Liquidity Builds

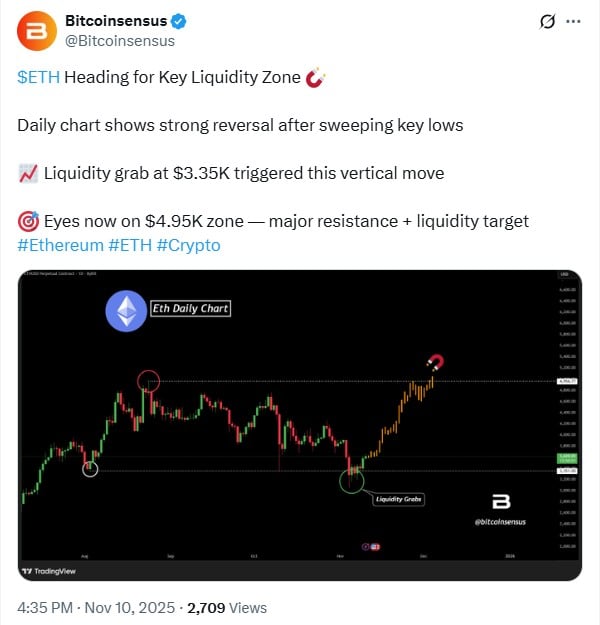

On-chain data from PRIME X shows Ethereum whales accumulating around $3,200, a level viewed as a high-confidence buy zone. Meanwhile, Bitcoinsensus identified $4,950 as the next major liquidity target — a zone likely to attract strong price action as traders anticipate either a breakout or pullback.

At press time, ETH traded at $3,520, with a 24% surge in daily volume to $39.8 billion. If current momentum continues, analysts see potential for a rally toward $4,500–$4,800 in the coming weeks.

Also Read: BitMine Buys 110,000+ ETH — Aims to Control 5% of All Ethereum Supply

Ethereum’s latest recovery resembles its classic rebound pattern from 2020 — a sharp dip followed by steady accumulation and an explosive rally. With strong whale activity, rising volume, and bullish indicators aligning, ETH may once again be setting up for its next major leg higher.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m a crypto enthusiast with a background in finance. I’m fascinated by the potential of crypto to disrupt traditional financial systems. I’m always on the lookout for new and innovative projects in the space. I believe that crypto has the potential to create a more equitable and inclusive financial system.