|

Getting your Trinity Audio player ready...

|

- Rothschild and PNC hold significant Solana ETF shares.

- SOL price jumps nearly 5% amid strong inflows.

- Futures and staking ETFs show renewed institutional confidence.

Solana (SOL) has caught the eye of major financial institutions as Rothschild Investment LLC and PNC Financial Services report notable positions in Solana ETFs. This institutional interest arrives amid sustained inflows into Solana-focused funds, signaling growing confidence despite a broader crypto market downturn.

Rothschild Investment, managing $1.5 billion in assets, disclosed a stake of 6,000 shares in the Volatility Shares Solana ETF (SOLZ), valued at $132,720. PNC Financial Services, with $569 billion under management, holds 1,453 shares worth $32,140 in the same ETF. These moves highlight a shift among traditional financial giants toward tokenized assets like Solana.

Solana ETF Inflows Drive Price Momentum

Recent weeks have seen strong inflows into Solana ETFs. Bitwise Solana Staking ETF (BSOL) alone attracted $323.8 million, contributing to total Solana ETF inflows of $336 million in just two weeks. Grayscale Solana ETF (GSOL) also benefited from the trend, reinforcing investor interest in staking-focused returns over traditional Bitcoin ETFs.

Analysts note technical signals supporting a potential rebound in SOL. Crypto strategist Ali Martinez highlighted the TD Sequential indicator flashing a buy signal, emphasizing the $150 support level as a crucial price floor.

SOL Price Rebound Signals Renewed Market Optimism

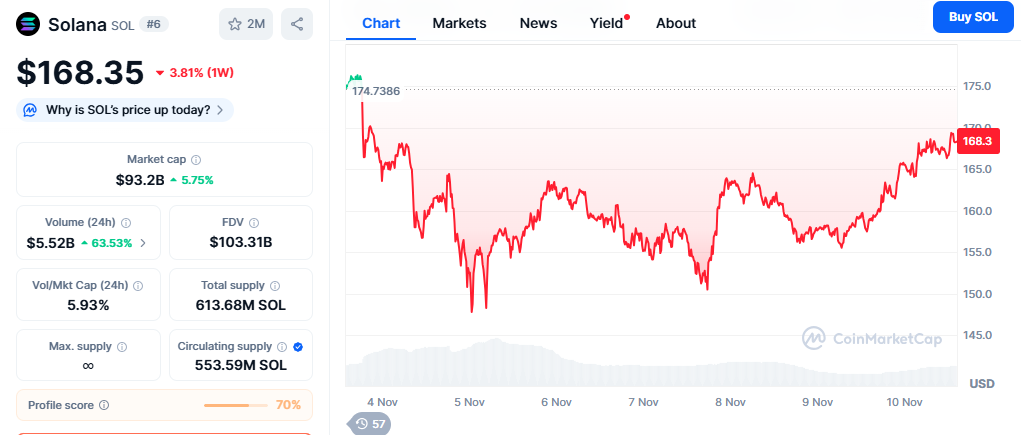

SOL has responded with a nearly 5% increase in the past 24 hours, trading around $167, with intraday lows and highs ranging between $157.45 and $168.71. Trading volume surged 55% over the same period, reflecting heightened trader activity.

Also Read: Solana ETF Inflows Hit $9.7M as SOL Gains Bullish Momentum Toward $200

Futures markets also show optimism. Coinglass data reports total SOL futures open interest climbing 3% to $7.80 billion, while SOL contracts on CME and Binance rose roughly 5% and 4%, respectively.

Institutional Moves Could Strengthen Solana Outlook

The entry of Rothschild and PNC into Solana ETFs reinforces growing institutional interest in Solana and staking-based investment strategies. Coupled with technical buy signals and robust inflows, these developments could provide a foundation for sustained SOL momentum.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m your translator between the financial Old World and the new frontier of crypto. After a career demystifying economics and markets, I enjoy elucidating crypto – from investment risks to earth-shaking potential. Let’s explore!