|

Getting your Trinity Audio player ready...

|

- Court rules FBI not responsible for wiping 3,400 BTC from seized hard drive.

- Convicted owner denied owning Bitcoin until years later.

- Highlights the irreversible loss risk of private keys in crypto.

A U.S. appeals court has ruled that the FBI is not liable for erasing a hard drive allegedly containing over 3,400 Bitcoin (BTC)—worth more than $345 million—belonging to convicted identity thief Michael Prime.

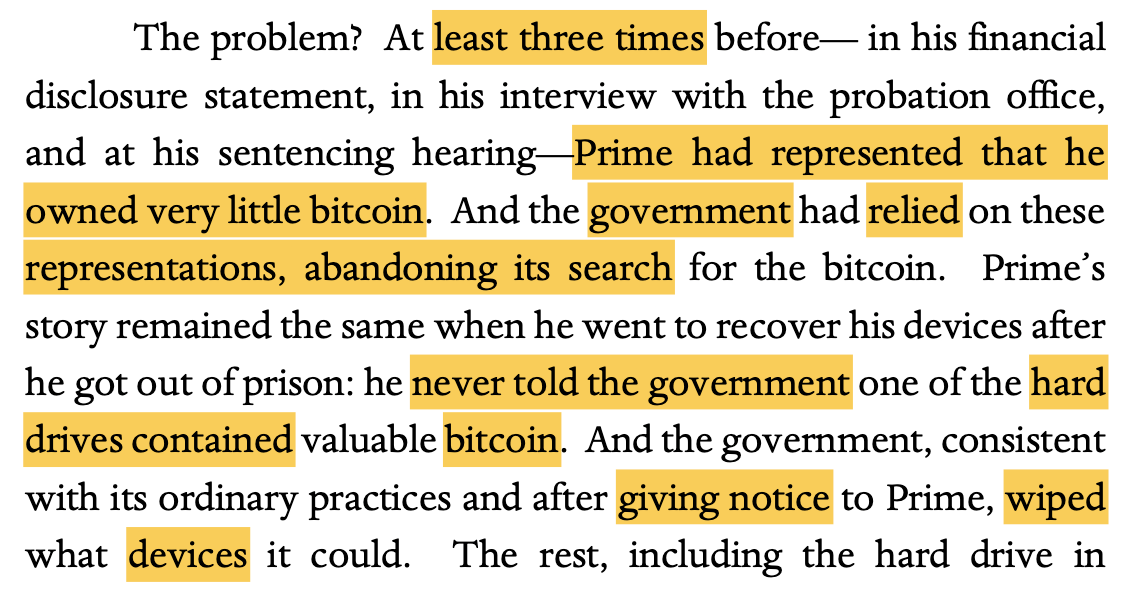

The Eleventh Circuit Court of Appeals upheld a lower court’s decision, stating that Prime cannot sue the government for the loss, as he repeatedly denied owning any significant amount of Bitcoin before and during his prison term.

“For years, Prime denied that he had much bitcoin at all,” the judges wrote. “Only later did Prime claim to be a bitcoin tycoon.”

Bitcoin Ownership Claim Rejected as “Unreasonable”

Prime, who was convicted in 2019 on charges of device fraud, identity theft, and illegal firearm possession, initially told authorities he owned between $200 and $1,500 in Bitcoin. When he later demanded the return of a hard drive that the FBI had erased under standard procedure, he claimed it actually held 3,443 Bitcoin.

The court rejected this claim as inconsistent and untimely, ruling that Prime’s failure to disclose the alleged holdings earlier made his current lawsuit invalid. “Even if the bitcoin existed—and that’s a big if—awarding Prime an equitable remedy here would be inequitable,” the panel stated.

Lost Bitcoin: A Growing Part of the Supply

Prime’s case underscores a broader phenomenon in the crypto world—lost Bitcoin. Because BTC is secured by private keys stored on devices or wallets, losing those keys permanently locks users out of their funds.

According to Glassnode, around 1.46 million BTC—roughly 7% of Bitcoin’s total supply—is likely lost forever. Chainalysis estimates that number could be as high as 3.7 million BTC, nearly 17.5% of the total supply, highlighting the irreversible nature of digital asset loss.

The appeals court’s decision reinforces the importance of accurate asset disclosure and personal responsibility in digital asset management. For Bitcoin holders, the case is a sobering reminder: if you lose your keys, you lose your coins—forever.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m a crypto enthusiast with a background in finance. I’m fascinated by the potential of crypto to disrupt traditional financial systems. I’m always on the lookout for new and innovative projects in the space. I believe that crypto has the potential to create a more equitable and inclusive financial system.